BTC-USD Trading Predictions

1 Day Prediction

Target: April 22, 2025$87300

$87100

$88000

$86000

Description

The price is expected to stabilize around 87300, supported by recent bullish momentum and a slight upward trend in volume. The RSI indicates a neutral position, suggesting potential for upward movement.

Analysis

Over the past 3 months, BTC-USD has shown a bearish trend with significant fluctuations. Key support is around 82000, while resistance is near 88000. The MACD is showing signs of convergence, indicating potential bullish reversals.

Confidence Level

Potential Risks

Market volatility and external news could impact this prediction, especially if bearish sentiment emerges.

1 Week Prediction

Target: April 29, 2025$86000

$85500

$87000

$84000

Description

A slight decline to 86000 is anticipated as the market may face resistance at higher levels. The Bollinger Bands suggest a tightening range, indicating potential for a breakout or breakdown.

Analysis

The last 3 months have seen BTC-USD oscillate between 80000 and 90000. The average volume has been declining, indicating reduced trader interest. The ATR suggests increasing volatility, which could lead to sharp price movements.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or regulatory news could lead to increased volatility, affecting price stability.

1 Month Prediction

Target: May 21, 2025$85000

$84500

$86000

$83000

Description

The price is expected to hover around 85000, reflecting a bearish sentiment. The Fibonacci retracement levels indicate strong resistance at 86000, which may cap any upward movements.

Analysis

BTC-USD has been in a bearish trend, with significant resistance at 86000. The RSI is approaching oversold territory, suggesting a potential bounce, but overall sentiment remains cautious. Volume patterns indicate a lack of strong buying interest.

Confidence Level

Potential Risks

Market sentiment can shift rapidly, and any positive news could lead to unexpected bullish movements.

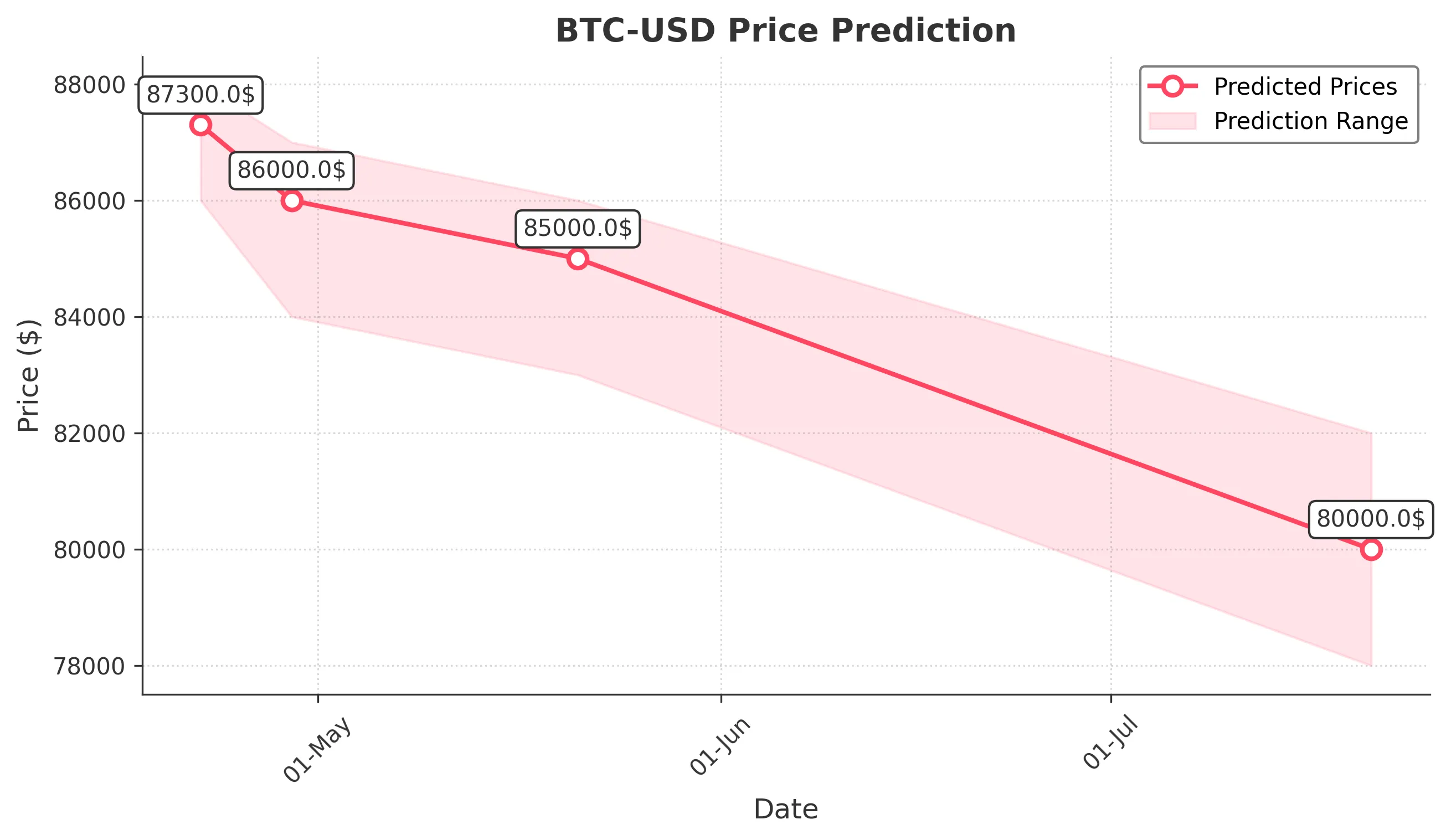

3 Months Prediction

Target: July 21, 2025$80000

$81000

$82000

$78000

Description

A further decline to 80000 is projected as bearish trends persist. The MACD indicates a bearish crossover, and the overall market sentiment remains negative.

Analysis

The past 3 months have shown a clear bearish trend, with significant support at 78000. The market is reacting to macroeconomic pressures, and the overall sentiment is cautious. The ATR indicates high volatility, which could lead to further price declines.

Confidence Level

Potential Risks

Potential for recovery exists if market conditions improve, but current trends suggest continued downward pressure.