BTC-USD Trading Predictions

1 Day Prediction

Target: April 23, 2025$88300

$88200

$89000

$87000

Description

The recent bullish momentum, supported by a rising MACD and RSI nearing 60, suggests a potential upward move. However, the market remains volatile, and a Doji pattern indicates indecision.

Analysis

Over the past 3 months, BTC-USD has shown a bearish trend with significant support around 82,000. Recent price action indicates a possible reversal, but resistance at 88,000 remains strong. Volume spikes suggest increased interest.

Confidence Level

Potential Risks

Market volatility and potential profit-taking could lead to a pullback.

1 Week Prediction

Target: April 30, 2025$89000

$88500

$90000

$87000

Description

With the RSI approaching overbought levels and a bullish engulfing pattern forming, a continued upward trend is likely. However, resistance at 90,000 could limit gains.

Analysis

The last three months have seen BTC-USD fluctuate between 82,000 and 90,000. The recent bullish momentum is supported by increased volume, but the market remains sensitive to macroeconomic news.

Confidence Level

Potential Risks

External market factors and profit-taking could reverse the trend.

1 Month Prediction

Target: May 22, 2025$91000

$89500

$92000

$86000

Description

If the bullish trend continues, BTC-USD could reach 91,000, supported by Fibonacci retracement levels. However, the RSI indicates potential overbought conditions.

Analysis

The overall trend has been bearish, but recent price action shows signs of recovery. Key resistance at 90,000 and support at 82,000 will be critical in determining future movements.

Confidence Level

Potential Risks

Market corrections and external economic factors could impact this prediction.

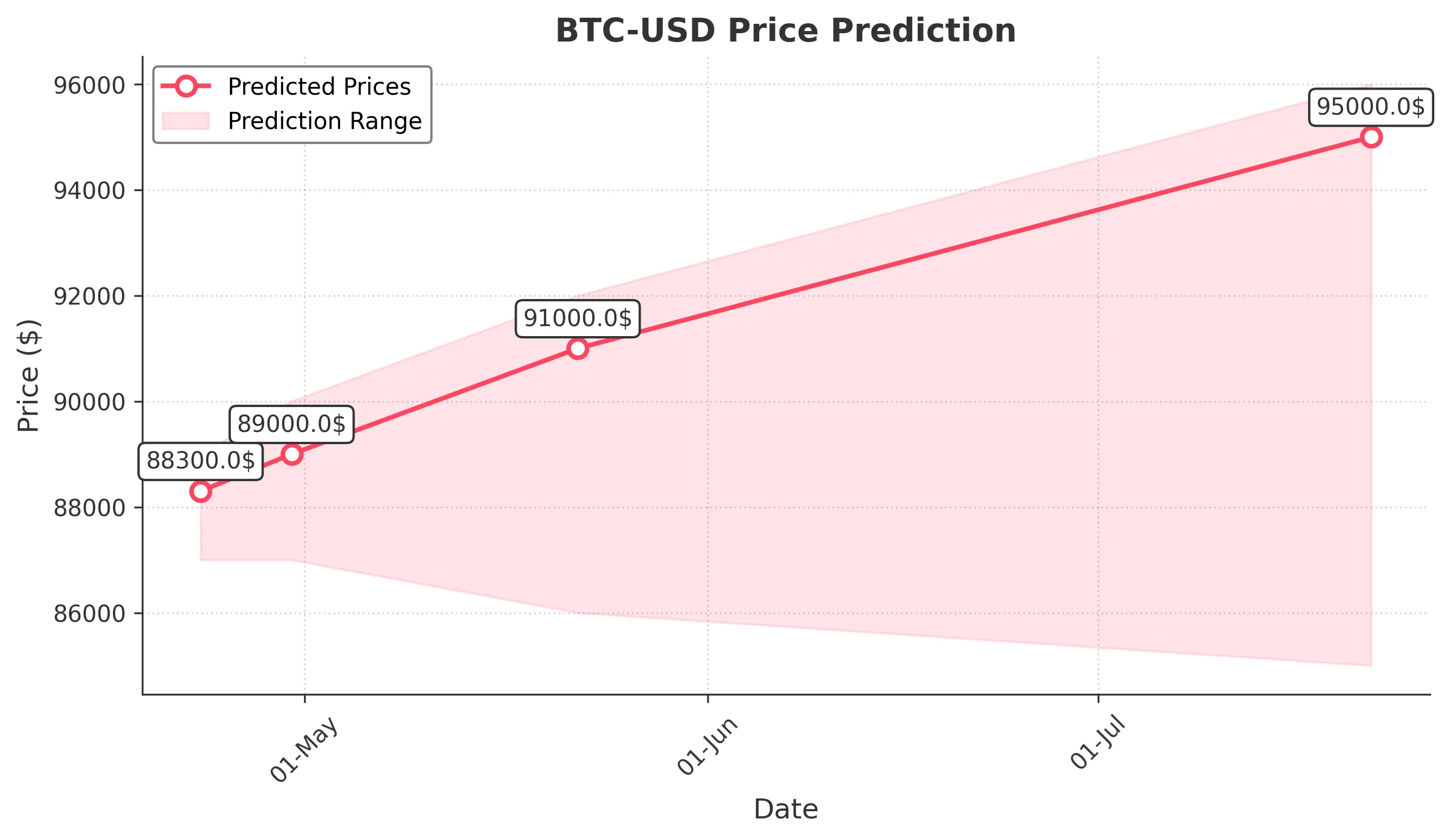

3 Months Prediction

Target: July 22, 2025$95000

$94000

$96000

$85000

Description

If the current bullish trend persists, BTC-USD could reach 95,000, driven by strong market sentiment and potential institutional interest. However, volatility remains a concern.

Analysis

The past three months have shown a bearish trend with a recent shift towards bullishness. Key support at 82,000 and resistance at 90,000 will be crucial in determining the future trajectory.

Confidence Level

Potential Risks

Unforeseen macroeconomic events could lead to significant price fluctuations.