BTC-USD Trading Predictions

1 Day Prediction

Target: April 25, 2025$92500

$92000

$93500

$91000

Description

The market shows signs of consolidation around the 92k level, with recent support at 91k. RSI indicates a neutral stance, while MACD suggests potential upward momentum. However, volatility remains high, warranting caution.

Analysis

Over the past 3 months, BTC-USD has experienced significant volatility, with a bearish trend recently. Key support at 91k and resistance at 94k. Volume spikes indicate strong trading interest, but the overall trend remains uncertain.

Confidence Level

Potential Risks

Market sentiment could shift rapidly due to macroeconomic news or regulatory changes, impacting price stability.

1 Week Prediction

Target: May 2, 2025$93000

$92500

$94000

$90000

Description

Expecting a slight recovery as the price stabilizes around 93k. The recent bullish engulfing pattern suggests potential upward movement, but resistance at 94k may limit gains. Watch for volume trends.

Analysis

The last three months have shown a bearish trend with significant price fluctuations. Key support at 91k and resistance at 94k. Volume analysis indicates strong trading activity, but uncertainty remains high.

Confidence Level

Potential Risks

Potential for bearish reversal if market sentiment shifts or if external factors negatively impact trading.

1 Month Prediction

Target: May 24, 2025$95000

$94000

$96000

$91000

Description

A gradual recovery is anticipated as bullish sentiment may return. Fibonacci retracement levels suggest 95k as a target. However, market volatility and external factors could impact this trajectory.

Analysis

The past three months have been marked by volatility and bearish trends. Key support at 91k and resistance at 94k. Volume patterns indicate strong trading interest, but the overall market sentiment remains cautious.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or regulatory news could lead to significant price corrections.

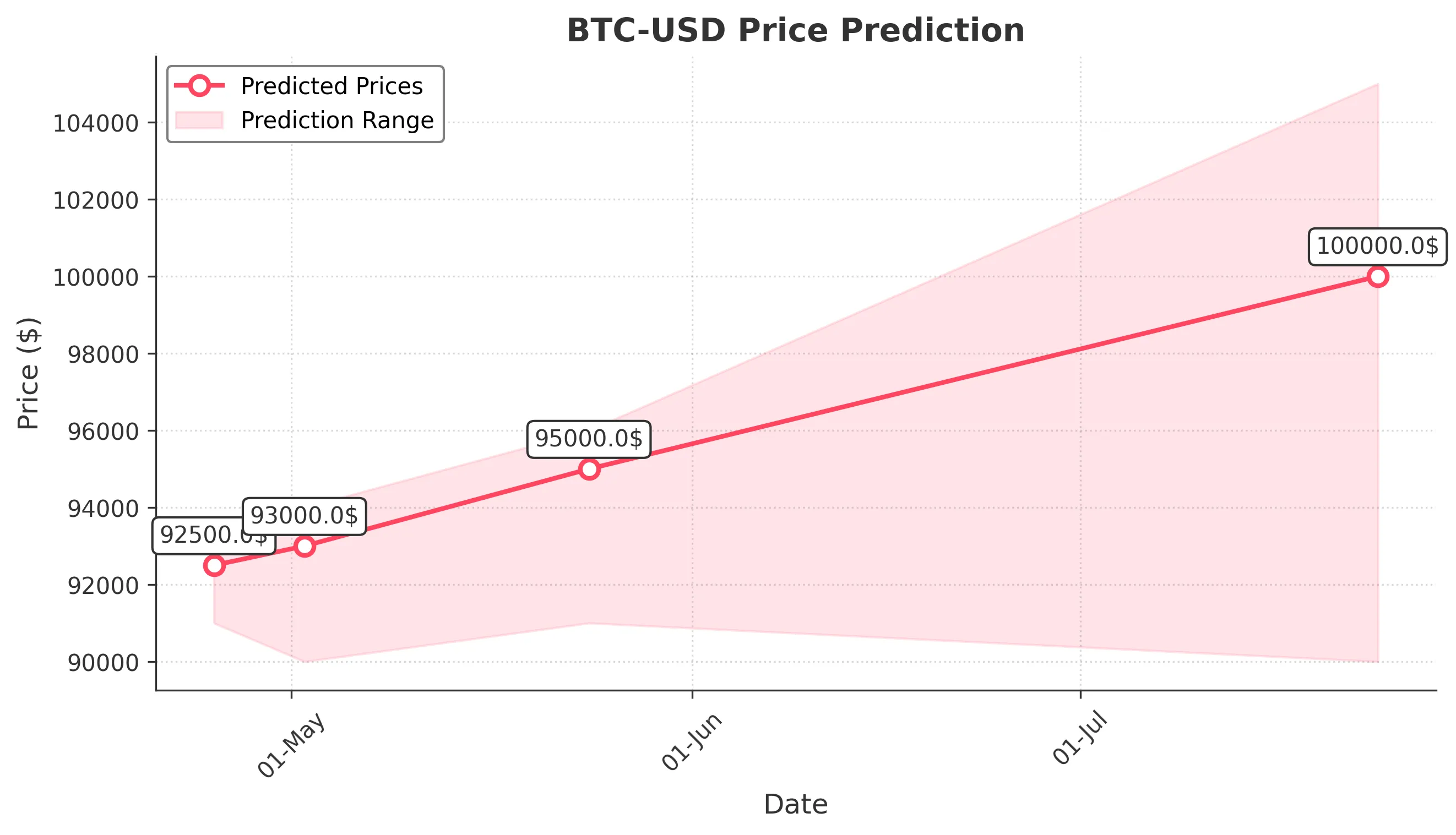

3 Months Prediction

Target: July 24, 2025$100000

$95000

$105000

$90000

Description

Long-term bullish outlook as market sentiment may improve. Key resistance at 100k could be tested. However, macroeconomic factors and market volatility remain significant risks.

Analysis

The last three months have shown a bearish trend with significant price fluctuations. Key support at 91k and resistance at 94k. Volume analysis indicates strong trading activity, but uncertainty remains high.

Confidence Level

Potential Risks

Market conditions are highly unpredictable, and external factors could lead to significant price fluctuations.