BTC-USD Trading Predictions

1 Day Prediction

Target: May 2, 2025$95100

$95000

$96000

$94000

Description

The price is expected to stabilize around 95,100 due to recent bullish momentum and support at 94,200. RSI indicates neutrality, while MACD shows a slight bullish crossover. Volume remains steady, suggesting continued interest.

Analysis

Over the past 3 months, BTC-USD has shown a bullish trend with significant support at 94,200. Recent price action indicates a recovery from lower levels, but volatility remains high. Key resistance is at 96,000.

Confidence Level

Potential Risks

Potential volatility due to macroeconomic news or market sentiment shifts could impact this prediction.

1 Week Prediction

Target: May 9, 2025$94000

$94500

$95000

$93000

Description

A slight pullback to 94,000 is anticipated as profit-taking may occur after recent gains. The RSI is approaching overbought territory, indicating potential for a correction. Watch for support at 93,000.

Analysis

The past three months have seen BTC-USD fluctuate between 82,000 and 95,000, with a recent bullish trend. However, the market is showing signs of exhaustion, and a correction could be imminent.

Confidence Level

Potential Risks

Market sentiment can shift quickly, and external factors like regulatory news could lead to unexpected price movements.

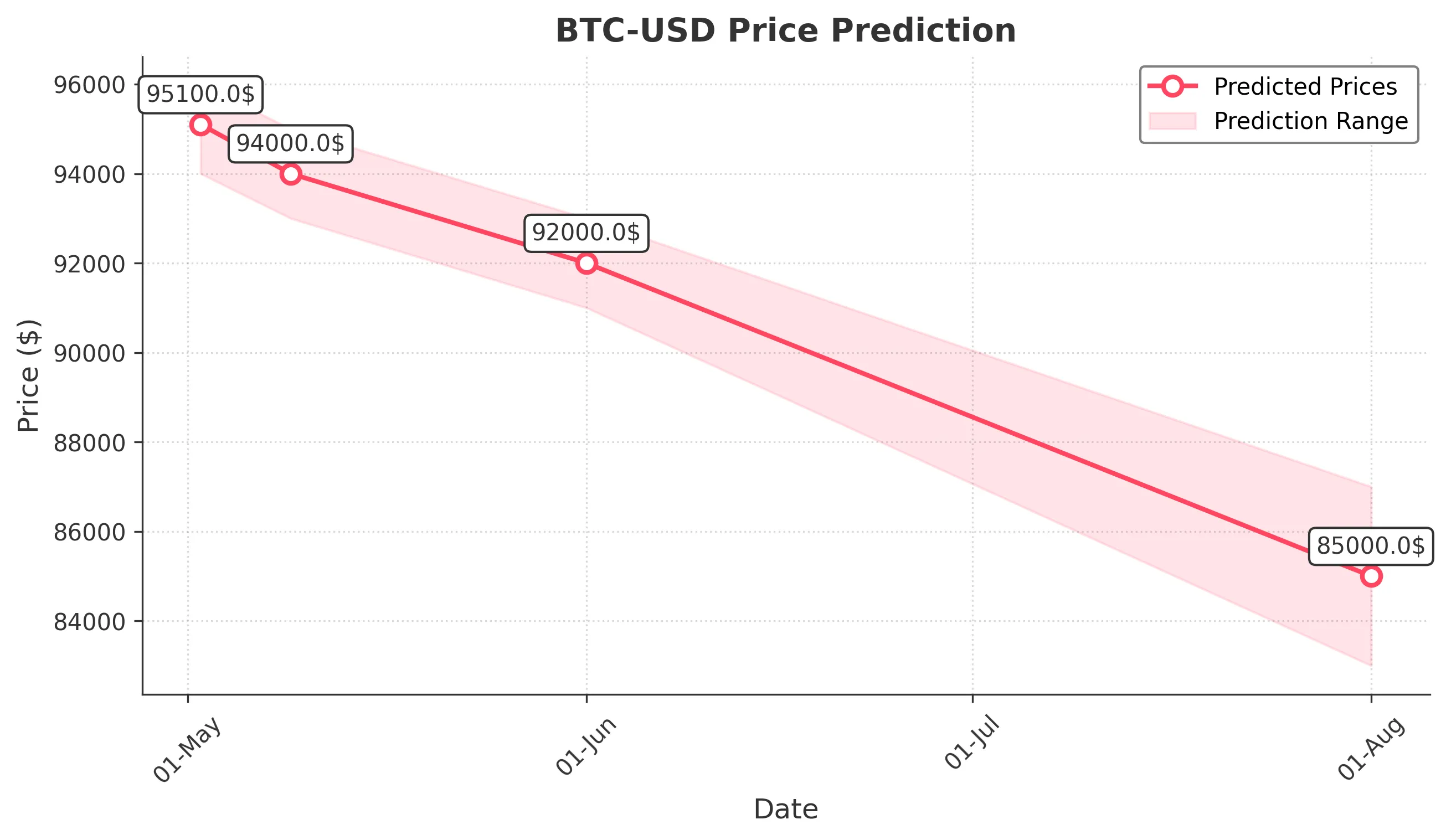

1 Month Prediction

Target: June 1, 2025$92000

$92500

$93000

$91000

Description

A bearish trend is expected as the market may face resistance at 95,000. The MACD is showing signs of divergence, and the RSI indicates overbought conditions. A decline to 92,000 is plausible.

Analysis

BTC-USD has been volatile, with significant price swings. The recent high of 95,000 may act as a strong resistance level, and the market sentiment appears cautious, indicating potential downward pressure.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or changes in investor sentiment could lead to a more significant decline or recovery.

3 Months Prediction

Target: August 1, 2025$85000

$86000

$87000

$83000

Description

A continued bearish trend is anticipated as the market adjusts to previous highs. Support at 84,000 may hold, but if broken, further declines could occur. The overall sentiment is cautious.

Analysis

The overall trend in the last three months has been bearish after reaching highs. Key support levels are being tested, and the market is reacting to broader economic conditions, which could lead to further declines.

Confidence Level

Potential Risks

Market volatility and external economic factors could lead to unexpected price movements, either up or down.