BTC-USD Trading Predictions

1 Day Prediction

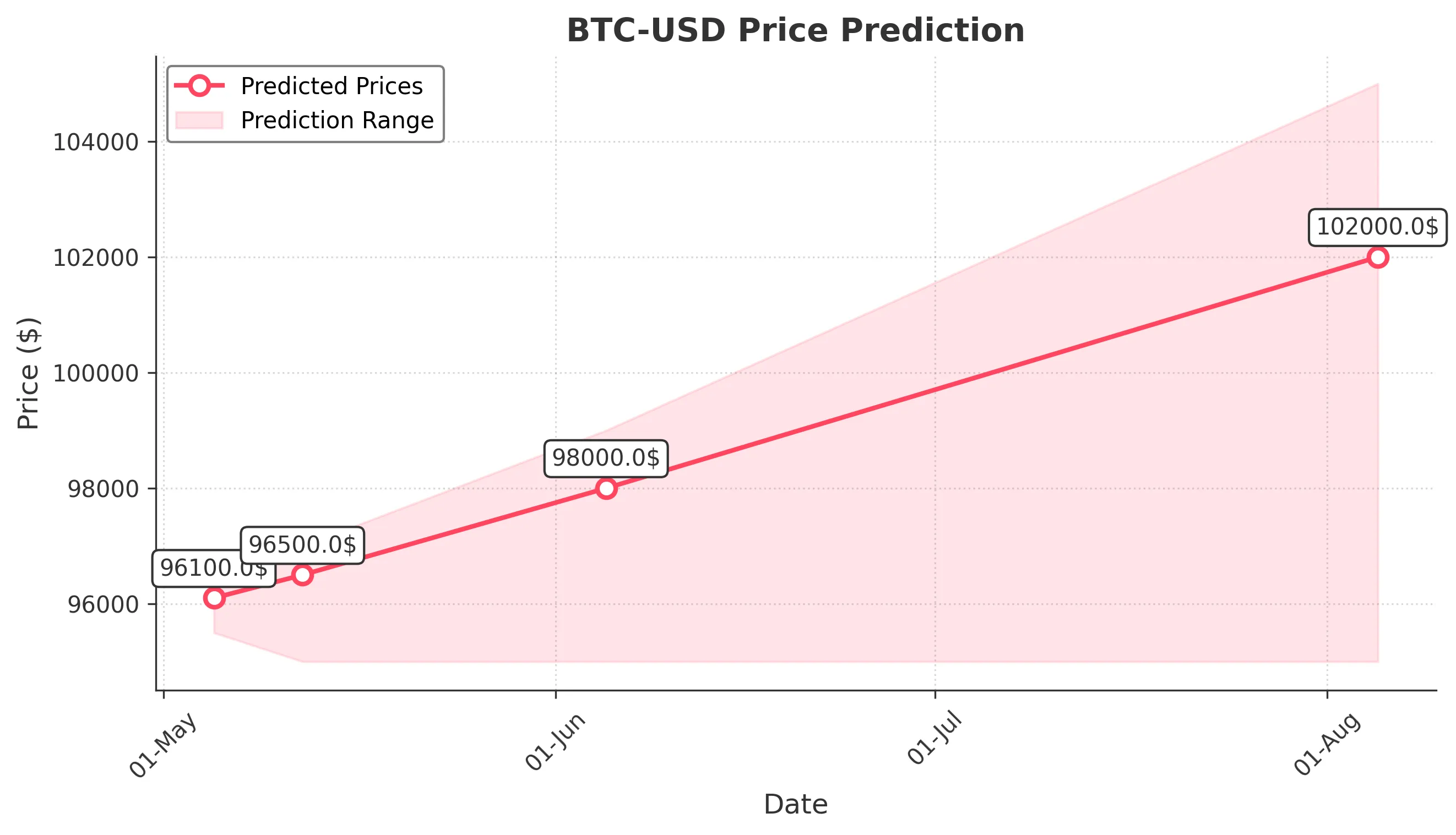

Target: May 5, 2025$96100

$96000

$96500

$95500

Description

The price is expected to stabilize around 96100, supported by recent bullish momentum and a slight upward trend in volume. RSI indicates neutrality, while MACD shows a potential bullish crossover.

Analysis

Over the past 3 months, BTC-USD has shown a bearish trend with significant fluctuations. Key support at 94000 and resistance at 97000. Recent volume spikes suggest increased interest, but RSI indicates potential overbought conditions.

Confidence Level

Potential Risks

Market volatility and external news could impact this prediction.

1 Week Prediction

Target: May 12, 2025$96500

$96100

$97000

$95000

Description

A slight bullish trend is anticipated as the market stabilizes. The MACD is showing bullish momentum, and the price is expected to test resistance at 97000. Volume is likely to increase as traders react to market sentiment.

Analysis

The last three months have seen BTC-USD fluctuating with a bearish bias, but recent price action suggests a possible reversal. Key resistance at 97000 and support at 94000. Volume patterns indicate increased trading activity.

Confidence Level

Potential Risks

Potential for sudden market corrections or negative news could affect the price.

1 Month Prediction

Target: June 5, 2025$98000

$96500

$99000

$95000

Description

Expecting a bullish trend as the market sentiment improves. The price may reach 98000, supported by positive MACD signals and increasing volume. However, resistance at 99000 could pose challenges.

Analysis

BTC-USD has been volatile, with a recent shift towards bullish sentiment. Key resistance at 99000 and support at 94000. Technical indicators suggest potential upward movement, but caution is advised due to market unpredictability.

Confidence Level

Potential Risks

Market sentiment can shift rapidly, and external factors may influence price movements.

3 Months Prediction

Target: August 5, 2025$102000

$98000

$105000

$95000

Description

Long-term bullish outlook as market conditions improve. Price may reach 102000, driven by strong demand and positive market sentiment. However, resistance at 105000 could limit upward movement.

Analysis

The past three months have shown significant volatility with a bearish trend, but recent indicators suggest a potential recovery. Key resistance at 105000 and support at 94000. Market sentiment is cautiously optimistic, but external factors remain a risk.

Confidence Level

Potential Risks

Long-term predictions are subject to high uncertainty due to market volatility and potential regulatory changes.