BTC-USD Trading Predictions

1 Day Prediction

Target: June 14, 2025$103500

$103800

$104500

$102000

Description

The market shows signs of consolidation after a recent decline. RSI indicates oversold conditions, suggesting a potential bounce. However, MACD is bearish, indicating caution. Volume spikes may signal increased interest, but volatility remains high.

Analysis

Over the past 3 months, BTC-USD has experienced significant volatility, with a recent peak around 111,000. The price has retraced, indicating a potential bearish trend. Key support is around 100,000, while resistance is near 110,000. Volume patterns show spikes during price drops, indicating selling pressure.

Confidence Level

Potential Risks

Market sentiment is mixed, and external factors could lead to sudden price movements. A bearish trend could continue if support levels fail.

1 Week Prediction

Target: June 21, 2025$102000

$103000

$103500

$100500

Description

The bearish momentum may continue as the price approaches key support levels. The MACD remains negative, and RSI suggests further downside potential. A break below 100,000 could trigger more selling.

Analysis

The past 3 months have shown a bearish trend following a peak in May. The price has retraced significantly, with key support at 100,000. Technical indicators suggest a potential continuation of this trend, but market sentiment remains uncertain.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or regulatory news could impact market sentiment and lead to volatility.

1 Month Prediction

Target: July 13, 2025$98000

$100000

$102000

$95000

Description

If the bearish trend persists, BTC-USD may test lower support levels. The MACD indicates continued selling pressure, while RSI suggests oversold conditions. A potential bounce could occur, but caution is advised.

Analysis

The analysis indicates a bearish trend with significant retracement from recent highs. Support levels are critical, and the market is reacting to macroeconomic factors. Volume patterns suggest selling pressure, and technical indicators confirm the bearish outlook.

Confidence Level

Potential Risks

Market volatility and external factors could lead to unexpected price movements. A reversal is possible if bullish sentiment returns.

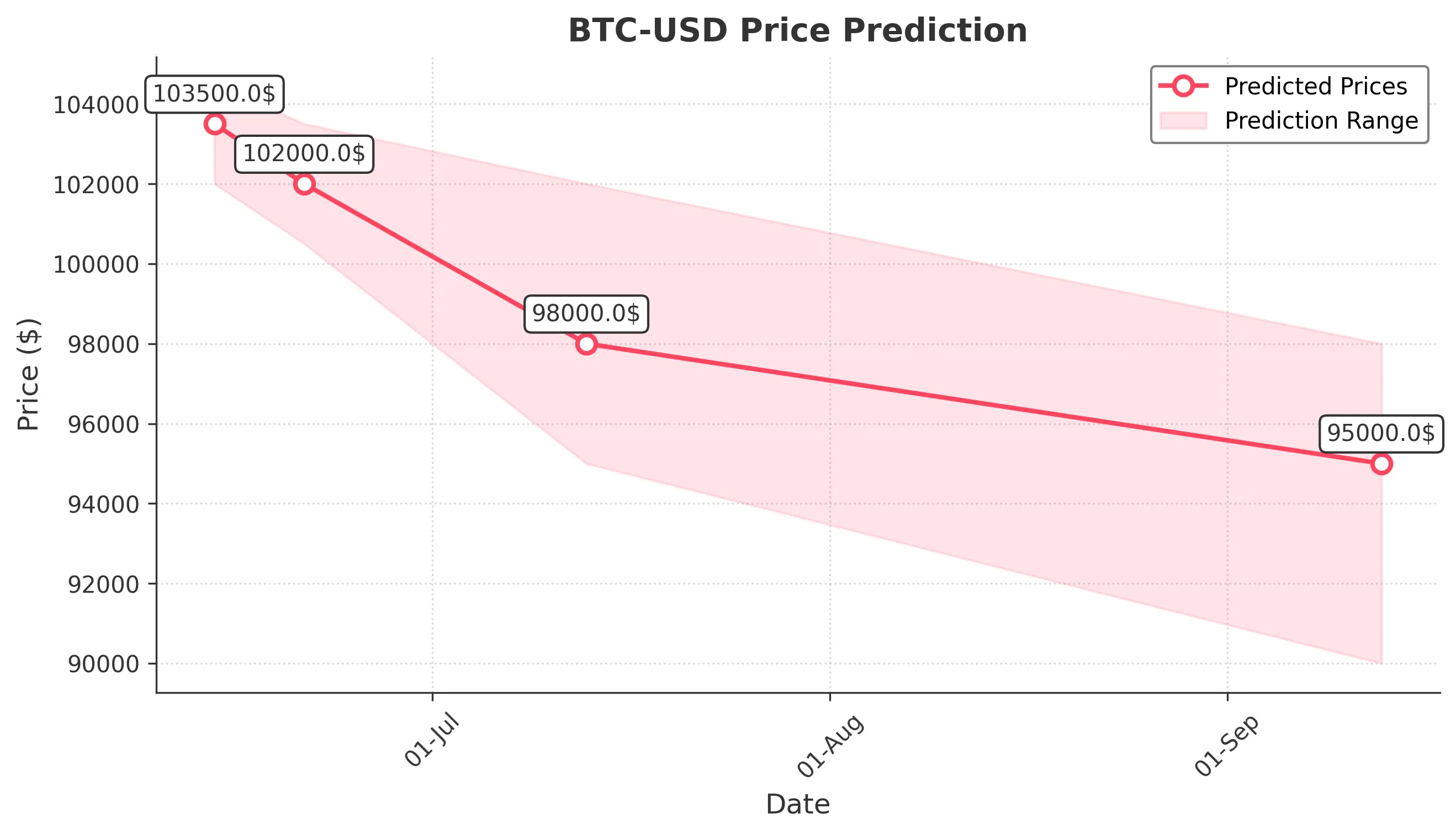

3 Months Prediction

Target: September 13, 2025$95000

$97000

$98000

$90000

Description

The long-term outlook remains bearish, with potential for further declines if support levels are breached. The market may stabilize around 90,000, but external factors could influence volatility.

Analysis

The overall performance shows a bearish trend with significant price corrections. Key support at 90,000 is critical, and the market is influenced by macroeconomic conditions. Technical indicators suggest continued selling pressure, but potential for recovery exists.

Confidence Level

Potential Risks

Unforeseen events or changes in market sentiment could lead to significant price fluctuations. A bullish reversal is possible if key resistance levels are broken.