BTC-USD Trading Predictions

1 Day Prediction

Target: June 23, 2025$102500

$102800

$103000

$101500

Description

The market shows signs of consolidation with a slight bearish trend. RSI indicates overbought conditions, while MACD is flattening. A potential pullback is expected, but support at 102000 may hold.

Analysis

Over the past 3 months, BTC-USD has shown a bullish trend with significant highs. However, recent price action indicates a potential reversal with lower highs and increased volume on down days. Key support at 102000 and resistance at 106000.

Confidence Level

Potential Risks

Market volatility and external news could impact the price significantly.

1 Week Prediction

Target: June 30, 2025$101000

$102000

$102500

$100000

Description

A bearish sentiment is building as the price approaches key support levels. The Bollinger Bands are tightening, indicating potential volatility. A break below 101000 could lead to further declines.

Analysis

The past 3 months have seen BTC-USD fluctuate with a recent bearish trend. Volume spikes on down days suggest selling pressure. Key support at 101000 is critical; a breach could lead to further declines.

Confidence Level

Potential Risks

Unforeseen macroeconomic events could lead to sudden price movements.

1 Month Prediction

Target: July 23, 2025$98000

$100500

$102000

$95000

Description

Expect continued bearish pressure as the market reacts to overbought conditions. The Fibonacci retracement levels suggest a potential drop towards 95000, with resistance at 102000.

Analysis

BTC-USD has been in a volatile phase, with significant price swings. The RSI indicates overbought conditions, and recent candlestick patterns suggest a potential reversal. Key support at 95000 is crucial.

Confidence Level

Potential Risks

Market sentiment can shift rapidly, and external factors may influence price unpredictably.

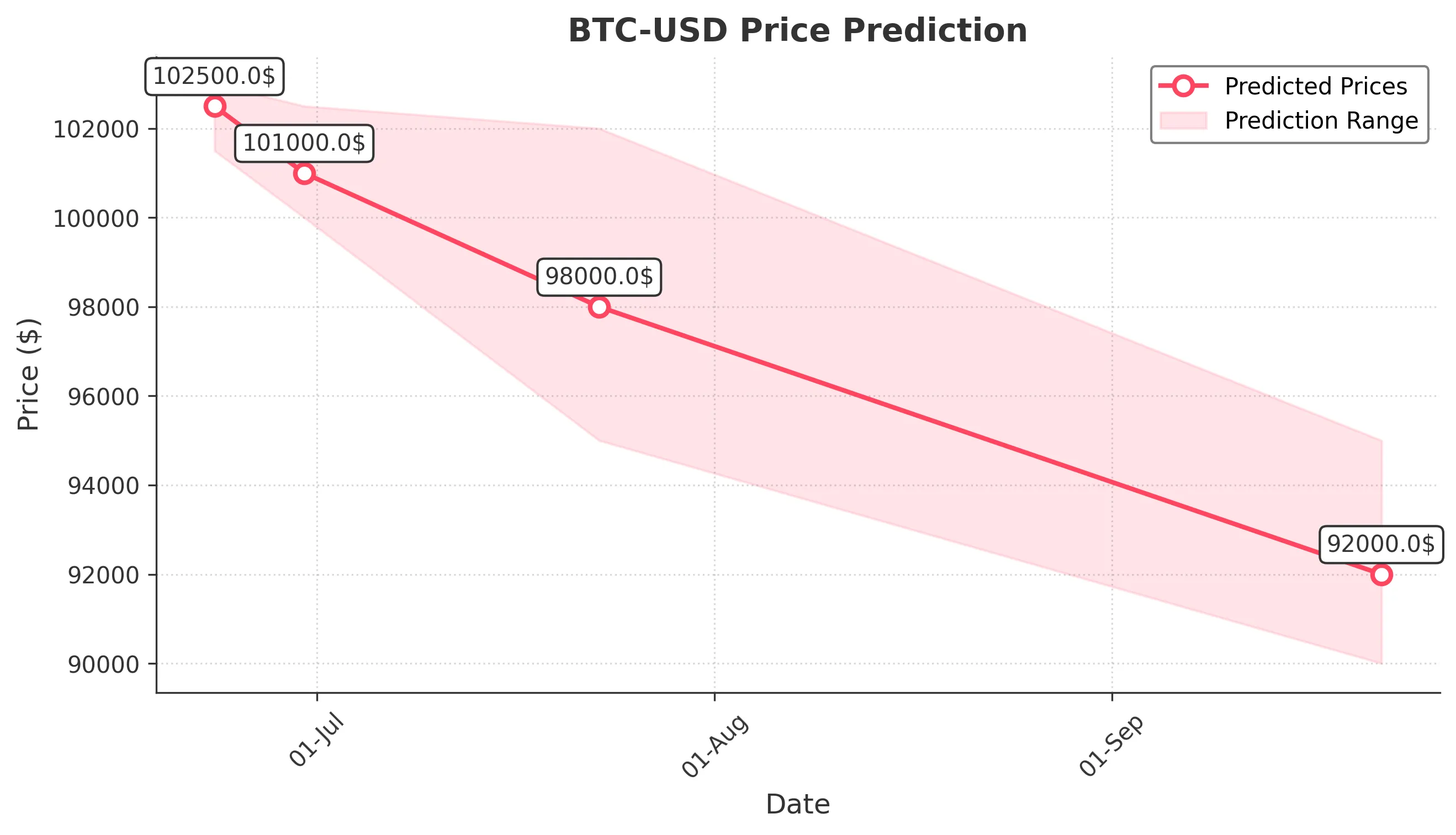

3 Months Prediction

Target: September 22, 2025$92000

$93000

$95000

$90000

Description

Long-term bearish outlook as the market adjusts to previous highs. A potential test of the 90000 support level is likely, with resistance at 95000. Market sentiment remains cautious.

Analysis

The overall trend in the last 3 months has been bearish, with significant resistance at 95000. Volume analysis shows increased selling pressure, and macroeconomic factors could further influence the price.

Confidence Level

Potential Risks

Long-term predictions are subject to high uncertainty due to market volatility and external economic factors.