BTC-USD Trading Predictions

1 Day Prediction

Target: June 28, 2025$107500

$107300

$108200

$106800

Description

The price is expected to rise slightly due to bullish momentum from recent candlestick patterns and a positive MACD crossover. RSI indicates overbought conditions, suggesting caution. Volume remains strong, supporting upward movement.

Analysis

The past 3 months show a bullish trend with significant upward movements. Key support at 100,000 and resistance around 110,000. Recent volume spikes indicate strong buying interest. However, overbought conditions may lead to short-term corrections.

Confidence Level

Potential Risks

Potential for a pullback if profit-taking occurs, especially with high RSI levels.

1 Week Prediction

Target: July 5, 2025$108000

$107500

$109000

$106500

Description

Continued bullish sentiment is expected, supported by strong volume and positive technical indicators. However, the RSI suggests potential overbought conditions, which could lead to volatility.

Analysis

The trend remains bullish with significant upward momentum. Key resistance at 110,000 may be tested. Volume patterns indicate strong interest, but caution is warranted due to potential overbought signals.

Confidence Level

Potential Risks

Market sentiment could shift due to external factors, such as regulatory news or macroeconomic events.

1 Month Prediction

Target: August 5, 2025$110500

$108500

$112000

$105000

Description

A bullish outlook is anticipated as the market continues to show strength. The MACD remains positive, and volume supports upward movement. However, the RSI indicates potential overbought conditions.

Analysis

The overall trend is bullish, with significant resistance at 110,000. Volume patterns suggest strong buying interest, but the market may face corrections due to overbought conditions and external influences.

Confidence Level

Potential Risks

Market corrections could occur if profit-taking increases or if negative news impacts sentiment.

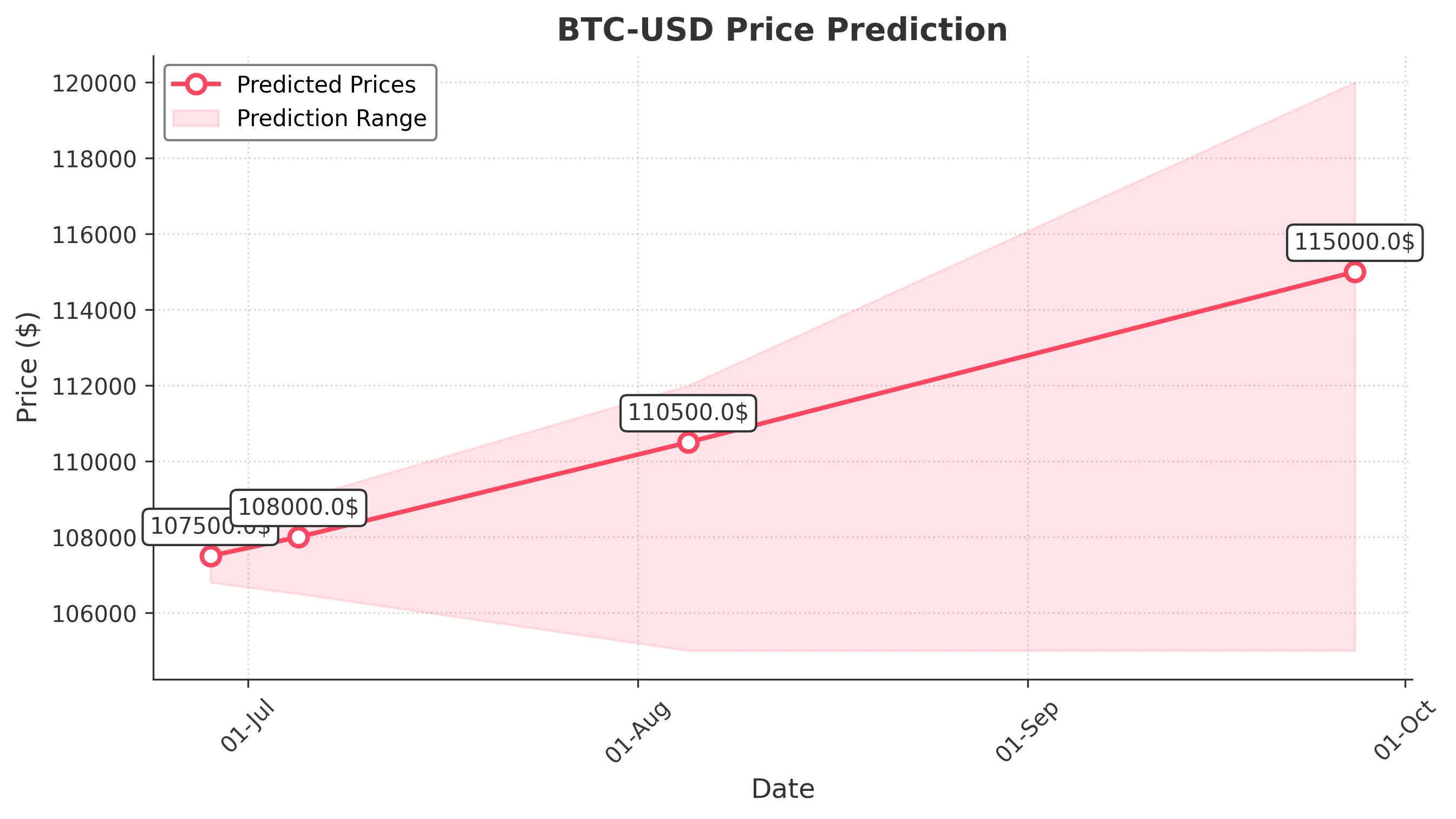

3 Months Prediction

Target: September 27, 2025$115000

$110000

$120000

$105000

Description

Long-term bullish sentiment is expected, driven by strong fundamentals and market interest. However, potential corrections may occur due to high volatility and external market factors.

Analysis

The trend remains bullish, with key resistance at 120,000. Volume patterns indicate sustained interest, but the market may face volatility due to external factors. Caution is advised as overbought conditions could lead to corrections.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or regulatory changes could impact the market significantly.