BTC-USD Trading Predictions

1 Day Prediction

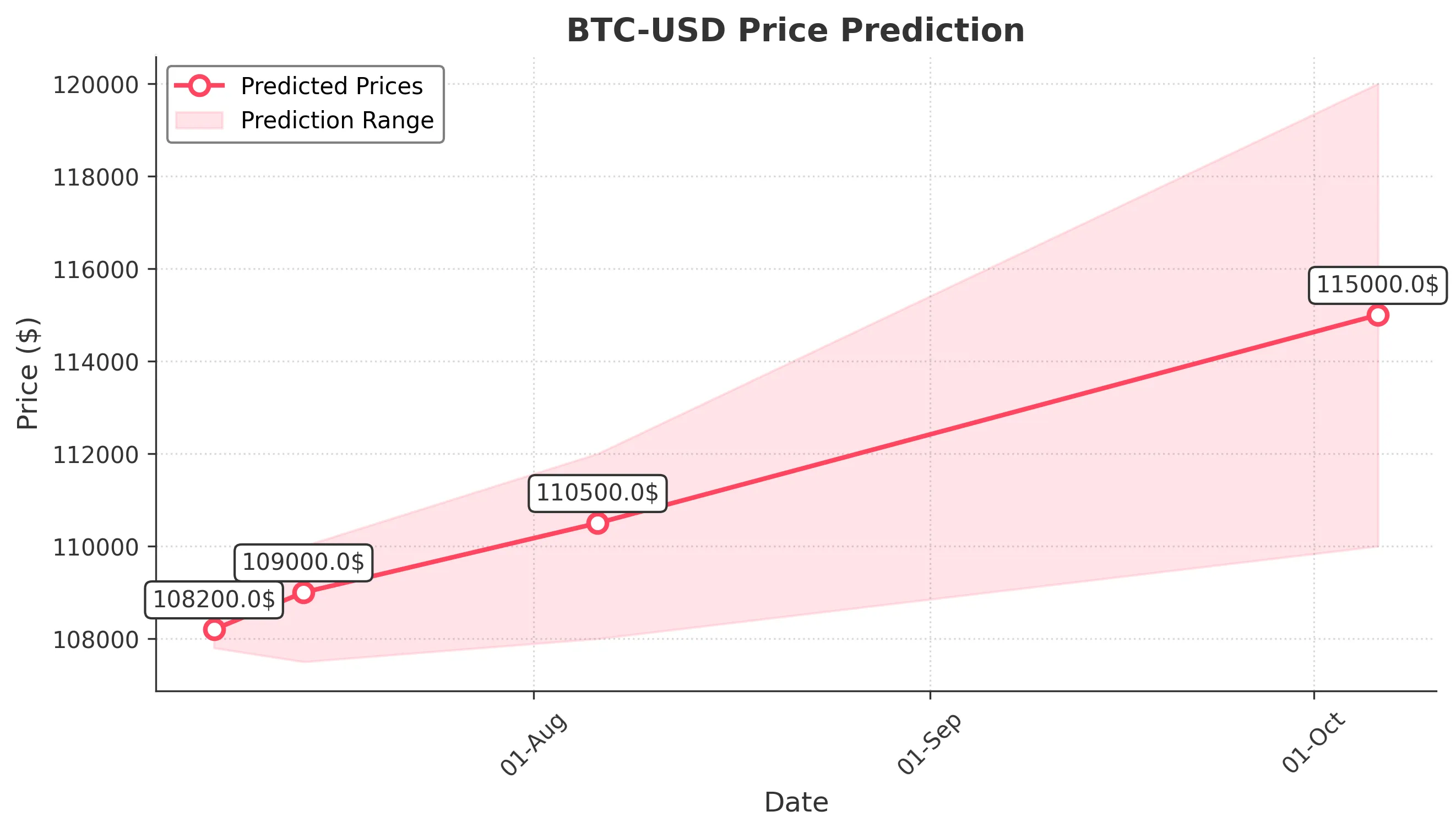

Target: July 7, 2025$108200

$108150

$108600

$107800

Description

The price is expected to stabilize around 108200, supported by recent bullish momentum and a strong closing pattern. RSI indicates overbought conditions, suggesting a potential pullback, but overall sentiment remains positive.

Analysis

The past 3 months show a bullish trend with significant upward movement. Key resistance at 110000 and support around 100000. RSI is nearing overbought levels, indicating caution. Volume has been strong, suggesting sustained interest.

Confidence Level

Potential Risks

Potential for a reversal exists if market sentiment shifts or if external news impacts trading.

1 Week Prediction

Target: July 14, 2025$109000

$108800

$110000

$107500

Description

Expect a slight increase to 109000 as bullish momentum continues. However, the RSI indicates potential overbought conditions, which could lead to a pullback. Watch for volume spikes that may signal reversals.

Analysis

The trend remains bullish, with recent highs indicating strong buying interest. Key support at 105000 and resistance at 110000. Volume patterns suggest healthy trading activity, but caution is advised due to overbought signals.

Confidence Level

Potential Risks

Market volatility and external factors could lead to unexpected price movements.

1 Month Prediction

Target: August 6, 2025$110500

$109500

$112000

$108000

Description

A gradual rise to 110500 is anticipated, supported by bullish sentiment and strong volume. However, the market may face resistance at 112000, and overbought conditions could trigger corrections.

Analysis

The overall trend is bullish, with significant upward momentum. Key resistance at 112000 and support at 105000. Technical indicators show strong buying pressure, but caution is warranted due to potential overbought conditions.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or regulatory news could impact the price trajectory.

3 Months Prediction

Target: October 6, 2025$115000

$113000

$120000

$110000

Description

Expect a rise to 115000 over the next three months, driven by sustained bullish sentiment. However, potential resistance at 120000 may lead to corrections. Monitor for changes in market sentiment.

Analysis

The trend remains bullish, but signs of potential exhaustion are emerging. Key resistance at 120000 and support at 110000. Volume analysis indicates strong interest, but macroeconomic factors could introduce volatility.

Confidence Level

Potential Risks

Long-term predictions are subject to high volatility and external market influences.