BTC-USD Trading Predictions

1 Day Prediction

Target: July 13, 2025$118500

$117990

$119000

$117000

Description

The bullish momentum continues with strong volume and a recent upward trend. The MACD is positive, and RSI indicates overbought conditions, suggesting a potential pullback. However, the overall sentiment remains bullish.

Analysis

The past 3 months show a strong bullish trend with significant price increases. Key support at 115000 and resistance at 120000. Volume spikes indicate strong buying interest. Recent candlestick patterns suggest continuation, but overbought conditions may lead to volatility.

Confidence Level

Potential Risks

Potential for a short-term correction due to overbought RSI levels.

1 Week Prediction

Target: July 20, 2025$119000

$118500

$120500

$116500

Description

The upward trend is expected to persist, supported by strong market sentiment and bullish technical indicators. However, the RSI is nearing overbought territory, indicating a possible pullback in the near term.

Analysis

The stock has shown consistent upward movement, with significant resistance at 120000. The MACD remains bullish, and volume trends indicate strong buying. However, the market may face corrections due to overbought conditions.

Confidence Level

Potential Risks

Market corrections could occur if profit-taking happens, especially with high RSI levels.

1 Month Prediction

Target: August 12, 2025$121000

$119500

$123000

$115000

Description

The bullish trend is expected to continue, with potential for new highs. The market sentiment remains strong, but caution is advised due to potential overbought conditions indicated by the RSI.

Analysis

The past three months have shown a strong bullish trend with significant price increases. Key support at 115000 and resistance at 123000. The MACD is bullish, but the RSI indicates potential overbought conditions, suggesting caution.

Confidence Level

Potential Risks

Unforeseen market events or profit-taking could lead to volatility and price corrections.

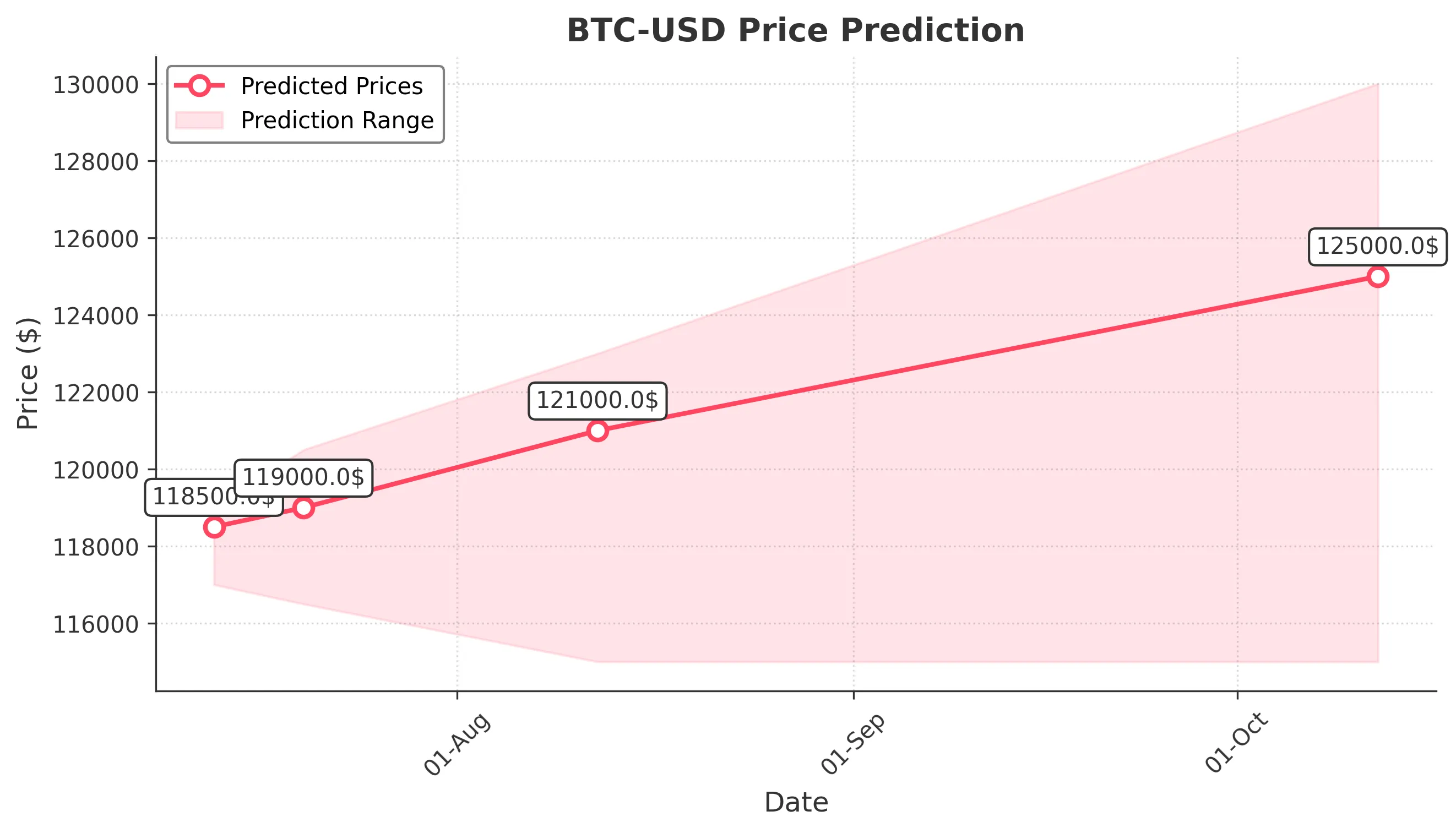

3 Months Prediction

Target: October 12, 2025$125000

$121500

$130000

$115000

Description

Long-term bullish sentiment is expected to drive prices higher, but market corrections may occur. The technical indicators suggest a strong upward trend, but caution is warranted due to potential volatility.

Analysis

The stock has shown a strong bullish trend over the past three months, with significant resistance at 130000. The MACD is bullish, and volume trends indicate strong buying interest. However, potential corrections due to overbought conditions should be monitored.

Confidence Level

Potential Risks

Market corrections, geopolitical events, or changes in macroeconomic conditions could impact the prediction.