BTC-USD Trading Predictions

1 Day Prediction

Target: July 18, 2025$118500

$118600

$119500

$117000

Description

The price is expected to stabilize around 118500, supported by recent bullish momentum and high trading volume. The RSI indicates overbought conditions, suggesting a potential pullback, but strong demand may keep prices elevated.

Analysis

The past 3 months show a bullish trend with significant upward movements. Key resistance at 120000 and support around 115000. Volume spikes indicate strong interest, but recent overbought conditions may lead to short-term corrections.

Confidence Level

Potential Risks

Potential for a reversal exists due to overbought RSI levels and market sentiment shifts.

1 Week Prediction

Target: July 25, 2025$117000

$118000

$119000

$115500

Description

Expect a slight decline to 117000 as profit-taking may occur after recent highs. The MACD shows signs of weakening momentum, and the Bollinger Bands suggest potential volatility ahead.

Analysis

The bullish trend remains, but signs of exhaustion are evident. Support at 115000 is critical, while resistance at 120000 looms. Volume analysis shows healthy trading activity, but caution is warranted due to potential corrections.

Confidence Level

Potential Risks

Market sentiment could shift rapidly, impacting the prediction. External news may also influence price movements.

1 Month Prediction

Target: August 18, 2025$115000

$116000

$118000

$112000

Description

A gradual decline to 115000 is anticipated as market corrections take hold. The Fibonacci retracement levels suggest support around this price, but bearish sentiment may increase if the trend continues.

Analysis

The overall trend is still bullish, but signs of a potential reversal are emerging. Key support at 115000 and resistance at 120000. Volume patterns indicate a possible slowdown in buying interest, warranting caution.

Confidence Level

Potential Risks

Unforeseen macroeconomic events could alter market dynamics significantly, leading to volatility.

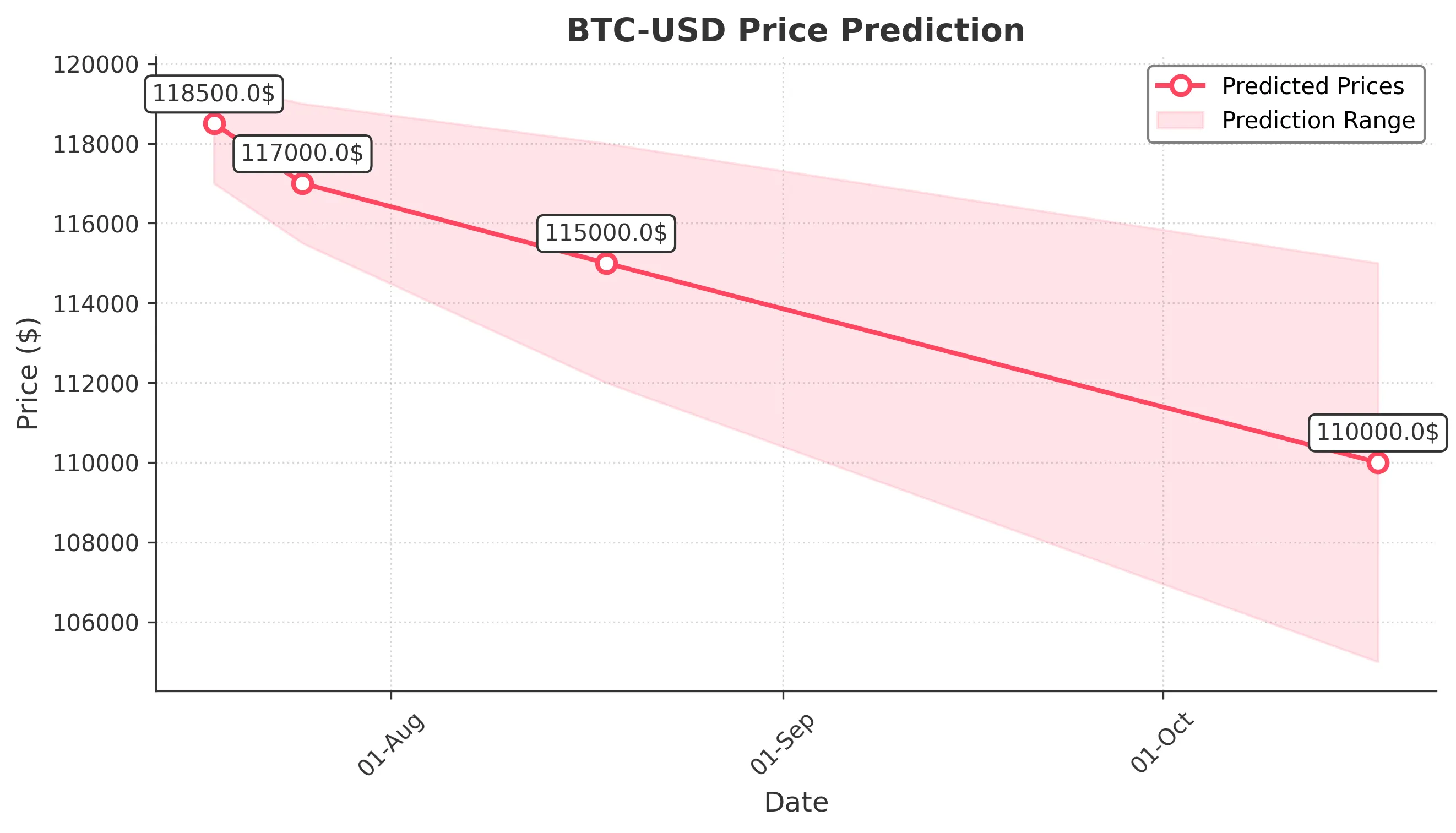

3 Months Prediction

Target: October 18, 2025$110000

$112000

$115000

$105000

Description

A further decline to 110000 is expected as the market adjusts to previous highs. The ATR indicates increasing volatility, and bearish patterns may emerge if selling pressure continues.

Analysis

The trend shows signs of weakening, with potential bearish reversals. Support at 105000 is critical, while resistance remains at 115000. Volume analysis indicates a potential decrease in buying pressure, suggesting caution for investors.

Confidence Level

Potential Risks

Market sentiment is highly unpredictable, and external factors could lead to significant price fluctuations.