BTC-USD Trading Predictions

1 Day Prediction

Target: July 28, 2025$118500

$118300

$119200

$117800

Description

The price is expected to stabilize around 118500, supported by recent bullish momentum and strong volume. The RSI indicates overbought conditions, suggesting a potential pullback, but overall sentiment remains positive.

Analysis

The past 3 months show a bullish trend with significant upward movements. Key resistance at 120000 and support around 115000. Volume spikes indicate strong buying interest, but recent high volatility raises concerns about sustainability.

Confidence Level

Potential Risks

Potential for a reversal exists due to overbought RSI levels and recent volatility. Market sentiment could shift quickly.

1 Week Prediction

Target: August 4, 2025$119000

$118500

$120500

$117000

Description

Expecting a slight increase to 119000 as bullish sentiment persists. However, the MACD shows signs of divergence, indicating potential weakening momentum. Watch for volume trends to confirm direction.

Analysis

The stock has shown strong bullish behavior, with significant support at 115000. The RSI is nearing overbought territory, suggesting caution. Volume patterns indicate strong interest, but volatility remains a concern.

Confidence Level

Potential Risks

Divergence in MACD could signal a trend reversal. Market reactions to macroeconomic news may also impact price.

1 Month Prediction

Target: August 28, 2025$115000

$117000

$118000

$113000

Description

A potential correction to 115000 is anticipated as profit-taking may occur. The Bollinger Bands indicate tightening, suggesting a breakout could happen soon. Watch for volume spikes to gauge market sentiment.

Analysis

The last three months have seen a strong upward trend, but recent price action suggests a possible consolidation phase. Key support at 115000 and resistance at 120000. Volume analysis shows fluctuations, indicating indecision.

Confidence Level

Potential Risks

Market sentiment could shift rapidly, and external factors like regulatory news may impact price. The potential for a deeper correction exists.

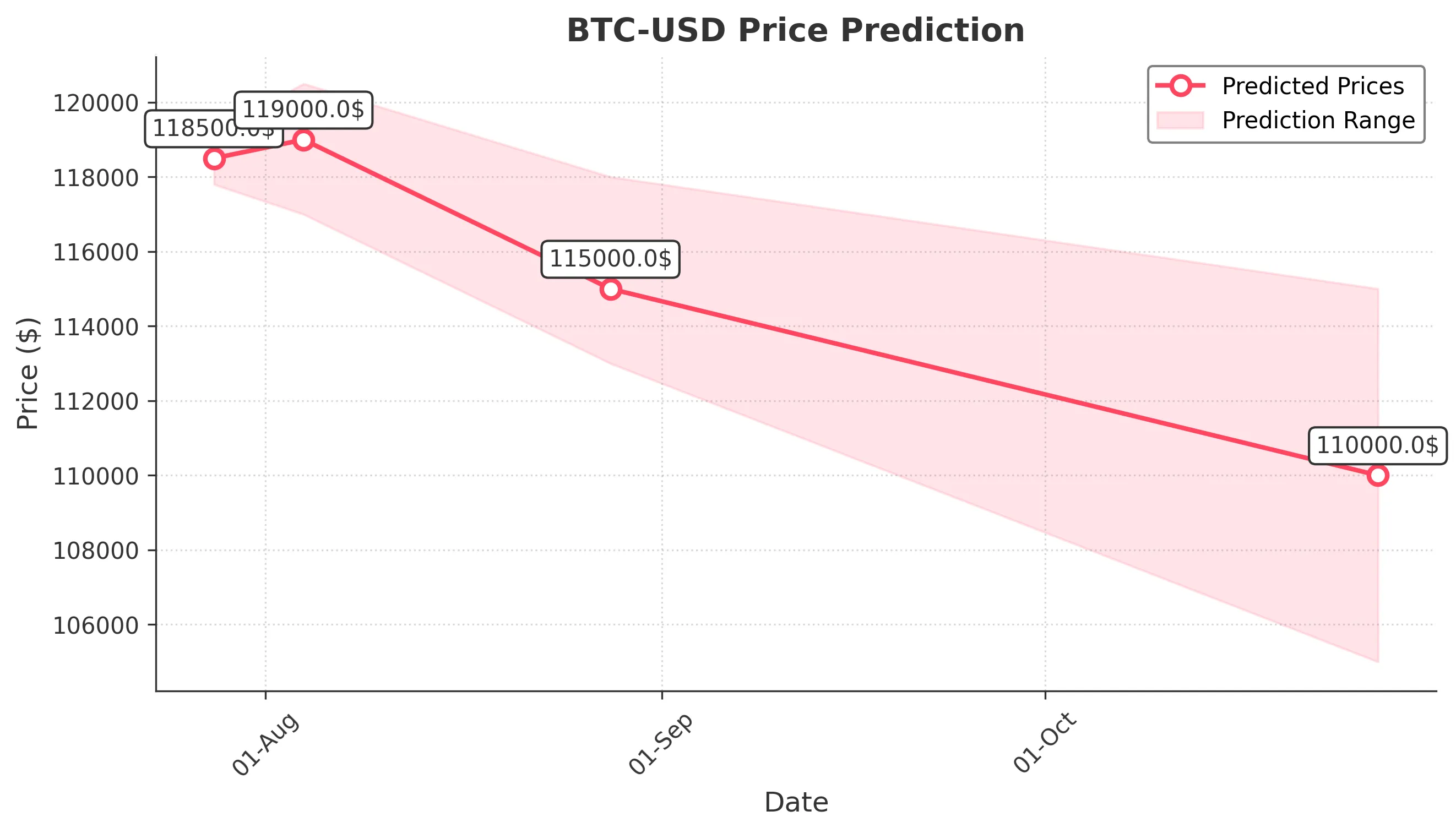

3 Months Prediction

Target: October 27, 2025$110000

$112000

$115000

$105000

Description

Expecting a decline to 110000 as market sentiment may shift towards bearish. The Fibonacci retracement levels suggest potential support at this price. Monitor for any significant news that could impact the market.

Analysis

The overall trend has been bullish, but signs of exhaustion are emerging. Key support at 110000 and resistance at 120000. The market is showing signs of indecision, and external factors could heavily influence future price movements.

Confidence Level

Potential Risks

Uncertainties in macroeconomic conditions and potential regulatory changes could lead to increased volatility. The risk of further declines is present.