BTC-USD Trading Predictions

1 Day Prediction

Target: August 9, 2025$117500

$117400

$118500

$116500

Description

The price is expected to stabilize around 117500, supported by recent bullish momentum and a strong closing on August 8. RSI indicates overbought conditions, suggesting a potential pullback, but overall sentiment remains positive.

Analysis

The past 3 months show a bullish trend with significant upward movements. Key resistance at 118500 and support around 115000. RSI is high, indicating overbought conditions, while MACD shows bullish momentum. Volume has been strong, indicating investor interest.

Confidence Level

Potential Risks

Potential volatility due to profit-taking or macroeconomic news could impact the price.

1 Week Prediction

Target: August 16, 2025$116000

$117000

$117500

$115000

Description

A slight decline to 116000 is anticipated as profit-taking may occur after recent highs. The market sentiment is mixed, with some bearish signals from the RSI and MACD indicating potential weakness.

Analysis

The bullish trend is showing signs of fatigue, with resistance at 118500. Recent candlestick patterns suggest indecision, and volume has decreased slightly. The market may face headwinds from macroeconomic factors.

Confidence Level

Potential Risks

Market sentiment could shift rapidly due to external factors, impacting the prediction.

1 Month Prediction

Target: September 8, 2025$115000

$116500

$117000

$113000

Description

A further decline to 115000 is expected as bearish sentiment grows. The RSI indicates overbought conditions, and MACD shows signs of a bearish crossover, suggesting a potential downtrend.

Analysis

The market has shown a strong bullish trend, but recent price action indicates a potential reversal. Key support at 113000 is critical. Volume patterns suggest decreasing interest, and external economic factors may weigh on prices.

Confidence Level

Potential Risks

Unforeseen market events or news could lead to volatility, affecting the accuracy of this prediction.

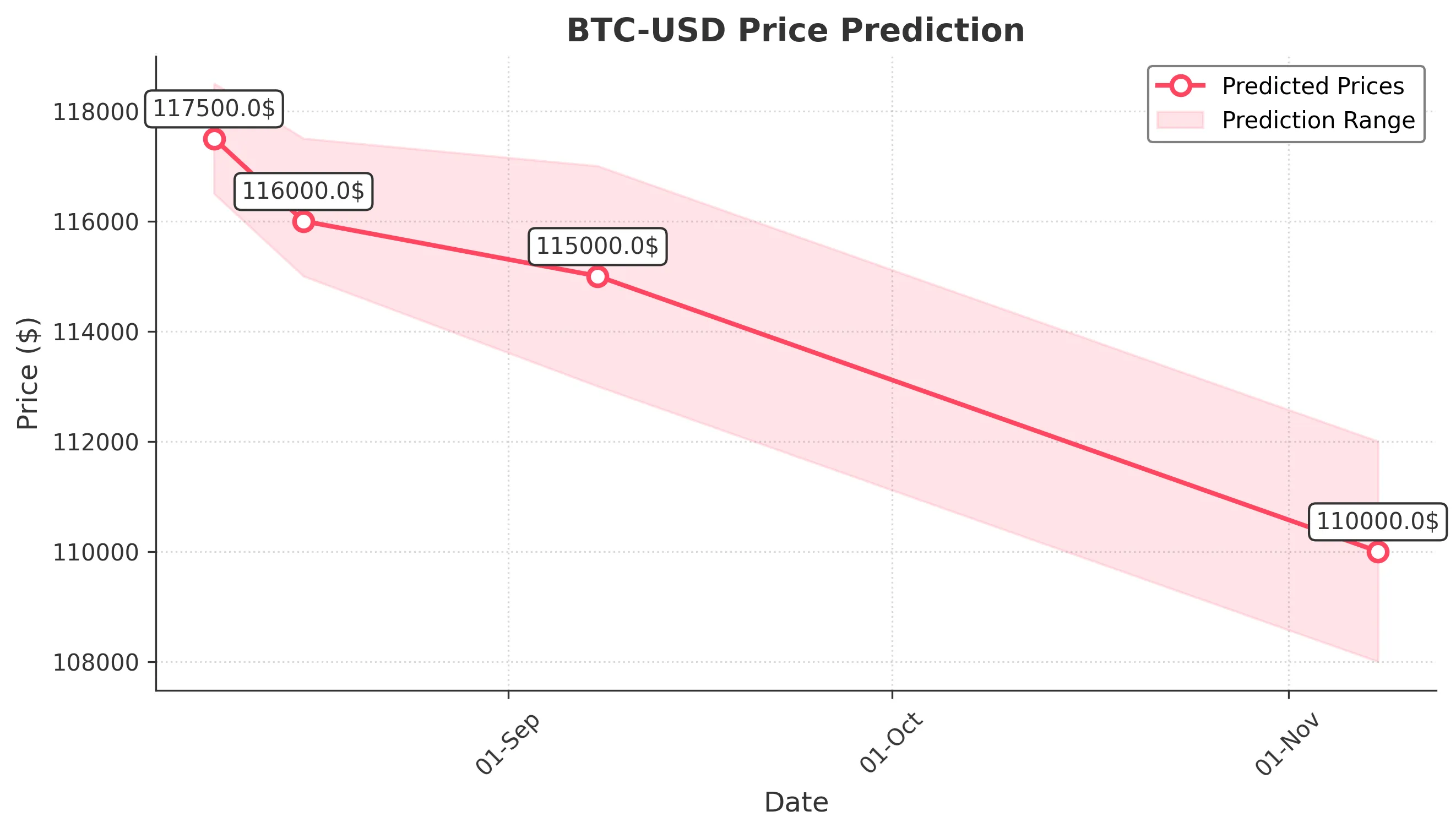

3 Months Prediction

Target: November 8, 2025$110000

$111000

$112000

$108000

Description

A continued downtrend to 110000 is projected as bearish sentiment prevails. The market may face resistance from macroeconomic pressures and declining volume, indicating a lack of buying interest.

Analysis

The overall trend appears to be shifting bearish, with significant resistance at 115000. Volume has been declining, and technical indicators suggest weakening momentum. External economic factors could further impact the market.

Confidence Level

Potential Risks

Market conditions are highly volatile, and any significant news could drastically alter the price trajectory.