BTC-USD Trading Predictions

1 Day Prediction

Target: August 16, 2025$119500

$119200

$120500

$118000

Description

The recent bullish momentum, supported by strong volume and a breakout above resistance levels, suggests a continued upward trend. However, overbought conditions indicated by RSI may lead to a slight pullback.

Analysis

The past 3 months show a bullish trend with significant price increases, particularly in early August. Key resistance at 120000 is being tested, while support is around 115000. Volume spikes indicate strong buying interest.

Confidence Level

Potential Risks

Potential profit-taking could lead to volatility, and external market factors may impact sentiment.

1 Week Prediction

Target: August 23, 2025$121000

$119800

$122500

$118500

Description

The bullish trend is expected to continue as the price consolidates above key support levels. The MACD shows a bullish crossover, indicating potential for further gains, although market corrections are possible.

Analysis

The stock has shown strong upward momentum, with significant volume supporting the price increases. Key resistance levels are being approached, and the market sentiment remains bullish despite potential overbought signals.

Confidence Level

Potential Risks

Market corrections or negative news could reverse the trend, impacting the prediction.

1 Month Prediction

Target: September 15, 2025$125000

$121500

$127000

$119000

Description

Continued bullish sentiment and strong technical indicators suggest further price appreciation. Fibonacci retracement levels indicate potential targets around 125000, but caution is advised due to market volatility.

Analysis

The overall trend remains bullish, with significant price increases observed. Key support at 120000 and resistance at 127000 are critical levels to watch. Volume patterns indicate strong buying interest, but market sentiment could shift.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or regulatory changes could impact the market significantly.

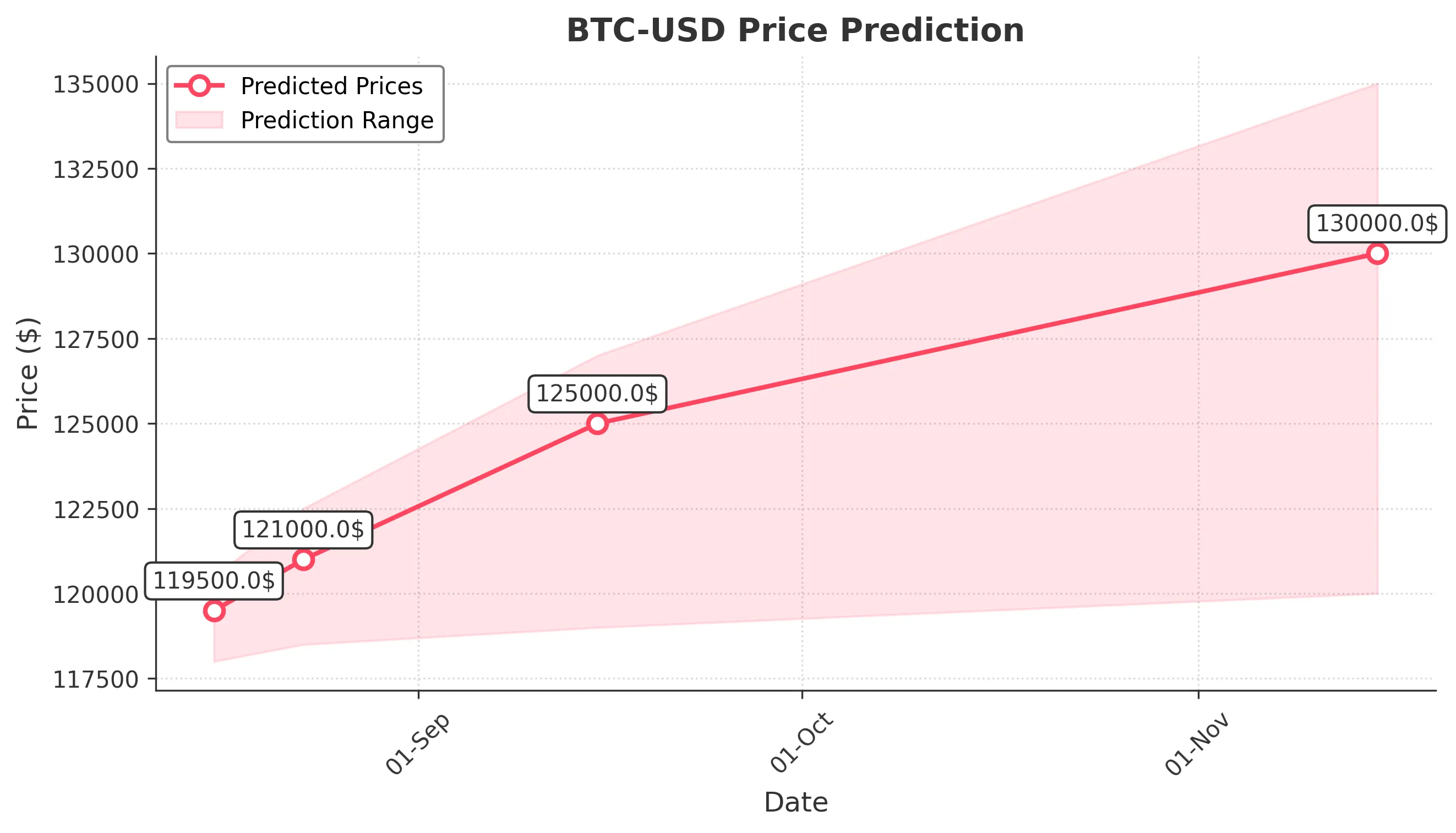

3 Months Prediction

Target: November 15, 2025$130000

$126000

$135000

$120000

Description

If the current bullish trend continues, the price could reach 130000, supported by strong fundamentals and market sentiment. However, potential corrections and profit-taking could create volatility.

Analysis

The stock has shown a strong upward trajectory, but the potential for corrections exists. Key support at 125000 and resistance at 135000 will be crucial in determining future price movements. Market sentiment remains cautiously optimistic.

Confidence Level

Potential Risks

Long-term predictions are uncertain due to market dynamics and potential external shocks.