ETH-USD Trading Predictions

1 Day Prediction

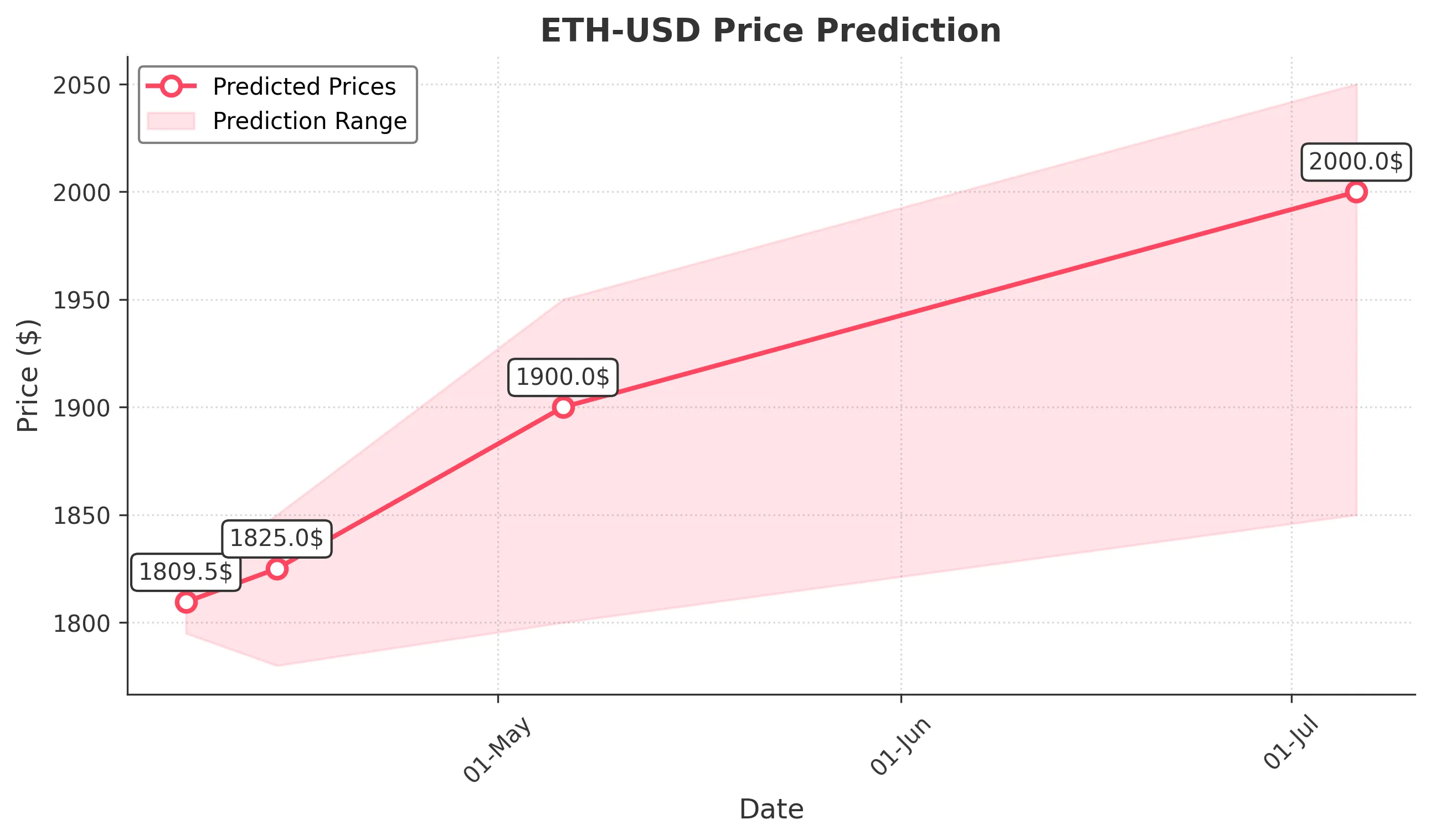

Target: April 7, 2025$1809.5

$1808

$1820

$1795

Description

The price is expected to stabilize around 1809.5 due to recent support at 1800. The RSI indicates oversold conditions, suggesting a potential bounce. However, bearish sentiment persists, limiting upside potential.

Analysis

The past 3 months show a bearish trend with significant volatility. Key support is around 1800, while resistance is at 1850. Volume spikes indicate selling pressure. The MACD is bearish, and the RSI is near oversold levels, suggesting potential for a short-term bounce.

Confidence Level

Potential Risks

Market volatility and external news could impact this prediction. A sudden negative sentiment could push prices lower.

1 Week Prediction

Target: April 14, 2025$1825

$1809.5

$1850

$1780

Description

A slight recovery to 1825.0 is anticipated as the market may react positively to potential bullish news. However, resistance at 1850 could limit gains. The MACD shows signs of convergence, hinting at a possible reversal.

Analysis

The stock has been in a bearish phase, with recent attempts to recover. Key resistance at 1850 remains a challenge. The Bollinger Bands indicate tightening, suggesting a potential breakout. Volume analysis shows a decrease in selling pressure, but caution is warranted.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or negative news could reverse this trend. The market remains sensitive to external factors.

1 Month Prediction

Target: May 6, 2025$1900

$1825

$1950

$1800

Description

A gradual recovery to 1900.0 is expected as bullish sentiment may return. The RSI is improving, and the MACD shows potential for a bullish crossover. However, resistance at 1950 could pose challenges.

Analysis

The stock has shown signs of recovery, but the overall trend remains bearish. Key support at 1800 is critical. The MACD is nearing a bullish crossover, and the RSI is improving, indicating potential for upward movement. However, resistance at 1950 remains a concern.

Confidence Level

Potential Risks

Market sentiment can shift quickly, and external economic factors may hinder recovery. Watch for any signs of renewed bearish pressure.

3 Months Prediction

Target: July 6, 2025$2000

$1900

$2050

$1850

Description

A recovery to 2000.0 is projected as market sentiment may improve with potential positive developments. The RSI is expected to stabilize, and the MACD may confirm a bullish trend.

Analysis

The stock has been in a bearish trend, but signs of recovery are emerging. Key resistance at 2050 could limit gains. The MACD is showing potential for a bullish trend, while the RSI indicates improving momentum. However, external economic factors remain a risk.

Confidence Level

Potential Risks

Long-term predictions are uncertain due to potential market volatility and economic changes. External factors could significantly impact this forecast.