ETH-USD Trading Predictions

1 Day Prediction

Target: April 11, 2025$1600

$1610

$1620

$1580

Description

The price is expected to stabilize around 1600 as recent volatility suggests a potential bottom. RSI indicates oversold conditions, while MACD shows a bullish crossover. However, market sentiment remains cautious due to recent declines.

Analysis

The past three months show a bearish trend with significant price drops. Key support is around 1500, while resistance is at 1700. Volume spikes indicate selling pressure. Technical indicators suggest potential for a short-term rebound, but overall sentiment is bearish.

Confidence Level

Potential Risks

Market volatility and external news could lead to unexpected price movements.

1 Week Prediction

Target: April 18, 2025$1650

$1600

$1700

$1550

Description

A slight recovery is anticipated as the market digests recent losses. The RSI is moving towards neutral, indicating potential for upward momentum. However, resistance at 1700 may limit gains.

Analysis

The stock has shown significant volatility with a bearish trend. Support at 1500 remains critical. Technical indicators suggest a possible short-term recovery, but overall market sentiment is still cautious.

Confidence Level

Potential Risks

Continued bearish sentiment and macroeconomic factors could hinder recovery.

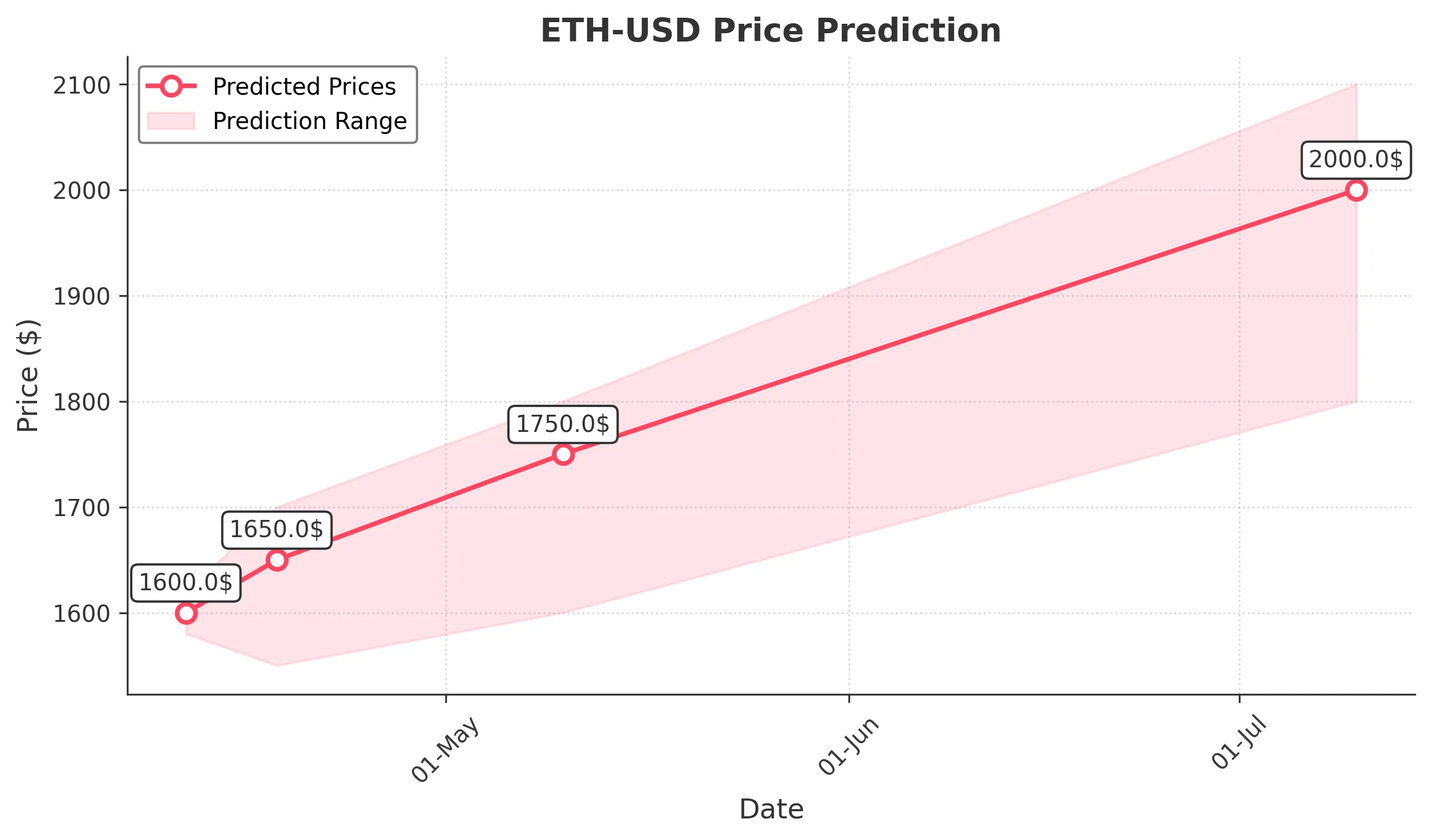

1 Month Prediction

Target: May 10, 2025$1750

$1650

$1800

$1600

Description

A gradual recovery is expected as market sentiment improves. The MACD may indicate a bullish trend, and if support holds, we could see a test of resistance at 1800.

Analysis

The stock has been in a bearish phase, with significant price drops. Key support at 1500 and resistance at 1800 are critical. Technical indicators suggest potential for recovery, but overall market sentiment remains fragile.

Confidence Level

Potential Risks

Unforeseen market events or economic data could impact this recovery.

3 Months Prediction

Target: July 10, 2025$2000

$1850

$2100

$1800

Description

If the market stabilizes, a recovery towards 2000 is plausible. The RSI may indicate a bullish trend, and if macroeconomic conditions improve, we could see a sustained upward movement.

Analysis

The stock has faced significant downward pressure. Key support at 1500 and resistance at 2100 are crucial. While technical indicators suggest potential for recovery, external factors could heavily influence future performance.

Confidence Level

Potential Risks

Long-term uncertainties and potential market corrections could affect this prediction.