ETH-USD Trading Predictions

1 Day Prediction

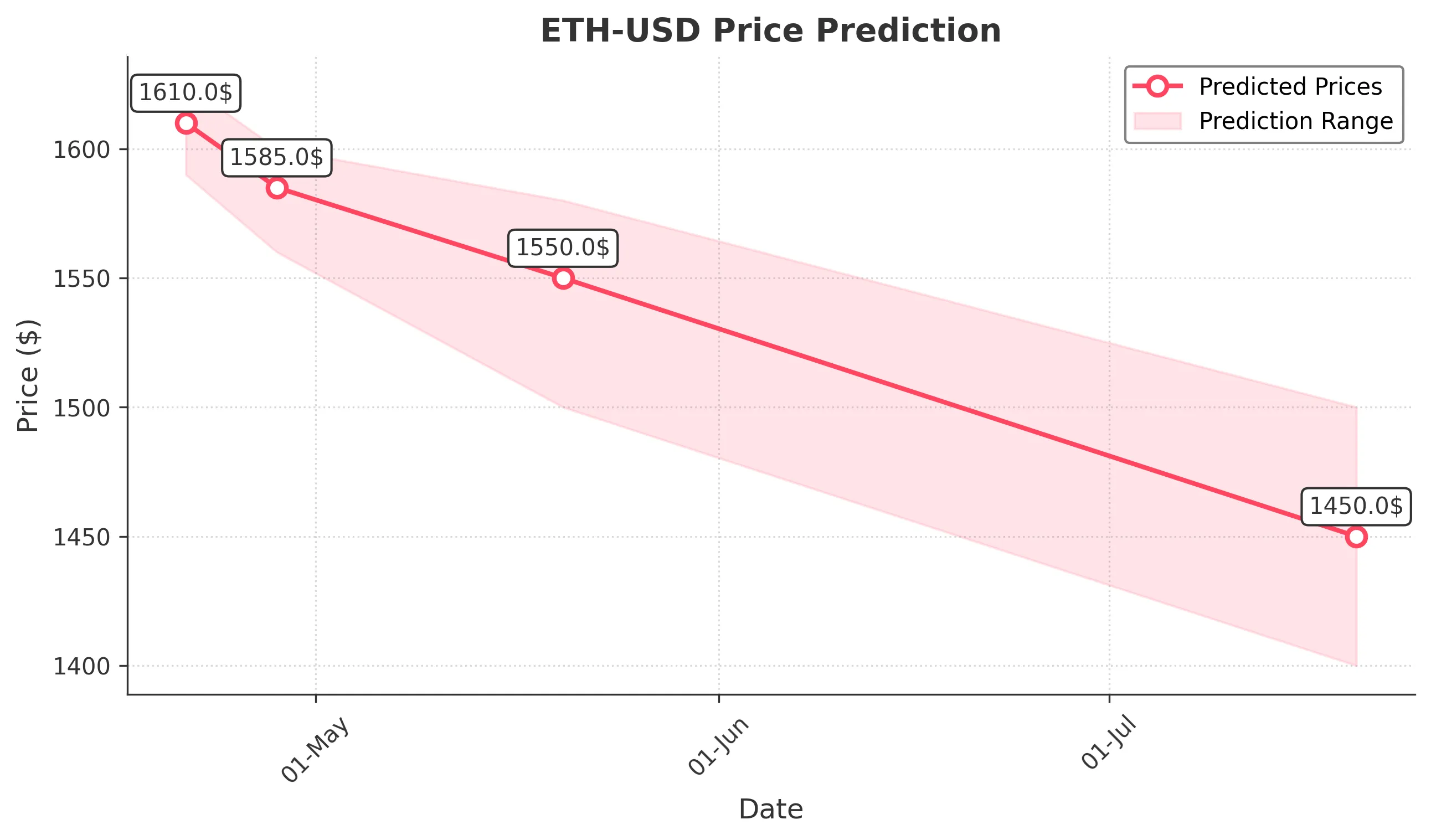

Target: April 21, 2025$1610

$1605

$1625

$1590

Description

The price is expected to stabilize around 1610.00 as recent bullish momentum is supported by a slight upward trend in volume. However, resistance at 1625.00 may limit gains.

Analysis

The past 3 months show a bearish trend with significant price drops. Key support is around 1580.00, while resistance is at 1650.00. Volume has been inconsistent, indicating uncertainty.

Confidence Level

Potential Risks

Market volatility and external news could impact this prediction, especially if bearish sentiment resurfaces.

1 Week Prediction

Target: April 28, 2025$1585

$1590

$1600

$1560

Description

A slight decline to 1585.00 is anticipated as bearish pressure continues. The RSI indicates oversold conditions, but resistance at 1600.00 may hinder recovery.

Analysis

The stock has shown a bearish trend with significant fluctuations. Support at 1560.00 is critical, while resistance at 1600.00 remains a barrier. Volume spikes suggest uncertainty.

Confidence Level

Potential Risks

Potential for sudden market shifts due to macroeconomic factors or news events could affect this outlook.

1 Month Prediction

Target: May 20, 2025$1550

$1570

$1580

$1500

Description

A continued bearish trend is expected, with a target close of 1550.00. The MACD indicates a bearish crossover, suggesting further downside potential.

Analysis

The overall trend remains bearish with significant resistance at 1600.00. Volume analysis shows declining interest, and key support at 1500.00 is crucial for future price action.

Confidence Level

Potential Risks

Market sentiment can shift rapidly, and any positive news could lead to unexpected price movements.

3 Months Prediction

Target: July 20, 2025$1450

$1480

$1500

$1400

Description

A bearish outlook persists with a predicted close of 1450.00. The market sentiment remains weak, and further declines are likely unless significant bullish catalysts emerge.

Analysis

The stock has been in a downtrend, with key support at 1400.00. The RSI indicates oversold conditions, but without a reversal signal, further declines are expected. Volume trends suggest waning interest.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or regulatory changes could drastically alter this prediction.