ETH-USD Trading Predictions

1 Day Prediction

Target: April 23, 2025$1580

$1580

$1600

$1560

Description

The price is expected to stabilize around 1580, with minor fluctuations. Recent candlestick patterns indicate indecision, and the RSI suggests a neutral stance. Volume remains high, indicating potential volatility.

Analysis

The past three months show a bearish trend with significant volatility. Key support is around 1560, while resistance is near 1600. The RSI is neutral, and MACD shows a bearish crossover, indicating potential further declines.

Confidence Level

Potential Risks

Market sentiment is mixed, and external factors could lead to unexpected price movements.

1 Week Prediction

Target: April 30, 2025$1565

$1570

$1585

$1550

Description

Expect a slight decline to 1565 as bearish momentum continues. The MACD remains negative, and the Bollinger Bands indicate potential for further downside. Volume trends suggest continued selling pressure.

Analysis

The stock has been in a bearish phase, with significant resistance at 1600. The ATR indicates high volatility, and recent volume spikes suggest strong selling. The market sentiment is cautious, with potential for further declines.

Confidence Level

Potential Risks

Unforeseen macroeconomic events could impact market sentiment and lead to volatility.

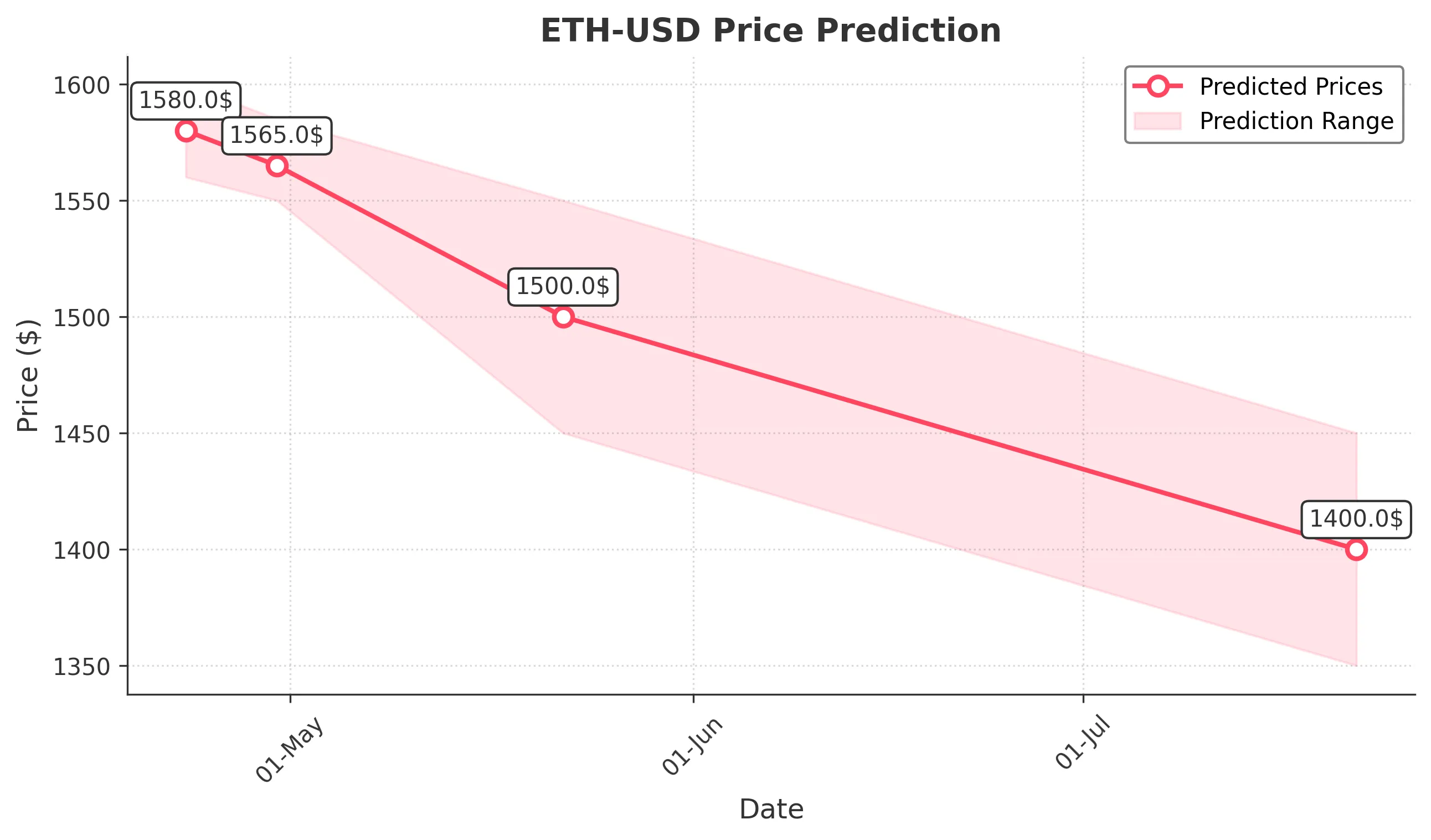

1 Month Prediction

Target: May 22, 2025$1500

$1550

$1550

$1450

Description

A bearish outlook suggests a drop to 1500, driven by continued selling pressure and negative market sentiment. The Fibonacci retracement levels indicate strong support at 1500, but further declines are possible.

Analysis

The stock has shown a consistent downtrend, with key support at 1500. The RSI indicates oversold conditions, but the MACD remains bearish. Volume analysis shows increased selling, suggesting a continued bearish sentiment.

Confidence Level

Potential Risks

Market volatility and potential bullish reversals could affect this prediction.

3 Months Prediction

Target: July 22, 2025$1400

$1450

$1450

$1350

Description

The prediction of 1400 reflects ongoing bearish trends and potential market corrections. The MACD and RSI indicate continued weakness, and support levels suggest further declines.

Analysis

The overall trend remains bearish, with significant resistance at 1450. The ATR indicates high volatility, and recent trading patterns suggest a lack of buying interest. External economic factors may further influence price movements.

Confidence Level

Potential Risks

Market conditions can change rapidly, and unexpected news could lead to price fluctuations.