ETH-USD Trading Predictions

1 Day Prediction

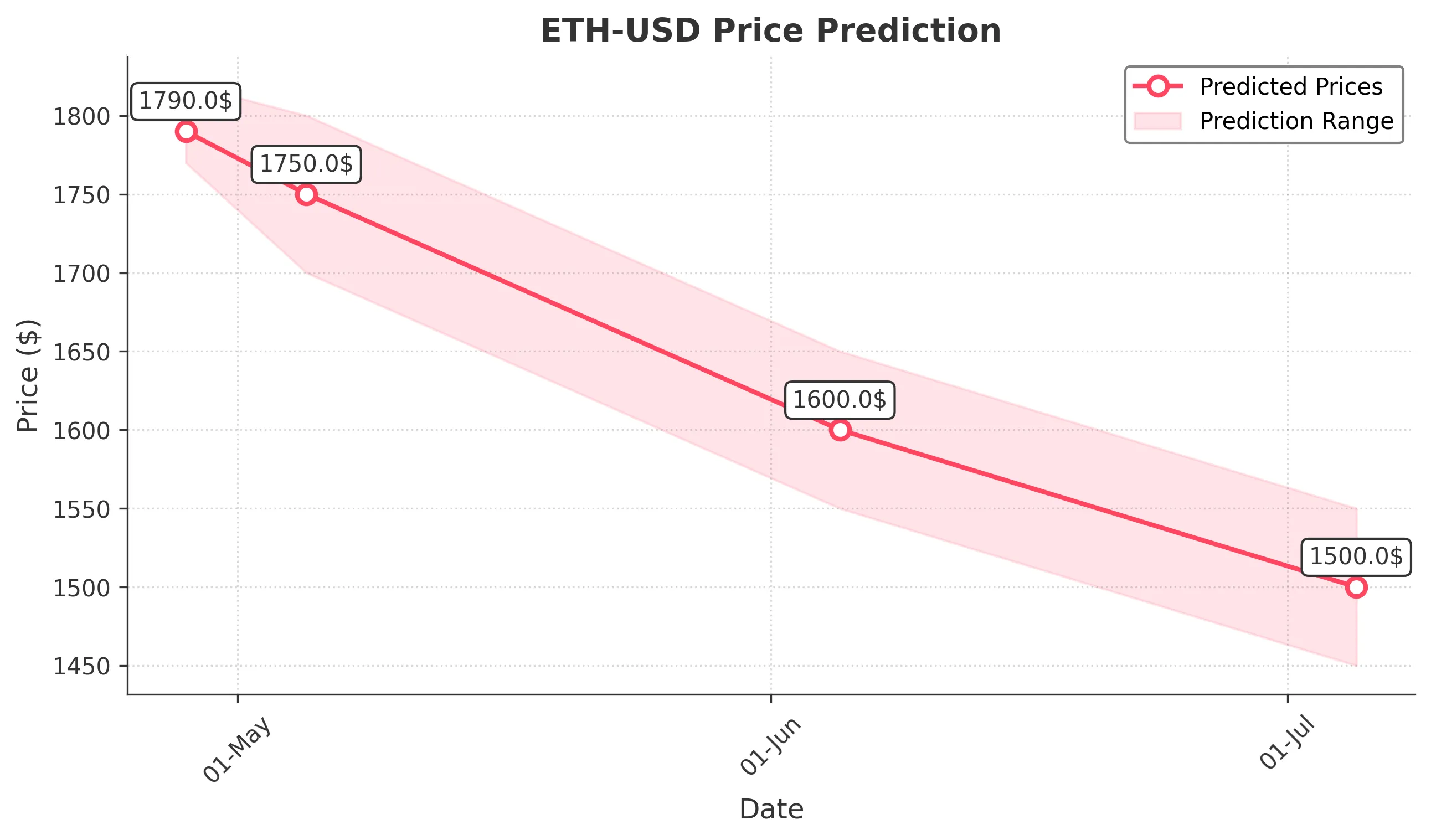

Target: April 28, 2025$1790

$1795

$1820

$1770

Description

The price is expected to stabilize around 1790.00 due to recent support at 1780.00. RSI indicates oversold conditions, suggesting a potential bounce. However, bearish sentiment persists from recent volatility.

Analysis

The past 3 months show a bearish trend with significant volatility. Key support at 1780.00 and resistance at 1820.00. RSI indicates oversold conditions, while MACD shows a bearish crossover. Volume spikes suggest uncertainty.

Confidence Level

Potential Risks

Market sentiment remains bearish, and any negative news could lead to further declines.

1 Week Prediction

Target: May 5, 2025$1750

$1790

$1800

$1700

Description

Expect further declines to around 1750.00 as bearish momentum continues. The MACD remains negative, and the recent price action suggests a lack of buying interest. Watch for support at 1700.00.

Analysis

The stock has been in a downtrend, with significant resistance at 1800.00. Volume analysis shows declining interest, and candlestick patterns indicate bearish sentiment. The market remains cautious.

Confidence Level

Potential Risks

Potential for a short-term rally exists, but overall sentiment is weak, and external factors could impact prices.

1 Month Prediction

Target: June 5, 2025$1600

$1750

$1650

$1550

Description

A continued bearish trend is expected, with a target of 1600.00. The market sentiment is negative, and technical indicators suggest further declines. Watch for potential support at 1550.00.

Analysis

The overall trend is bearish, with significant resistance at 1750.00. The RSI indicates oversold conditions, but the MACD remains negative. Volume patterns suggest a lack of buying pressure.

Confidence Level

Potential Risks

Market conditions could change rapidly, and any positive news could lead to a reversal.

3 Months Prediction

Target: July 5, 2025$1500

$1600

$1550

$1450

Description

Expect a further decline to around 1500.00 as bearish trends persist. The market is likely to remain under pressure, with key support at 1450.00. Watch for any changes in macroeconomic conditions.

Analysis

The stock has shown a consistent downtrend, with key resistance at 1600.00. Technical indicators suggest continued bearish momentum, and volume analysis indicates a lack of buying interest.

Confidence Level

Potential Risks

Unforeseen macroeconomic events could significantly impact the prediction, leading to volatility.