ETH-USD Trading Predictions

1 Day Prediction

Target: May 6, 2025$1820

$1818

$1840

$1780

Description

The price is expected to stabilize around 1820. The RSI indicates oversold conditions, suggesting a potential bounce. However, recent bearish trends and high volatility may limit upward movement.

Analysis

Over the past 3 months, ETH-USD has shown a bearish trend with significant volatility. Key support is around 1780, while resistance is near 1850. Volume spikes indicate potential reversals, but overall sentiment is cautious.

Confidence Level

Potential Risks

Market sentiment remains cautious due to recent declines, and any negative news could lead to further drops.

1 Week Prediction

Target: May 13, 2025$1850

$1820

$1900

$1800

Description

A slight recovery is anticipated as the market may react positively to potential bullish news. The MACD shows signs of a bullish crossover, but caution is advised due to ongoing volatility.

Analysis

The past 3 months have been marked by bearish trends, with significant support at 1780. The RSI is recovering, indicating potential upward movement, but overall market sentiment is mixed.

Confidence Level

Potential Risks

Uncertainty remains high due to macroeconomic factors and potential regulatory news that could impact prices.

1 Month Prediction

Target: June 5, 2025$1900

$1850

$1950

$1850

Description

A gradual recovery is expected as market sentiment improves. The Fibonacci retracement levels suggest a potential target around 1900, but caution is warranted due to previous volatility.

Analysis

ETH-USD has faced significant downward pressure, with key resistance at 1950. The market is showing signs of recovery, but the overall trend remains uncertain, influenced by external economic factors.

Confidence Level

Potential Risks

Market conditions are unpredictable, and external factors could lead to sudden price changes.

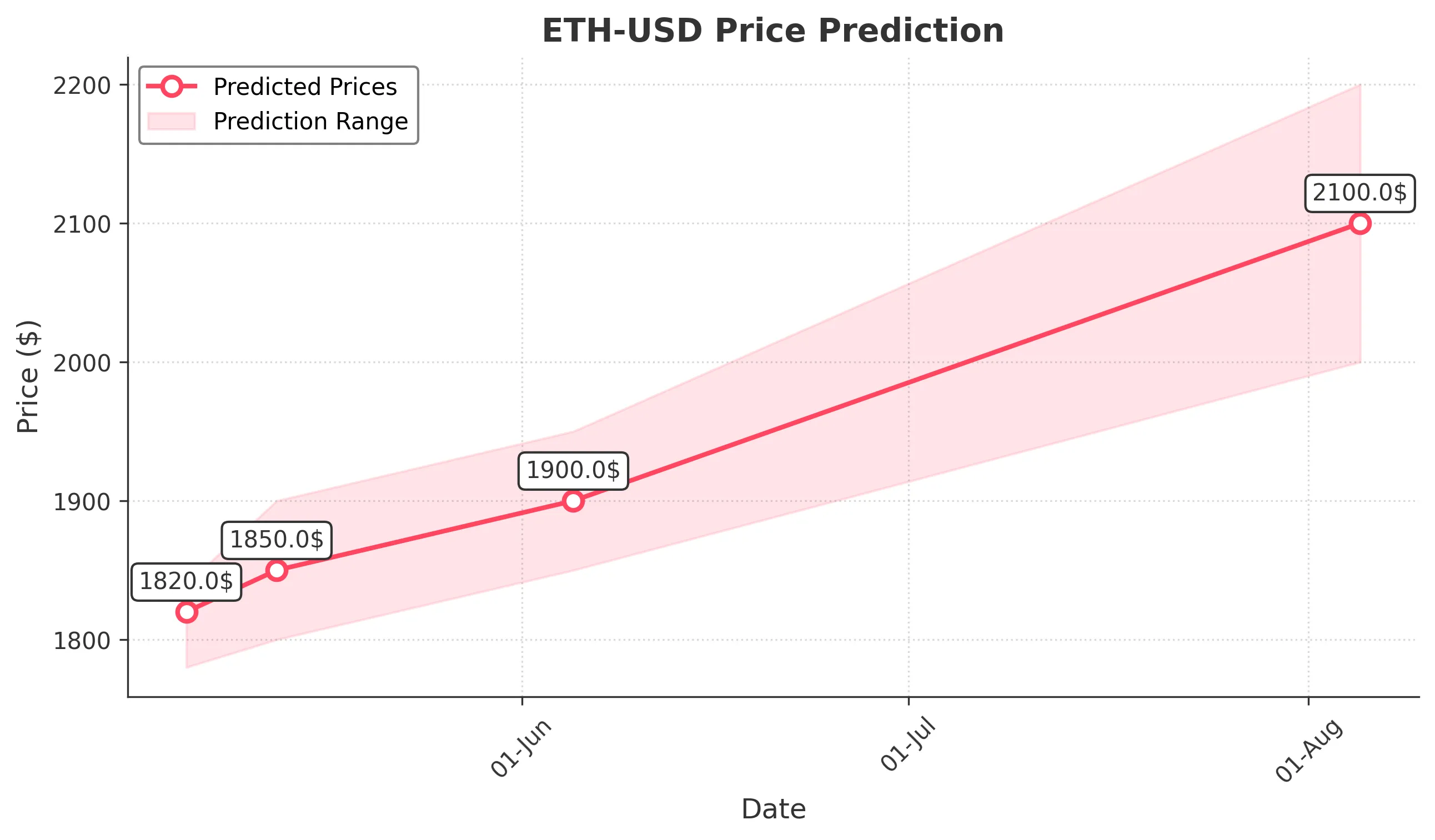

3 Months Prediction

Target: August 5, 2025$2100

$2050

$2200

$2000

Description

Long-term recovery is anticipated as market conditions stabilize. Positive macroeconomic developments could support upward momentum, but caution is advised due to potential market corrections.

Analysis

The overall trend has been bearish, but signs of recovery are emerging. Key resistance levels are at 2200, while support remains at 2000. Market sentiment is cautiously optimistic, but volatility remains a concern.

Confidence Level

Potential Risks

Long-term predictions are highly uncertain due to potential regulatory changes and market sentiment shifts.