ETH-USD Trading Predictions

1 Day Prediction

Target: June 8, 2025$2480

$2485

$2500

$2460

Description

The price is expected to stabilize around 2480.00 as the RSI indicates oversold conditions, suggesting a potential bounce. However, recent volatility and bearish sentiment may cap gains.

Analysis

Over the past 3 months, ETH-USD has shown significant volatility with a bearish trend recently. Key support is around 2400, while resistance is near 2600. Volume spikes indicate strong selling pressure.

Confidence Level

Potential Risks

Market sentiment remains bearish, and any negative news could lead to further declines.

1 Week Prediction

Target: June 15, 2025$2500

$2480

$2550

$2450

Description

A slight recovery is anticipated as the market may react positively to potential bullish news. The MACD shows signs of convergence, indicating a possible trend reversal.

Analysis

The past 3 months have seen ETH-USD fluctuating with a bearish bias. Key resistance at 2600 remains unbroken, while support at 2400 is critical. Volume analysis shows increased selling pressure.

Confidence Level

Potential Risks

Uncertainty remains due to macroeconomic factors and potential regulatory news that could impact prices.

1 Month Prediction

Target: July 7, 2025$2550

$2500

$2600

$2400

Description

A gradual recovery is expected as bullish sentiment may return. The Fibonacci retracement levels suggest a potential bounce back towards 2550.00.

Analysis

ETH-USD has been in a bearish trend, with significant fluctuations. Support at 2400 is crucial, while resistance at 2600 remains a barrier. Volume patterns indicate strong selling pressure.

Confidence Level

Potential Risks

Market volatility and external economic factors could hinder recovery, leading to unexpected price movements.

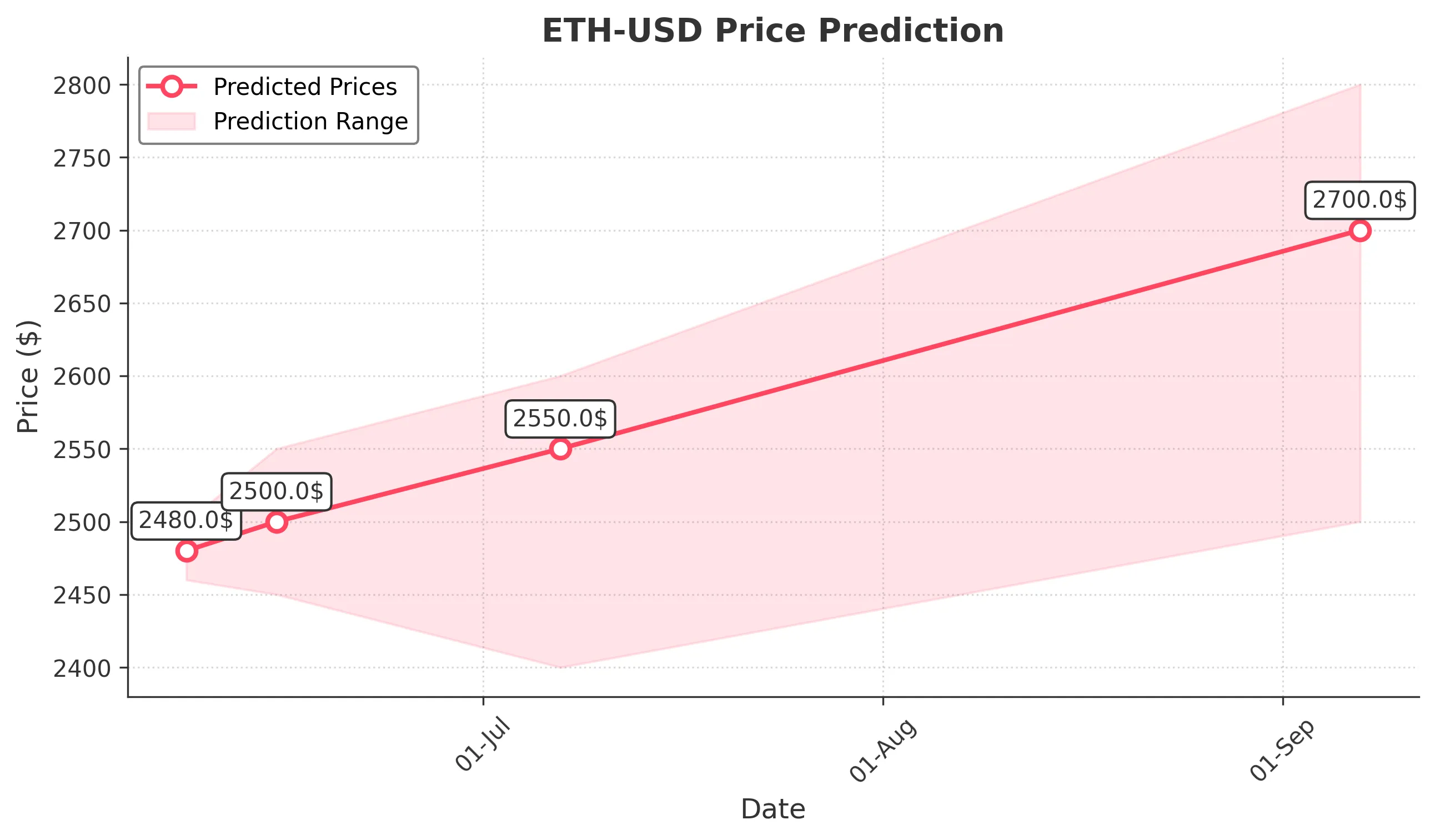

3 Months Prediction

Target: September 7, 2025$2700

$2600

$2800

$2500

Description

If the market stabilizes, a bullish trend could emerge, pushing prices towards 2700.00. Positive macroeconomic developments may support this outlook.

Analysis

The overall trend has been bearish, but potential recovery signals are emerging. Key support at 2400 and resistance at 2600 are critical. Volume analysis shows a shift towards buying interest.

Confidence Level

Potential Risks

Long-term predictions are uncertain due to potential regulatory changes and market sentiment shifts.