ETH-USD Trading Predictions

1 Day Prediction

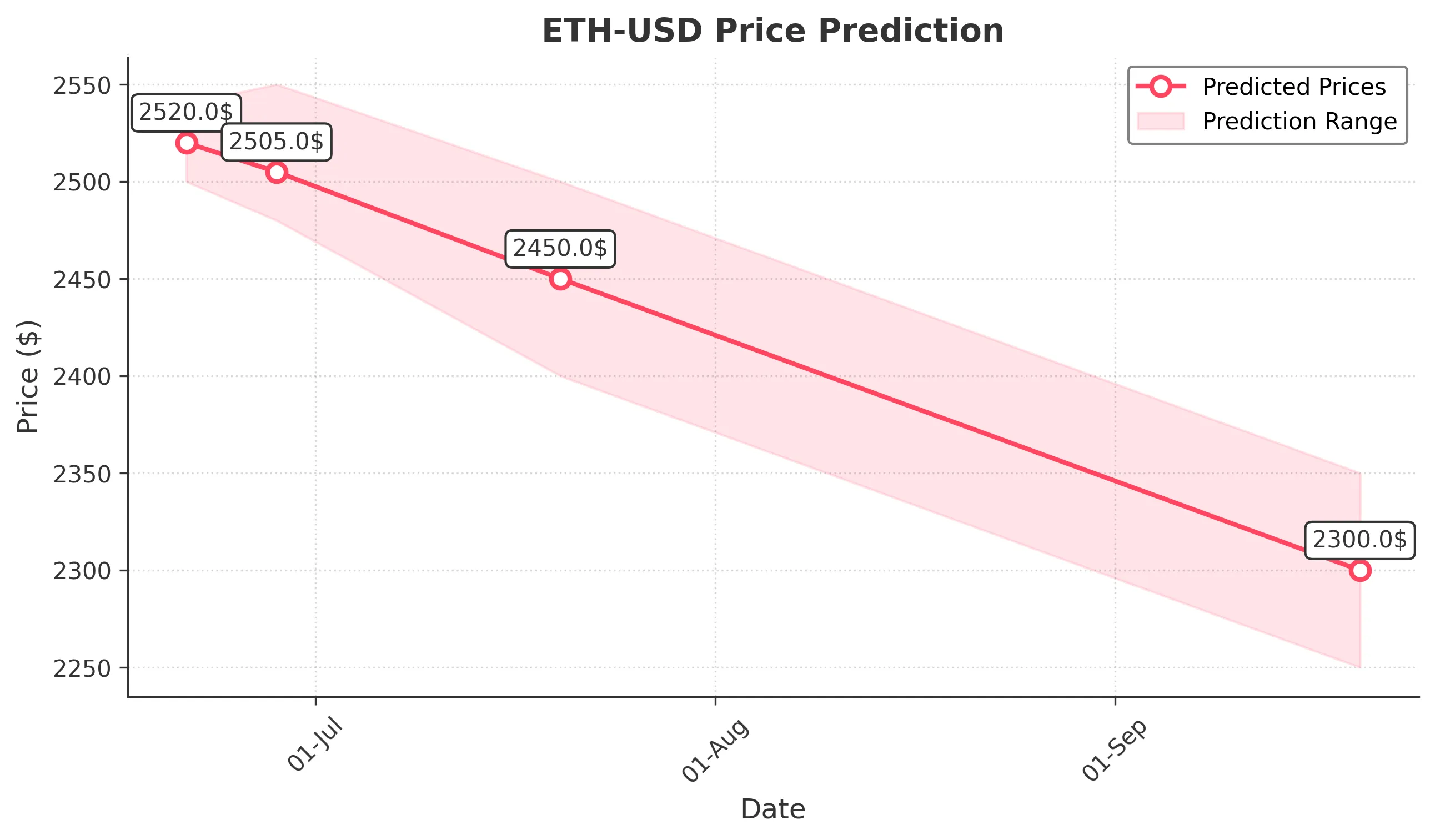

Target: June 21, 2025$2520

$2521.200195

$2540

$2500

Description

The price is expected to stabilize around 2520.0, with support from recent trading volume and a slight bullish sentiment. However, the RSI indicates overbought conditions, suggesting potential pullbacks.

Analysis

The past 3 months show a bullish trend with significant price fluctuations. Key resistance at 2600 and support around 2500. RSI indicates overbought conditions, while MACD shows potential bearish divergence.

Confidence Level

Potential Risks

Market volatility and external news could impact the price significantly.

1 Week Prediction

Target: June 28, 2025$2505

$2520

$2550

$2480

Description

Expect a slight decline to 2505.0 as profit-taking may occur. The MACD shows weakening momentum, and the Bollinger Bands indicate potential consolidation.

Analysis

The stock has shown volatility with a recent peak at 2813.5. Support at 2500 is critical, while resistance remains at 2600. Volume spikes indicate strong interest, but RSI suggests caution.

Confidence Level

Potential Risks

Unforeseen market events could lead to sharper declines or rebounds.

1 Month Prediction

Target: July 20, 2025$2450

$2505

$2500

$2400

Description

A bearish trend is anticipated, with a target of 2450.0. The market sentiment is shifting, and the Fibonacci retracement levels suggest a pullback towards 2400.

Analysis

The stock has been volatile, with a recent high of 2813.5. The overall trend appears to be bearish, with significant resistance at 2600 and support at 2400. Volume analysis shows potential for further declines.

Confidence Level

Potential Risks

Market sentiment can change rapidly, and external factors may influence price movements.

3 Months Prediction

Target: September 20, 2025$2300

$2450

$2350

$2250

Description

A continued bearish trend is expected, with a target of 2300.0. The market may face headwinds from macroeconomic factors and potential regulatory changes affecting sentiment.

Analysis

The stock has shown a bearish trend with significant fluctuations. Key support at 2250 and resistance at 2400. The overall market sentiment is cautious, and external factors may lead to further declines.

Confidence Level

Potential Risks

Economic indicators and regulatory news could significantly alter the market landscape.