ETH-USD Trading Predictions

1 Day Prediction

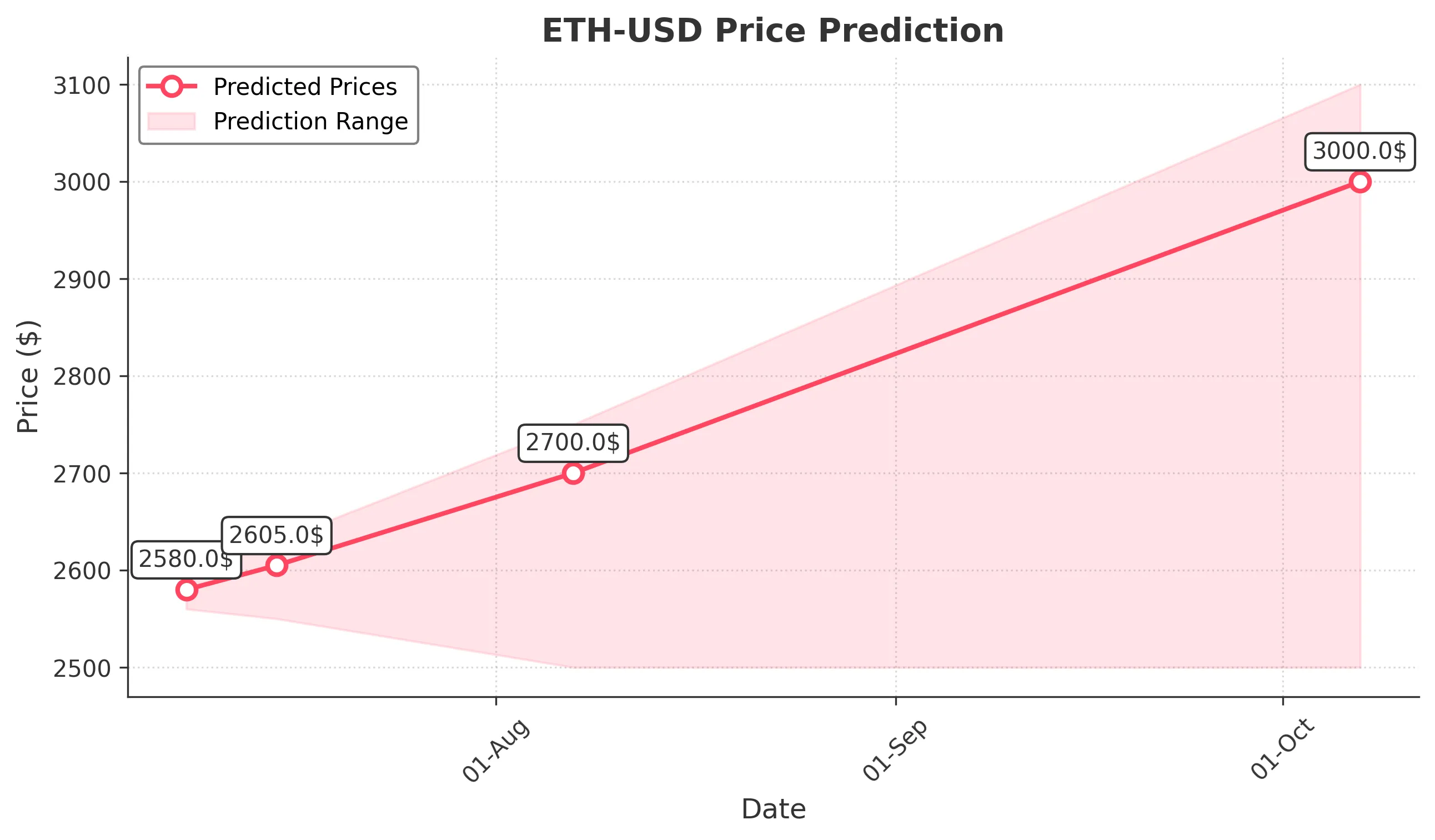

Target: July 8, 2025$2580

$2575

$2600

$2560

Description

The price is expected to stabilize around 2580, supported by recent bullish momentum and a potential breakout above resistance levels. RSI indicates overbought conditions, suggesting caution.

Analysis

ETH-USD has shown a bullish trend recently, with significant volume spikes indicating strong buying interest. Key resistance at 2600 may limit upward movement, while support at 2500 remains critical.

Confidence Level

Potential Risks

Potential for a pullback due to overbought RSI and recent volatility. Market sentiment may shift quickly.

1 Week Prediction

Target: July 15, 2025$2605

$2580

$2630

$2550

Description

Expect a slight upward trend as bullish sentiment persists. However, the market may face resistance at 2630, and profit-taking could lead to volatility.

Analysis

The past week has shown a bullish trend with increasing volume. The MACD indicates upward momentum, but the RSI suggests potential overbought conditions, warranting caution.

Confidence Level

Potential Risks

Market sentiment can shift rapidly, and external factors like regulatory news could impact prices significantly.

1 Month Prediction

Target: August 7, 2025$2700

$2600

$2750

$2500

Description

A bullish outlook for the month ahead, driven by strong market sentiment and potential new highs. However, watch for resistance at 2750.

Analysis

ETH-USD has been trending upward with strong volume. Key support at 2500 and resistance at 2750 are critical levels to monitor. The overall sentiment remains bullish.

Confidence Level

Potential Risks

Market corrections are possible, especially if profit-taking occurs or if macroeconomic factors change.

3 Months Prediction

Target: October 7, 2025$3000

$2800

$3100

$2500

Description

Long-term bullish outlook as ETH-USD may reach new highs. However, potential market corrections could occur, especially if external factors impact sentiment.

Analysis

The overall trend has been bullish, but the market is susceptible to corrections. Key resistance at 3100 and support at 2500 will be crucial in the coming months.

Confidence Level

Potential Risks

High uncertainty due to potential market volatility and external economic factors that could influence prices.