ETH-USD Trading Predictions

1 Day Prediction

Target: July 11, 2025$2800

$2790

$2850

$2750

Description

The recent bullish momentum, indicated by higher highs and higher lows, suggests a continuation. The RSI is approaching overbought levels, but MACD remains positive. Volume spikes on recent days support the upward trend.

Analysis

The past 3 months show a bullish trend with significant price increases. Key resistance at $2800. The MACD is bullish, and RSI indicates overbought conditions. Volume has been strong, indicating strong buying interest.

Confidence Level

Potential Risks

Potential profit-taking could lead to a pullback. Market sentiment may shift due to external factors.

1 Week Prediction

Target: July 18, 2025$2750

$2780

$2800

$2700

Description

A slight pullback is expected as the market consolidates after recent highs. The RSI indicates overbought conditions, and profit-taking may occur. However, support at $2700 should hold.

Analysis

The stock has shown strong bullish momentum, but recent overbought signals suggest a potential correction. Key support at $2700 and resistance at $2800. Volume remains high, indicating continued interest.

Confidence Level

Potential Risks

Market volatility and external news could impact price direction. A break below $2700 could signal further declines.

1 Month Prediction

Target: August 10, 2025$2600

$2750

$2700

$2500

Description

Expect a gradual decline as the market corrects from recent highs. The RSI is likely to normalize, and MACD may turn bearish. Support at $2500 is critical.

Analysis

The stock has experienced significant volatility with a recent peak. The overall trend remains bullish, but signs of exhaustion are evident. Key support at $2500 and resistance at $2700. Volume patterns suggest potential selling pressure.

Confidence Level

Potential Risks

Unforeseen macroeconomic events could alter market sentiment. A strong bullish reversal could occur if support holds.

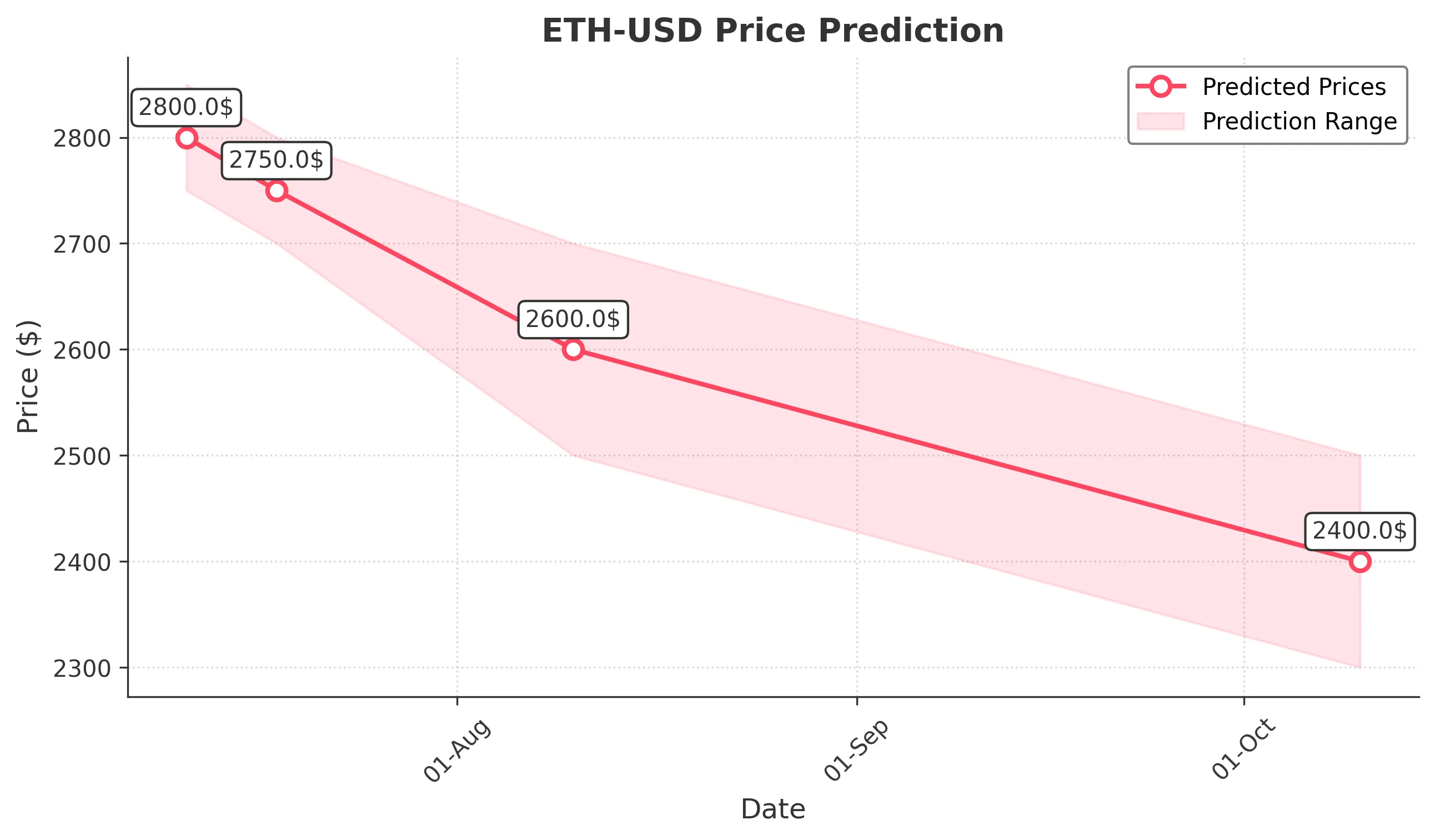

3 Months Prediction

Target: October 10, 2025$2400

$2450

$2500

$2300

Description

A bearish trend is anticipated as the market adjusts to previous highs. Continued selling pressure may push prices lower, with key support at $2300.

Analysis

The stock has shown a strong upward trend but is now facing potential resistance. The overall sentiment is mixed, with bearish signals emerging. Key support at $2300 and resistance at $2500. Volume has decreased, indicating waning interest.

Confidence Level

Potential Risks

Market sentiment could shift positively if new bullish catalysts emerge. Economic indicators may also influence price direction.