ETH-USD Trading Predictions

1 Day Prediction

Target: July 14, 2025$2950

$2955

$3000

$2900

Description

The price is expected to remain strong due to recent bullish momentum and high trading volume. The MACD shows a bullish crossover, and RSI is near 70, indicating overbought conditions. A slight pullback may occur, but overall sentiment remains positive.

Analysis

The past three months show a bullish trend with significant price increases. Key resistance at $3000 and support around $2900. Volume spikes indicate strong buying interest. However, the RSI suggests caution as it approaches overbought territory.

Confidence Level

Potential Risks

Potential for a pullback due to overbought RSI levels and market volatility.

1 Week Prediction

Target: July 21, 2025$2900

$2950

$2950

$2800

Description

Expect a slight correction as profit-taking may occur after recent highs. The MACD is flattening, indicating potential loss of momentum. Support at $2900 is critical; a break below could lead to further declines.

Analysis

The bullish trend is showing signs of fatigue. Recent highs have led to increased volatility. Key support at $2900 and resistance at $3000. Volume remains high, but a correction is likely as traders lock in profits.

Confidence Level

Potential Risks

Market sentiment could shift rapidly due to external news or macroeconomic factors.

1 Month Prediction

Target: August 14, 2025$2700

$2900

$2800

$2600

Description

A bearish trend may develop as the market corrects from recent highs. The RSI is expected to drop, indicating weakening momentum. If support at $2600 fails, further declines could follow.

Analysis

The market shows signs of a potential reversal after a strong bullish run. Key support at $2600 and resistance at $2900. Volume patterns suggest profit-taking, and the overall sentiment is shifting towards caution.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or regulatory news could impact the market significantly.

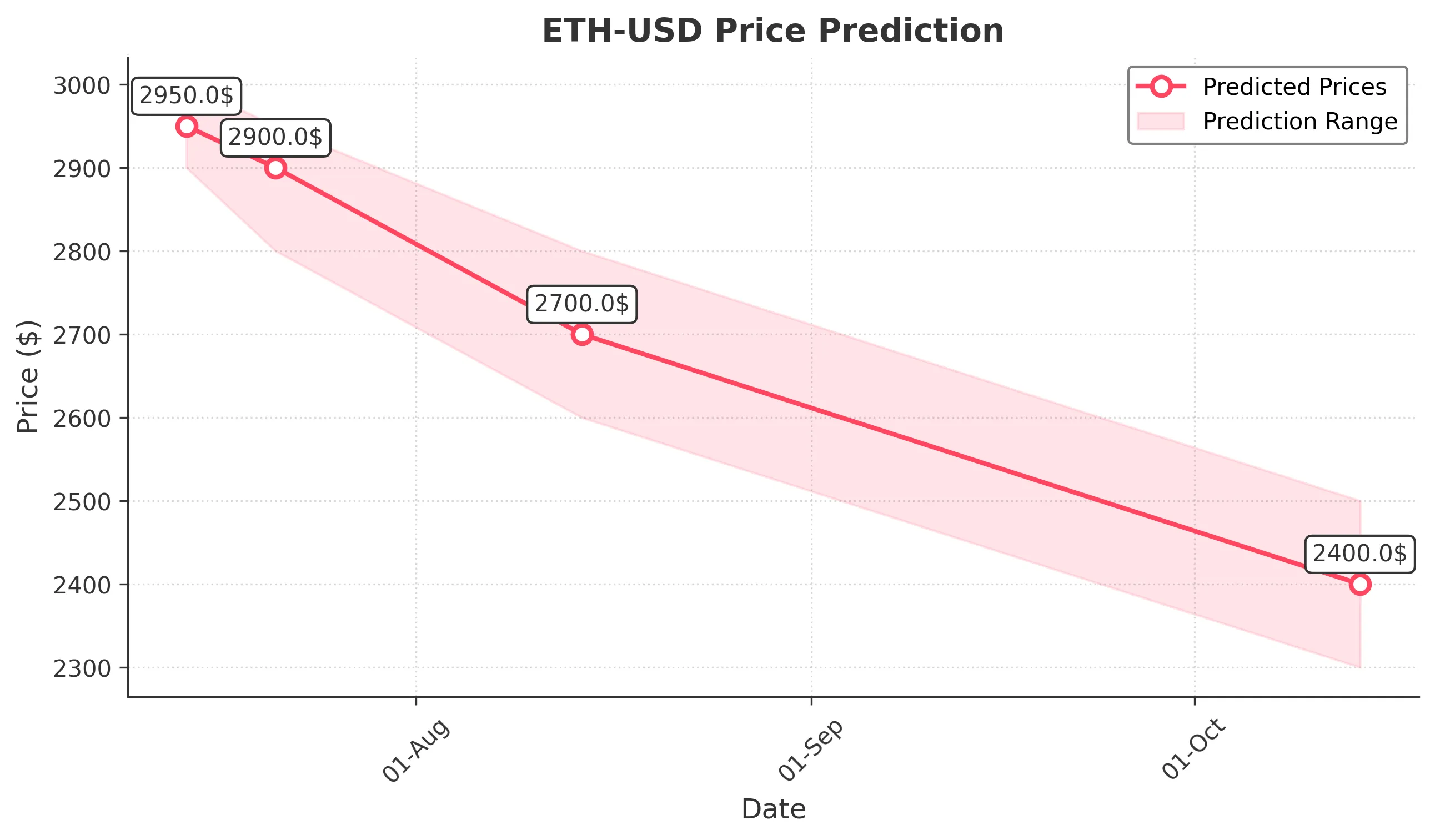

3 Months Prediction

Target: October 14, 2025$2400

$2700

$2500

$2300

Description

Long-term bearish sentiment may prevail as the market adjusts to previous highs. The MACD may indicate a bearish crossover, and if support at $2300 is breached, further declines are likely.

Analysis

The overall trend appears to be shifting bearish after a prolonged bullish phase. Key support at $2300 and resistance at $2700. Volume is decreasing, indicating waning interest. External factors may heavily influence future price movements.

Confidence Level

Potential Risks

Market volatility and external economic factors could lead to unexpected price movements.