ETH-USD Trading Predictions

1 Day Prediction

Target: July 17, 2025$3150

$3145

$3200

$3100

Description

The bullish momentum continues with strong volume and a recent breakout above resistance levels. RSI indicates overbought conditions, suggesting a potential pullback, but overall sentiment remains positive.

Analysis

ETH-USD has shown a strong bullish trend over the past three months, with significant upward movements and high trading volumes. Key resistance levels are around 3200, while support is at 3100. The MACD is bullish, but RSI indicates overbought conditions.

Confidence Level

Potential Risks

Potential for a short-term correction due to overbought RSI levels.

1 Week Prediction

Target: July 24, 2025$3200

$3150

$3250

$3100

Description

Continued bullish sentiment with potential for a slight pullback. The MACD remains positive, and the price is above the 50-day moving average, indicating strength. Watch for volume spikes that could signal reversals.

Analysis

The trend remains bullish, with ETH-USD breaking through previous resistance levels. The average volume has increased, indicating strong interest. However, the RSI is approaching overbought territory, suggesting caution.

Confidence Level

Potential Risks

Market volatility and potential profit-taking could lead to fluctuations.

1 Month Prediction

Target: August 16, 2025$3300

$3200

$3400

$3000

Description

Expecting continued upward momentum, but with increased volatility. The price may test the 3400 resistance level. Watch for any bearish divergence in RSI as a potential warning sign.

Analysis

ETH-USD has shown strong performance, but the market is susceptible to corrections. Key support is at 3000, while resistance is at 3400. The MACD is bullish, but caution is advised due to potential overbought conditions.

Confidence Level

Potential Risks

External market factors and potential regulatory news could impact price.

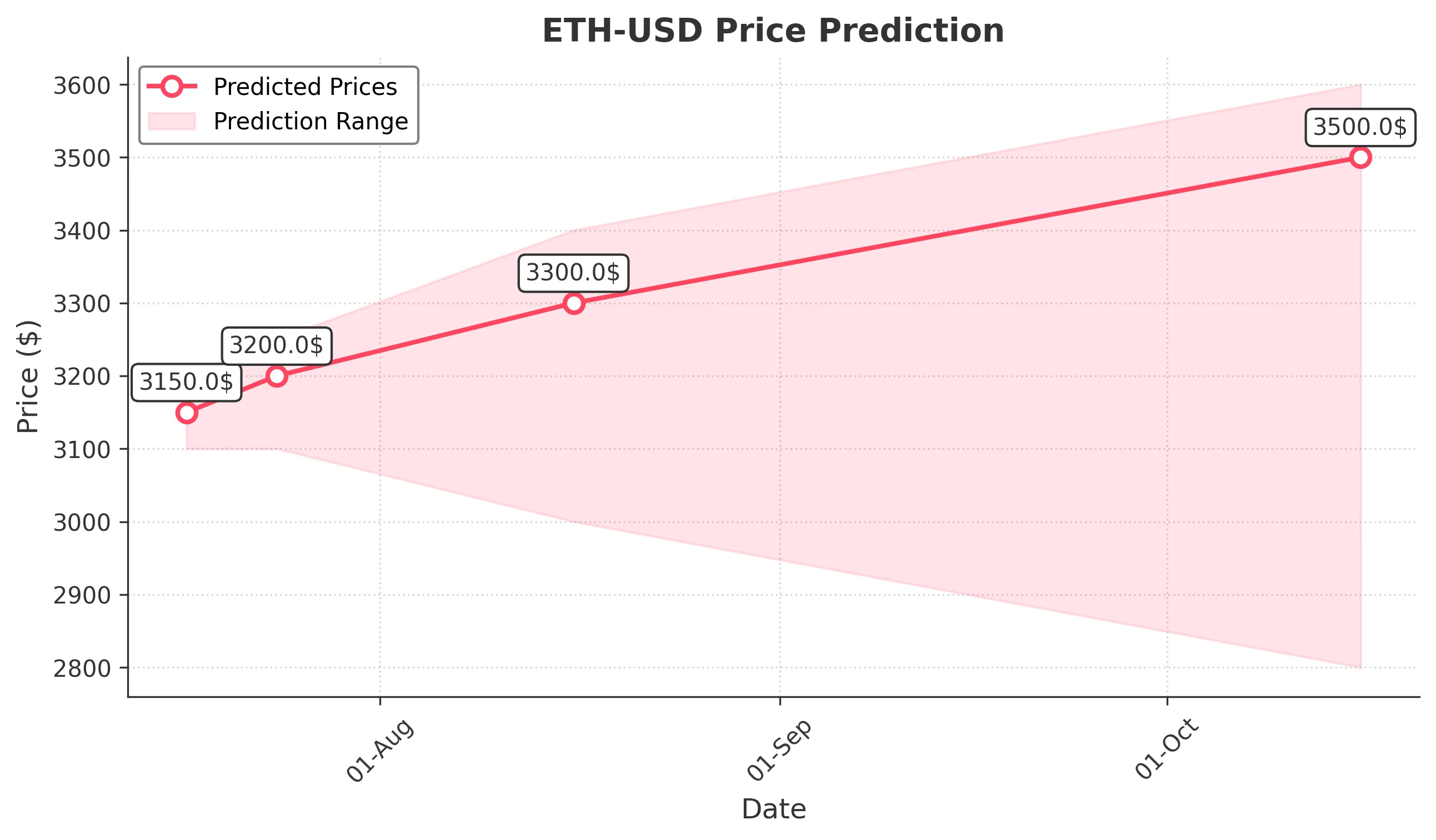

3 Months Prediction

Target: October 16, 2025$3500

$3300

$3600

$2800

Description

Long-term bullish outlook, but expect significant volatility. The market may face resistance at 3600, and a correction could occur if bearish sentiment emerges. Monitor macroeconomic factors closely.

Analysis

The overall trend is bullish, but the market is at risk of corrections. Key support is at 2800, and resistance at 3600. The ATR indicates increasing volatility, and external factors could heavily influence price movements.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or regulatory changes could lead to sharp declines.