ETH-USD Trading Predictions

1 Day Prediction

Target: July 18, 2025$3450

$3435

$3500

$3400

Description

The bullish momentum continues with strong volume and a recent breakout above resistance levels. RSI indicates overbought conditions, suggesting a potential pullback, but the overall trend remains upward.

Analysis

The past 3 months show a strong bullish trend with significant price increases. Key resistance at $3500 and support around $3000. Volume spikes indicate strong buying interest. However, overbought conditions may lead to volatility.

Confidence Level

Potential Risks

Potential for a short-term correction due to overbought RSI levels and market sentiment shifts.

1 Week Prediction

Target: July 25, 2025$3600

$3450

$3700

$3500

Description

Continued bullish sentiment with strong upward momentum. The MACD shows a bullish crossover, and the price is above the upper Bollinger Band, indicating potential for further gains despite overbought conditions.

Analysis

The stock has shown consistent upward movement, with key support at $3400. The MACD and RSI suggest bullish momentum, but caution is warranted due to potential overextension in price.

Confidence Level

Potential Risks

Market corrections could occur if profit-taking happens, especially if external factors influence sentiment.

1 Month Prediction

Target: August 18, 2025$3800

$3600

$3900

$3600

Description

The bullish trend is expected to continue, with strong support at $3500. Fibonacci retracement levels suggest potential for further gains, but watch for signs of market fatigue.

Analysis

The stock has been on a strong upward trajectory, with significant volume supporting the price increases. Key resistance at $3900 and support at $3500. Market sentiment remains bullish, but caution is advised.

Confidence Level

Potential Risks

External market conditions and potential regulatory news could impact price movements significantly.

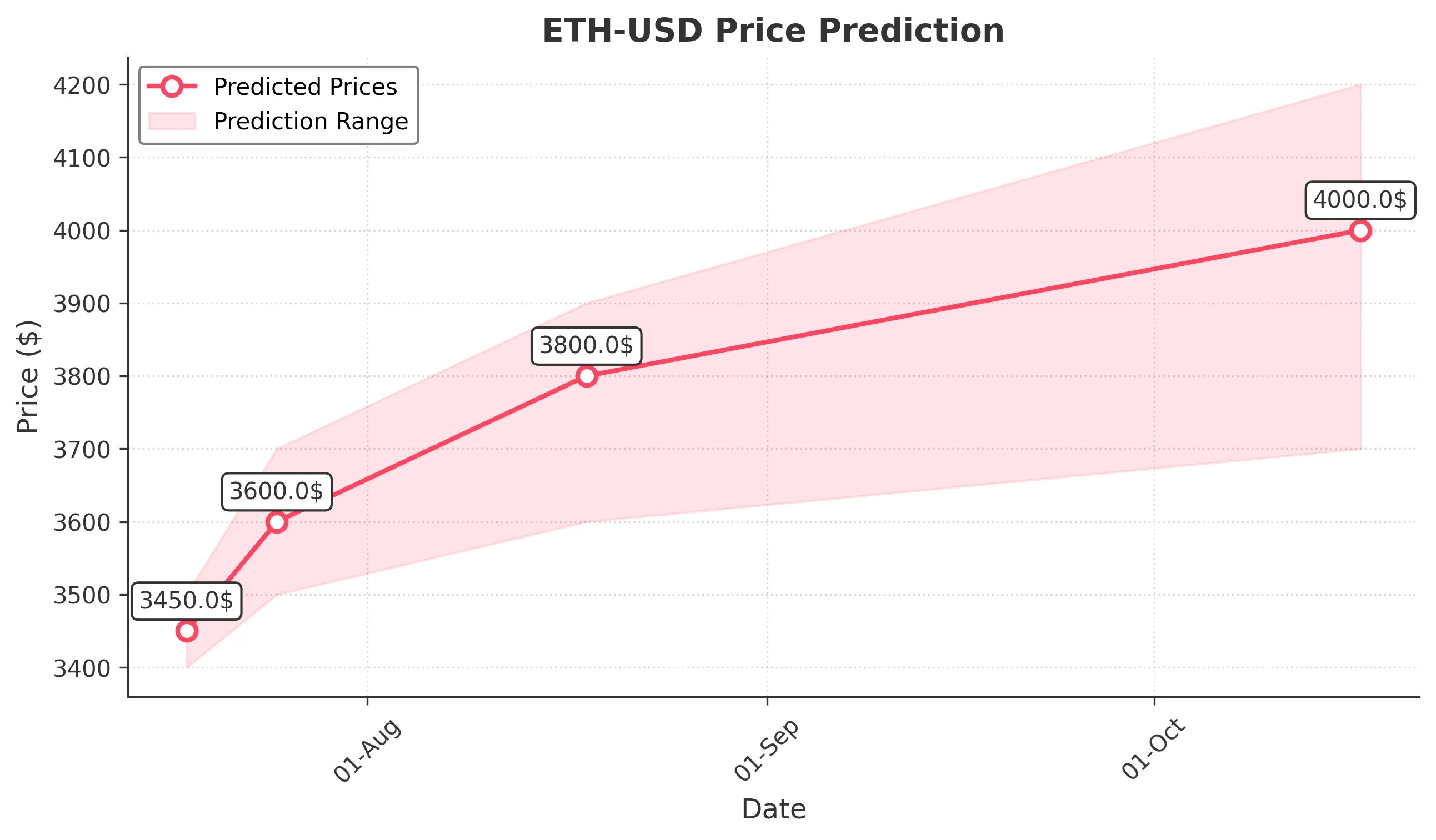

3 Months Prediction

Target: October 17, 2025$4000

$3800

$4200

$3700

Description

Long-term bullish outlook with potential for price to reach $4000. However, market volatility and external economic factors could lead to fluctuations.

Analysis

The overall trend remains bullish, but the market may face headwinds from external factors. Key support at $3700 and resistance at $4200. Volume trends indicate strong interest, but caution is warranted as the market matures.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or regulatory changes could significantly impact the price trajectory.