ETH-USD Trading Predictions

1 Day Prediction

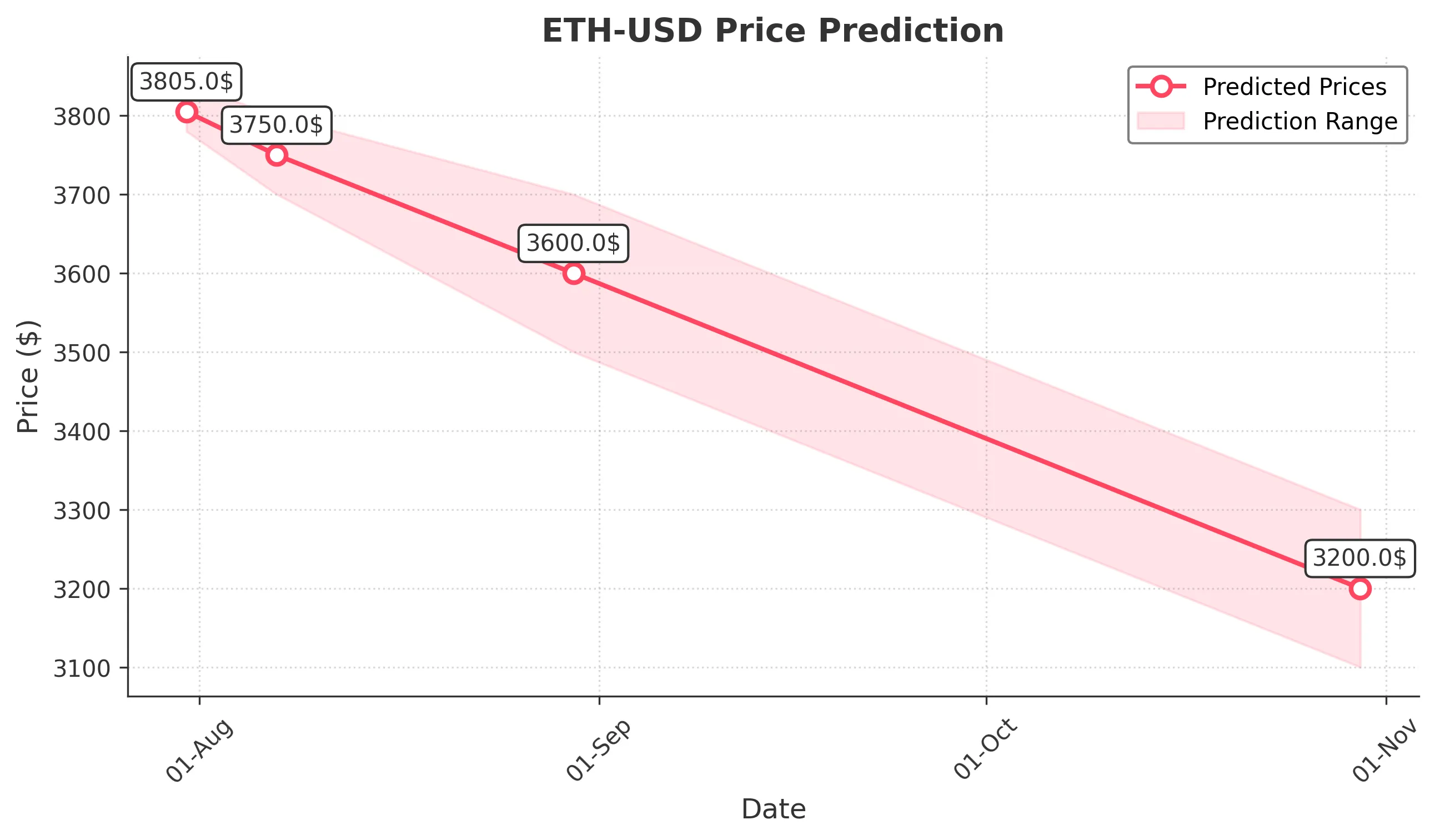

Target: July 31, 2025$3805

$3800

$3840

$3780

Description

The price is expected to remain strong due to bullish momentum from recent highs. The RSI indicates overbought conditions, suggesting a potential pullback, but strong volume supports upward movement.

Analysis

ETH-USD has shown a strong bullish trend over the past three months, with significant support at $3700. Recent volume spikes indicate strong buying interest, but the RSI suggests caution as it approaches overbought territory.

Confidence Level

Potential Risks

Potential for a short-term correction due to overbought RSI levels.

1 Week Prediction

Target: August 7, 2025$3750

$3780

$3800

$3700

Description

A slight pullback is anticipated as profit-taking may occur after recent highs. The MACD shows signs of divergence, indicating potential weakening momentum.

Analysis

The bullish trend remains intact, but the recent price action suggests a possible consolidation phase. Key support at $3700 will be critical to watch, while resistance is seen around $3800.

Confidence Level

Potential Risks

Market sentiment could shift quickly, especially with macroeconomic news impacting crypto markets.

1 Month Prediction

Target: August 30, 2025$3600

$3750

$3700

$3500

Description

A bearish trend may develop as the market corrects from overbought conditions. The Bollinger Bands indicate potential for a price squeeze, suggesting volatility ahead.

Analysis

The past three months have shown a strong upward trend, but signs of exhaustion are emerging. The RSI is high, and a correction could lead to a test of lower support levels around $3500.

Confidence Level

Potential Risks

Unforeseen market events or regulatory news could impact price direction significantly.

3 Months Prediction

Target: October 30, 2025$3200

$3250

$3300

$3100

Description

Longer-term bearish sentiment may prevail as macroeconomic factors weigh on crypto markets. The Fibonacci retracement levels suggest a potential drop towards $3100.

Analysis

ETH-USD has experienced significant volatility, with a clear bullish trend recently. However, macroeconomic pressures and potential regulatory changes could lead to a bearish reversal, especially if support levels fail.

Confidence Level

Potential Risks

Market volatility and external economic factors could lead to unexpected price movements.