EURUSDX Trading Predictions

1 Day Prediction

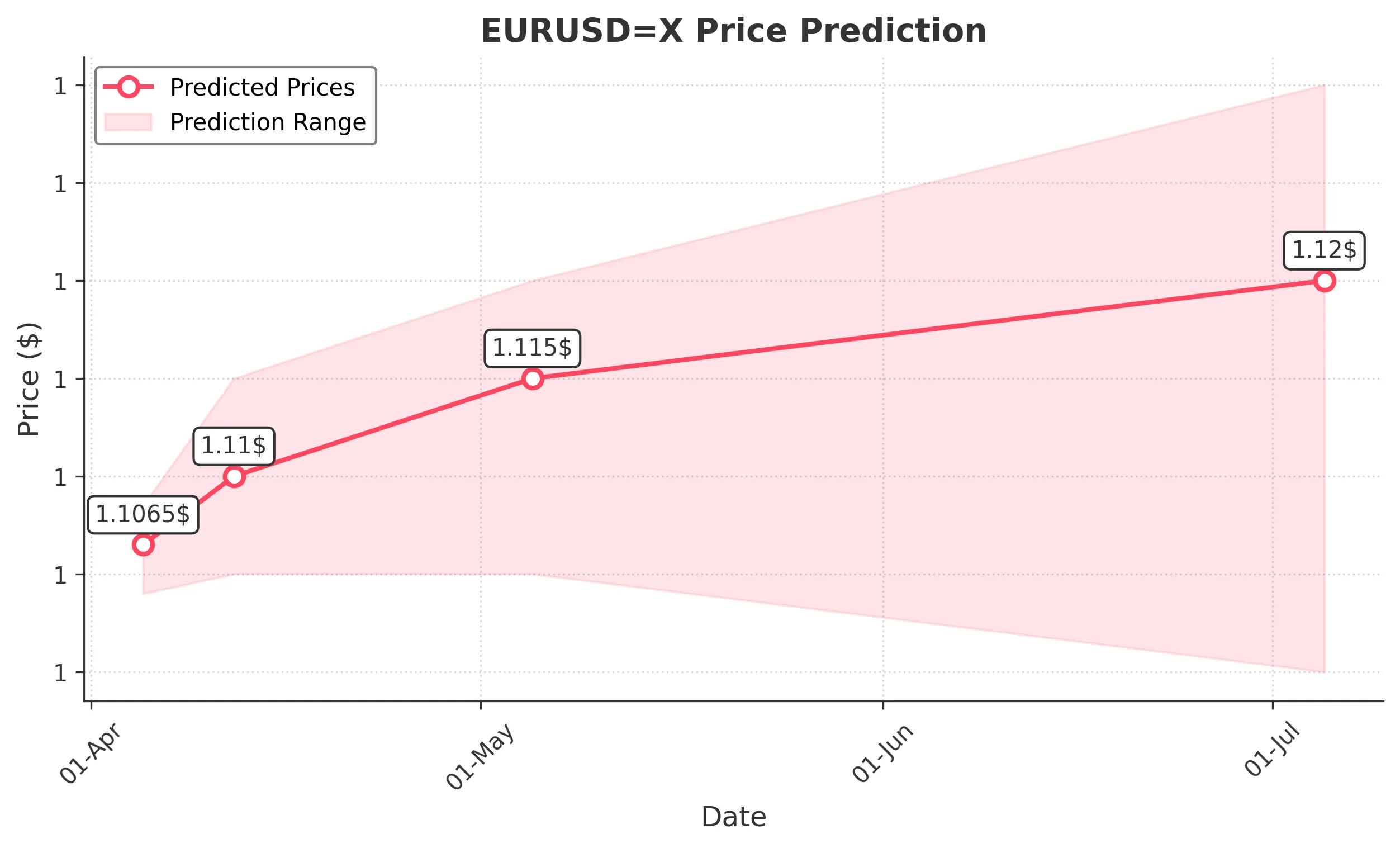

Target: April 5, 2025$1.1065

$1.105339

$1.1085

$1.104

Description

The recent bullish trend, supported by a MACD crossover and RSI indicating strength, suggests a continuation. The price is near the upper Bollinger Band, indicating potential for a slight pullback but overall bullish sentiment prevails.

Analysis

The past three months show a bullish trend with significant upward momentum. Key resistance at 1.1100 and support around 1.0800. Volume has been low, indicating less conviction in the moves. Recent candlestick patterns show bullish engulfing, reinforcing upward momentum.

Confidence Level

Potential Risks

Potential volatility due to macroeconomic news could impact the prediction.

1 Week Prediction

Target: April 12, 2025$1.11

$1.1065

$1.115

$1.105

Description

With the bullish trend continuing and the RSI remaining above 50, the price is expected to test the 1.1100 resistance level. A potential breakout could occur if momentum continues, but watch for overbought conditions.

Analysis

The stock has shown strong upward movement, with key support at 1.1000. The MACD remains bullish, and the ATR indicates increasing volatility. Recent price action suggests a bullish bias, but caution is warranted as the market approaches resistance.

Confidence Level

Potential Risks

Market sentiment could shift due to geopolitical events or economic data releases.

1 Month Prediction

Target: May 5, 2025$1.115

$1.11

$1.12

$1.105

Description

If the bullish momentum persists, the price could reach 1.1150, testing the upper resistance. However, overbought conditions may lead to a correction, so watch for signs of reversal.

Analysis

The overall trend remains bullish, with significant resistance at 1.1200. The RSI is approaching overbought territory, suggesting a potential pullback. Volume patterns indicate a lack of strong buying interest, which could lead to volatility.

Confidence Level

Potential Risks

Economic indicators and central bank decisions could significantly impact the price direction.

3 Months Prediction

Target: July 5, 2025$1.12

$1.115

$1.13

$1.1

Description

The price may stabilize around 1.1200, but potential economic shifts could lead to volatility. A breakout above 1.1300 could signal a stronger bullish trend, while a drop below 1.1000 would indicate bearish pressure.

Analysis

The market shows a bullish trend, but with increasing volatility and potential resistance at 1.1300. The ATR indicates rising volatility, and the market sentiment is mixed. Key support at 1.1000 will be crucial for future price movements.

Confidence Level

Potential Risks

Unforeseen economic events or changes in market sentiment could lead to significant price fluctuations.