EURUSDX Trading Predictions

1 Day Prediction

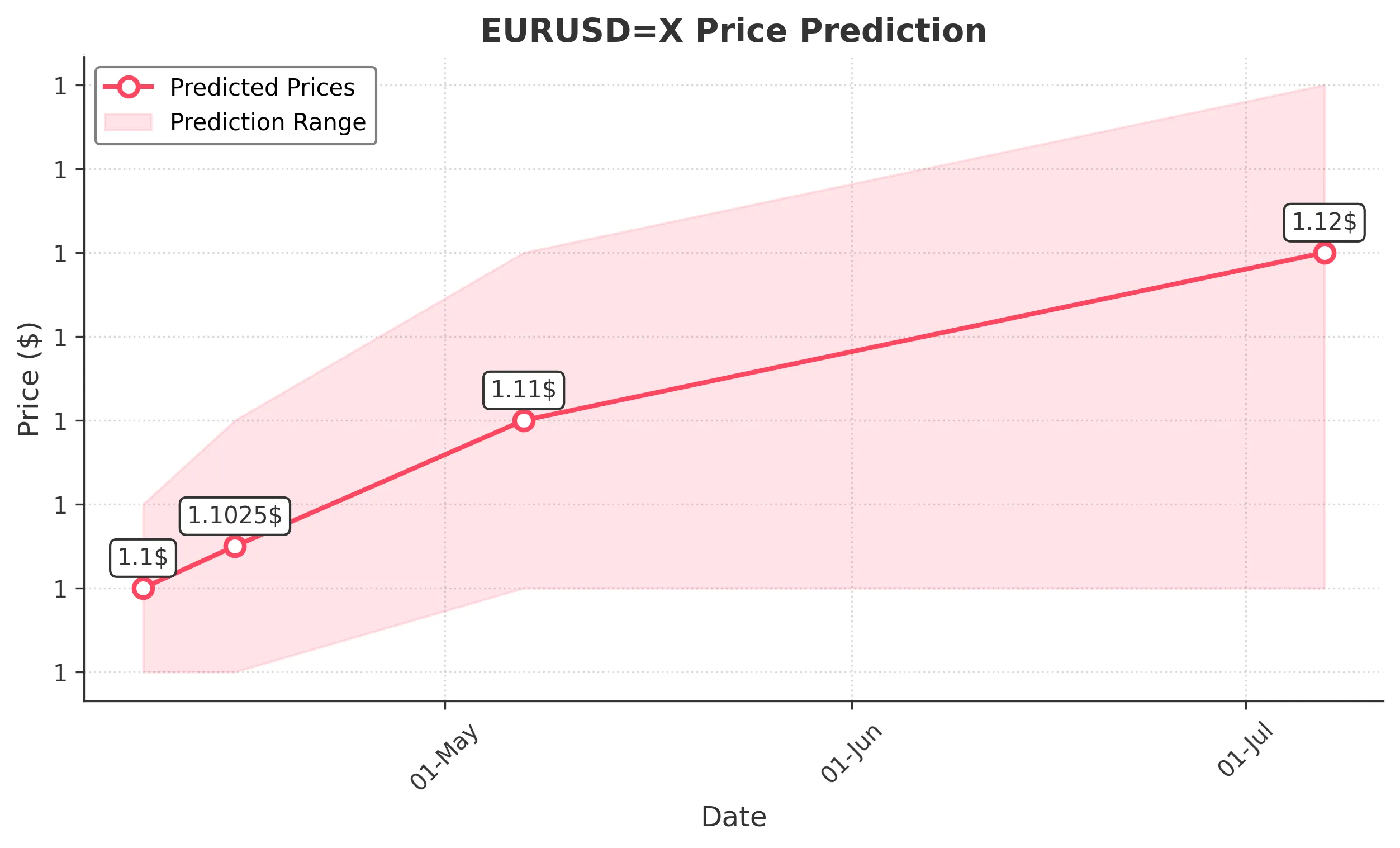

Target: April 8, 2025$1.1

$1.099022

$1.105

$1.095

Description

The recent bullish trend, supported by a MACD crossover and RSI indicating upward momentum, suggests a potential rise. However, resistance at 1.105 may limit gains.

Analysis

The past 3 months show a bullish trend with significant support at 1.080 and resistance around 1.105. The MACD is bullish, and RSI is approaching overbought levels, indicating potential for a pullback.

Confidence Level

Potential Risks

Market volatility and external economic news could impact the prediction.

1 Week Prediction

Target: April 15, 2025$1.1025

$1.1

$1.11

$1.095

Description

Continued bullish sentiment and a potential breakout above 1.105 could drive prices higher. However, overbought conditions may lead to a correction.

Analysis

The bullish trend persists, with the price consistently testing resistance levels. Volume has been low, indicating caution among traders. The ATR suggests moderate volatility.

Confidence Level

Potential Risks

Potential market corrections and geopolitical events could affect price stability.

1 Month Prediction

Target: May 7, 2025$1.11

$1.1025

$1.12

$1.1

Description

If the bullish trend continues, a target of 1.110 is feasible, supported by Fibonacci retracement levels. However, watch for bearish divergences in RSI.

Analysis

The market shows a strong upward trend, with key support at 1.100. The RSI indicates potential overbought conditions, suggesting a possible pullback. Volume patterns remain low.

Confidence Level

Potential Risks

Economic data releases and central bank decisions could shift market sentiment.

3 Months Prediction

Target: July 7, 2025$1.12

$1.11

$1.13

$1.1

Description

Long-term bullish sentiment could push prices to 1.120, but macroeconomic factors may introduce volatility. Watch for signs of reversal.

Analysis

The overall trend remains bullish, but the market is susceptible to external shocks. Key resistance at 1.130 may pose challenges, while support at 1.100 remains critical.

Confidence Level

Potential Risks

Unforeseen economic events and market corrections could lead to significant price fluctuations.