EURUSDX Trading Predictions

1 Day Prediction

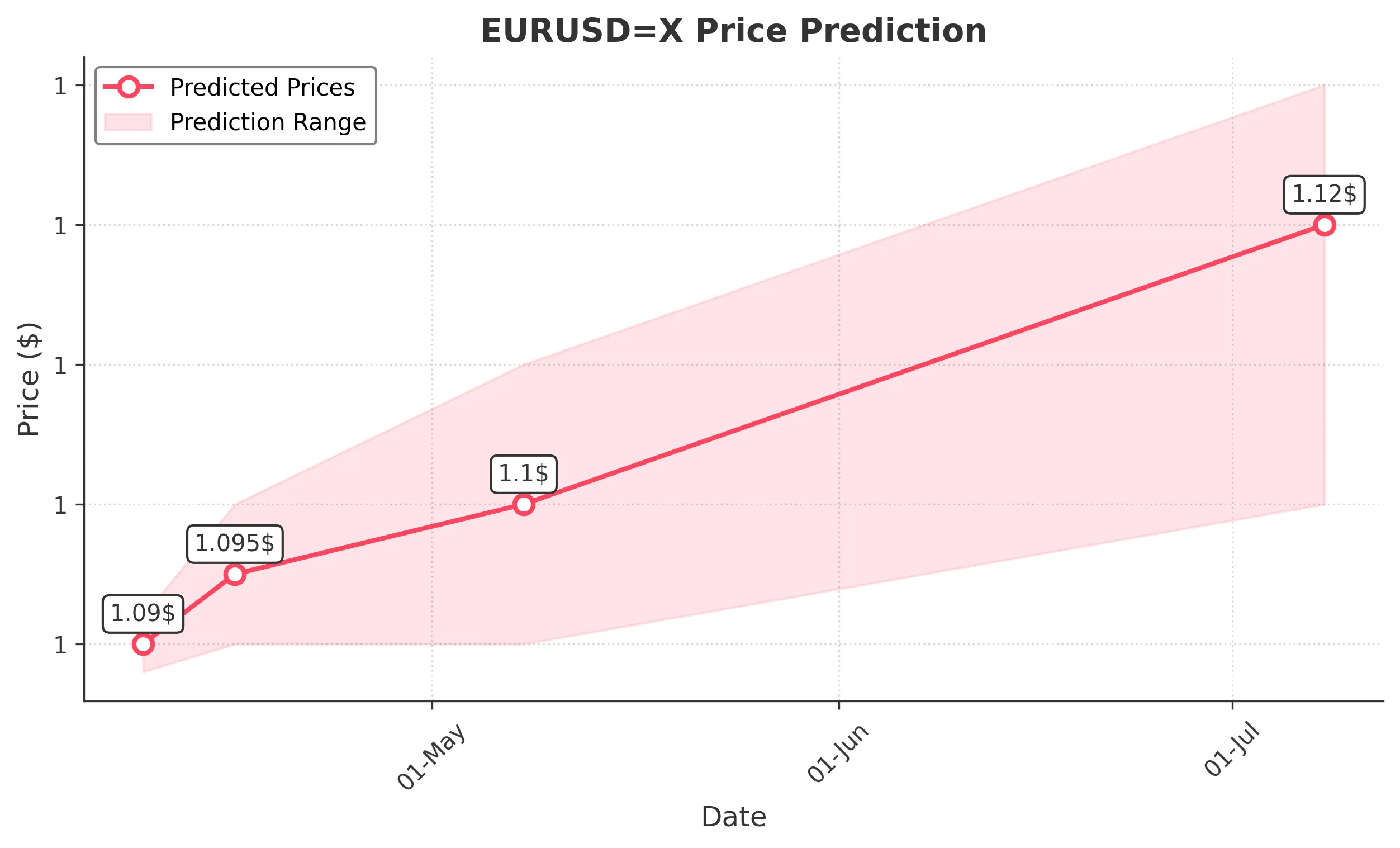

Target: April 9, 2025$1.09

$1.09

$1.092

$1.088

Description

The price is expected to stabilize around 1.0900, supported by recent bullish momentum and a slight upward trend in the MACD. RSI indicates neutrality, suggesting no immediate overbought conditions.

Analysis

The past three months show a bullish trend with significant resistance at 1.104374. Recent price action indicates a consolidation phase, with support around 1.0800. Volume has been low, indicating cautious trading.

Confidence Level

Potential Risks

Potential volatility due to macroeconomic news could impact the prediction.

1 Week Prediction

Target: April 16, 2025$1.095

$1.09

$1.1

$1.09

Description

Expect a gradual rise to 1.0950 as bullish sentiment persists. The 50-day moving average supports this upward trend, while the RSI remains below overbought levels, indicating room for growth.

Analysis

The market has shown resilience with a bullish trend. Key support at 1.0800 and resistance at 1.104374 are critical. The MACD indicates potential upward momentum, but low volume suggests caution.

Confidence Level

Potential Risks

Market sentiment could shift due to geopolitical events or economic data releases.

1 Month Prediction

Target: May 8, 2025$1.1

$1.095

$1.11

$1.09

Description

A target of 1.1000 is anticipated as the market continues to trend upward. The Bollinger Bands suggest a breakout potential, while the RSI indicates a healthy upward movement without being overbought.

Analysis

The overall trend remains bullish, with significant resistance at 1.104374. The market has shown a tendency to retrace to support levels, and any negative news could lead to a pullback.

Confidence Level

Potential Risks

Economic indicators and central bank policies could introduce volatility.

3 Months Prediction

Target: July 8, 2025$1.12

$1.11

$1.13

$1.1

Description

A longer-term bullish outlook targets 1.1200, supported by a strong upward trend and potential economic recovery. However, caution is advised as market conditions can change rapidly.

Analysis

The past three months indicate a bullish trend with key resistance at 1.104374. The market's performance is influenced by macroeconomic factors, and while the trend is upward, risks remain.

Confidence Level

Potential Risks

Unforeseen economic events or shifts in market sentiment could lead to significant price fluctuations.