EURUSDX Trading Predictions

1 Day Prediction

Target: April 10, 2025$1.0985

$1.097

$1.1

$1.096

Description

The recent bullish momentum, indicated by the MACD crossover and RSI nearing overbought levels, suggests a potential continuation. However, the high volatility and recent price spikes may lead to corrections.

Analysis

The past 3 months show a bullish trend with significant support at 0.905 and resistance around 1.100. The MACD indicates upward momentum, while RSI suggests caution. Volume spikes on recent highs indicate strong interest, but volatility remains a concern.

Confidence Level

Potential Risks

Potential for a pullback due to overbought conditions and market sentiment shifts.

1 Week Prediction

Target: April 17, 2025$1.1

$1.0985

$1.105

$1.095

Description

Continued bullish sentiment supported by strong economic data may push prices higher. However, resistance at 1.105 could limit gains, and profit-taking may occur.

Analysis

The bullish trend persists, with key resistance at 1.105. The RSI is approaching overbought territory, indicating potential for a pullback. Volume trends suggest strong buying interest, but external factors could introduce volatility.

Confidence Level

Potential Risks

Economic data releases and geopolitical events could impact market sentiment.

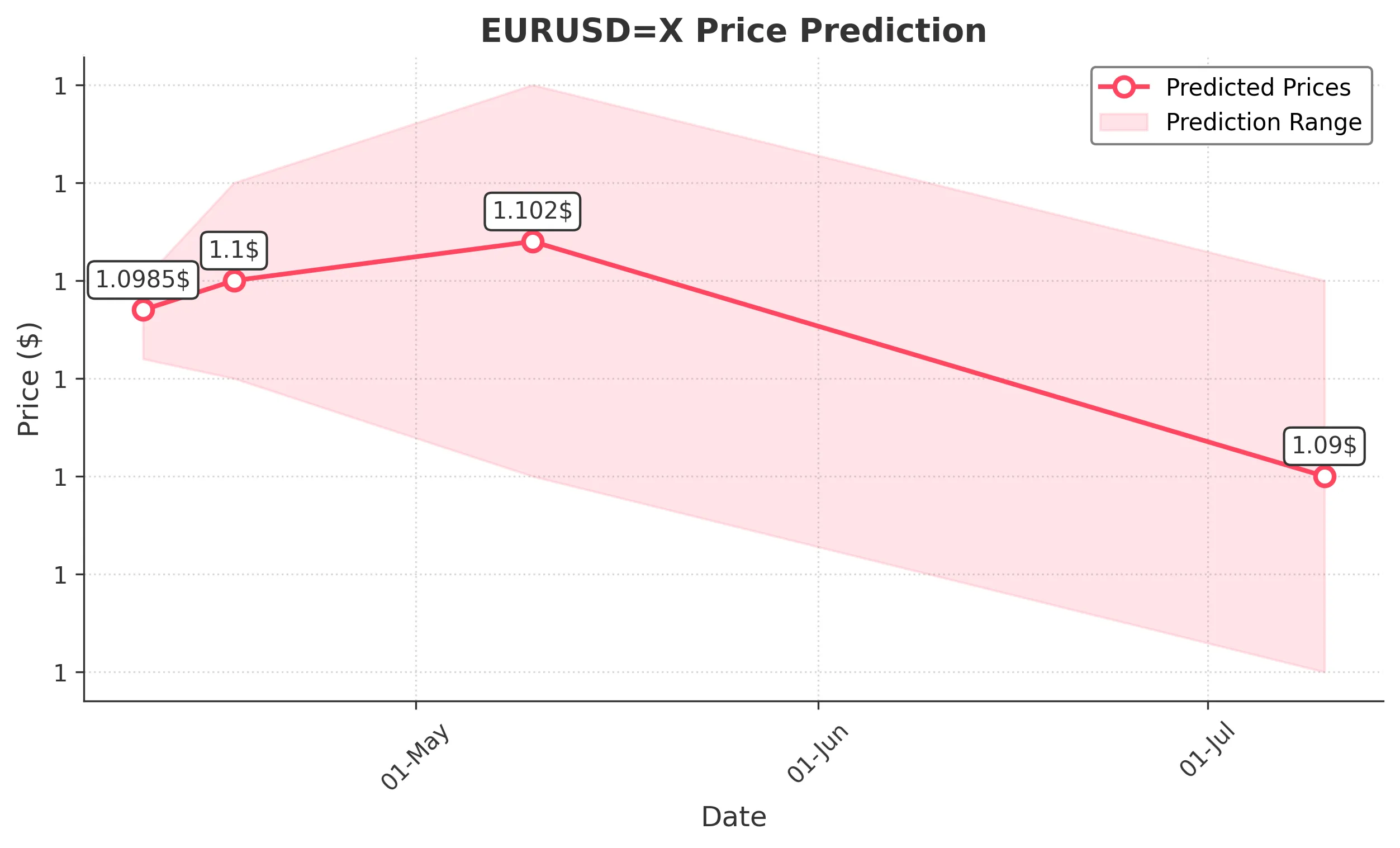

1 Month Prediction

Target: May 10, 2025$1.102

$1.1

$1.11

$1.09

Description

If the bullish trend continues, prices may stabilize around 1.102. However, market corrections are possible if resistance levels hold, especially with potential economic shifts.

Analysis

The overall trend remains bullish, but resistance at 1.105 is significant. The ATR indicates increasing volatility, and the RSI suggests caution. Volume patterns show strong interest, but external economic factors could lead to fluctuations.

Confidence Level

Potential Risks

Market corrections and economic data could lead to unexpected volatility.

3 Months Prediction

Target: July 10, 2025$1.09

$1.095

$1.1

$1.08

Description

A potential bearish reversal could occur as the market reacts to economic data and geopolitical tensions. The price may retrace towards 1.090, testing support levels.

Analysis

The market shows signs of potential reversal with resistance at 1.105. The past three months indicate a bullish trend, but the RSI suggests overbought conditions. Volume analysis indicates strong interest, but external factors could lead to a bearish shift.

Confidence Level

Potential Risks

Unforeseen economic events and market sentiment shifts could lead to significant price changes.