EURUSDX Trading Predictions

1 Day Prediction

Target: April 11, 2025$1.095

$1.095

$1.097

$1.09

Description

The recent bullish trend indicates a potential continuation, supported by a strong close above 1.095. RSI shows overbought conditions, suggesting a slight pullback may occur. However, MACD remains positive, indicating upward momentum.

Analysis

The EUR/USD has shown a bullish trend over the past three months, with significant resistance at 1.1000. Technical indicators like moving averages and MACD suggest upward momentum, while RSI indicates overbought conditions. Volume has been stable, but any unexpected news could lead to volatility.

Confidence Level

Potential Risks

Potential volatility due to macroeconomic news could impact the prediction.

1 Week Prediction

Target: April 18, 2025$1.09

$1.095

$1.095

$1.085

Description

A potential correction is expected as the market may react to overbought conditions. The price is likely to test support around 1.085, with resistance at 1.095. Market sentiment may shift due to upcoming economic data releases.

Analysis

The EUR/USD has been in a bullish phase, but recent price action suggests a possible correction. Key support levels are around 1.085, while resistance remains at 1.095. Technical indicators show mixed signals, with RSI indicating overbought conditions and MACD showing potential bearish divergence.

Confidence Level

Potential Risks

Economic data releases could lead to unexpected volatility, impacting the accuracy of this prediction.

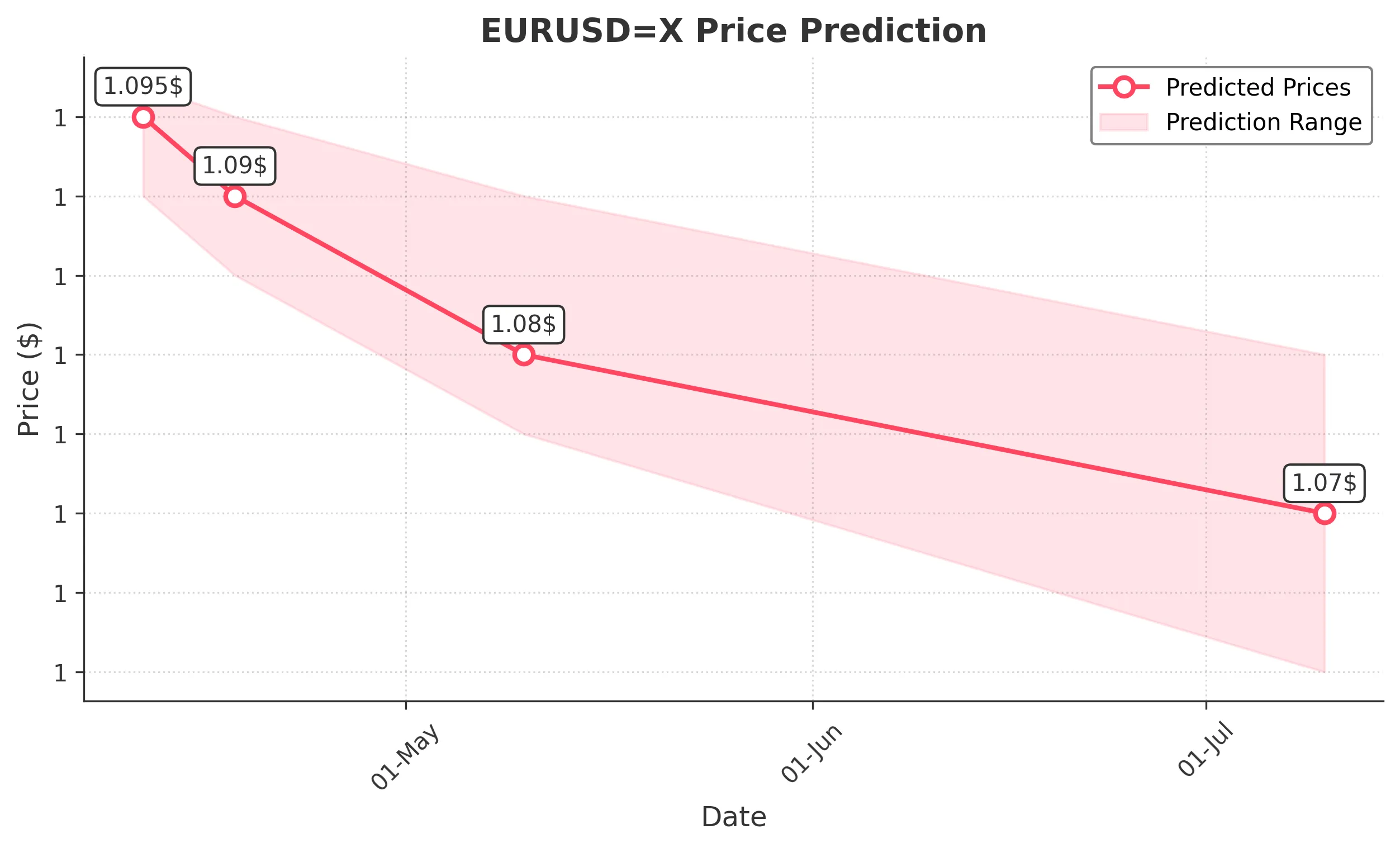

1 Month Prediction

Target: May 10, 2025$1.08

$1.09

$1.09

$1.075

Description

A bearish trend may develop as the market reacts to potential economic downturns. The price is expected to test lower support levels, with a possibility of breaking below 1.080 if bearish sentiment prevails.

Analysis

The EUR/USD has shown signs of weakening, with key support at 1.080. Technical indicators suggest a potential bearish reversal, with RSI moving towards neutral territory. Volume patterns indicate a decrease in buying interest, and macroeconomic factors may further influence the trend.

Confidence Level

Potential Risks

Unforeseen macroeconomic events could significantly alter market sentiment and price direction.

3 Months Prediction

Target: July 10, 2025$1.07

$1.08

$1.08

$1.06

Description

The long-term outlook suggests a bearish trend as economic conditions may worsen. The price is likely to test lower support levels, with a potential decline towards 1.070 if bearish sentiment continues.

Analysis

The EUR/USD has been under pressure, with a bearish outlook developing. Key support levels are at 1.070, and technical indicators suggest a continuation of the downtrend. Volume analysis shows declining interest, and macroeconomic factors could further exacerbate the bearish sentiment.

Confidence Level

Potential Risks

Long-term predictions are subject to high uncertainty due to potential geopolitical events and economic shifts.