EURUSDX Trading Predictions

1 Day Prediction

Target: April 15, 2025$1.135

$1.134

$1.138

$1.13

Description

The recent bullish trend, supported by a strong MACD crossover and RSI indicating overbought conditions, suggests a slight pullback. However, the overall momentum remains positive, likely pushing the price to close around 1.135.

Analysis

The EUR/USD has shown a bullish trend over the past three months, with significant support at 1.130 and resistance at 1.140. The MACD is bullish, and RSI is nearing overbought levels, indicating a possible correction.

Confidence Level

Potential Risks

Potential volatility due to macroeconomic news could impact the prediction.

1 Week Prediction

Target: April 22, 2025$1.13

$1.134

$1.135

$1.125

Description

Expect a slight decline as the market may correct after recent highs. The RSI indicates overbought conditions, and a potential bearish divergence is forming, suggesting a pullback to around 1.130.

Analysis

The price has been fluctuating around 1.130-1.140, with recent highs indicating strong bullish momentum. However, the RSI suggests a correction is due, and support at 1.125 may be tested.

Confidence Level

Potential Risks

Market sentiment could shift rapidly based on economic data releases.

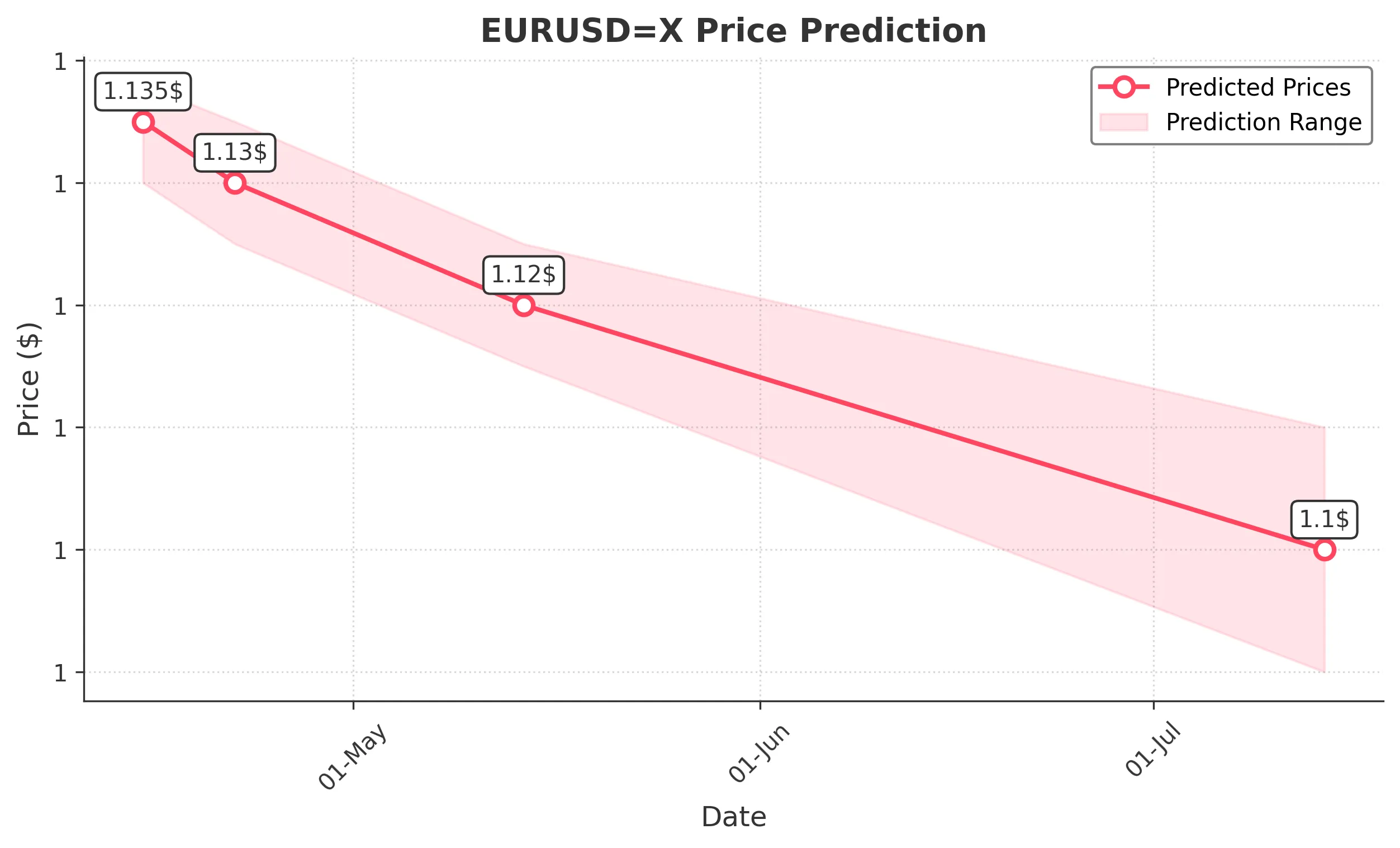

1 Month Prediction

Target: May 14, 2025$1.12

$1.125

$1.125

$1.115

Description

A bearish trend may develop as the market corrects from overbought conditions. The MACD shows signs of weakening momentum, and a drop to 1.120 is likely as traders take profits.

Analysis

The EUR/USD has been in a bullish phase, but signs of exhaustion are evident. Key support at 1.120 is critical, and if broken, further declines could occur. Watch for volume spikes indicating shifts in sentiment.

Confidence Level

Potential Risks

Unforeseen geopolitical events or economic data could alter market dynamics significantly.

3 Months Prediction

Target: July 14, 2025$1.1

$1.105

$1.11

$1.09

Description

Long-term bearish sentiment may prevail as economic indicators suggest a slowdown. The price could test lower support levels around 1.100, especially if the Fed signals tightening.

Analysis

The overall trend appears to be shifting bearish as the market reacts to macroeconomic factors. Key resistance at 1.140 has held, and if bearish momentum continues, a drop to 1.100 is plausible.

Confidence Level

Potential Risks

Economic conditions and central bank policies could lead to unexpected volatility.