EURUSDX Trading Predictions

1 Day Prediction

Target: April 26, 2025$1.1375

$1.136

$1.14

$1.135

Description

The recent bullish trend suggests a slight upward movement. The RSI is approaching overbought levels, indicating potential resistance. However, the MACD shows bullish momentum, supporting a close around 1.1375.

Analysis

The EUR/USD has shown a bullish trend over the past three months, with significant support at 1.1300 and resistance around 1.1500. The MACD indicates bullish momentum, while the RSI is nearing overbought territory, suggesting caution.

Confidence Level

Potential Risks

Potential reversal signals from the RSI and market volatility could impact the prediction.

1 Week Prediction

Target: May 3, 2025$1.135

$1.136

$1.14

$1.13

Description

Expecting a slight pullback as the market consolidates. The recent high volume indicates strong interest, but the RSI suggests overbought conditions, which may lead to a correction.

Analysis

The market has been bullish, but recent price action shows signs of consolidation. Key support at 1.1300 and resistance at 1.1500 remain critical. The ATR indicates increasing volatility, which could affect price stability.

Confidence Level

Potential Risks

Market sentiment and external economic factors could lead to unexpected volatility.

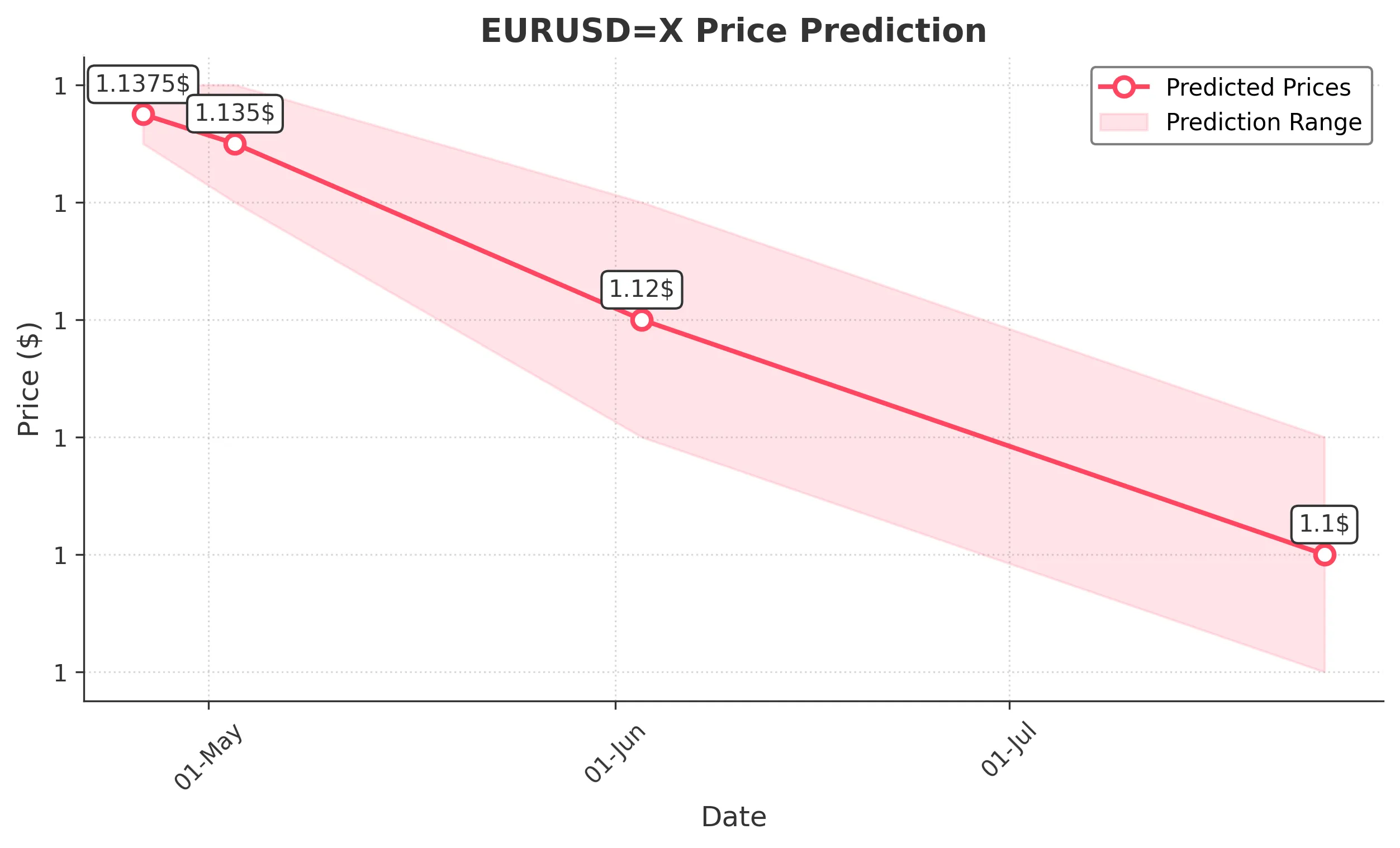

1 Month Prediction

Target: June 3, 2025$1.12

$1.125

$1.13

$1.11

Description

A bearish outlook is anticipated as the market may correct from overbought levels. The MACD is showing signs of divergence, indicating potential weakness in the bullish trend.

Analysis

The past three months have shown a strong bullish trend, but signs of exhaustion are emerging. The RSI is high, and the MACD divergence suggests a potential reversal. Key support at 1.1100 could be tested.

Confidence Level

Potential Risks

Economic data releases and geopolitical events could significantly impact the EUR/USD direction.

3 Months Prediction

Target: July 25, 2025$1.1

$1.105

$1.11

$1.09

Description

Long-term bearish sentiment is expected as the market corrects from recent highs. The overall trend may shift due to macroeconomic factors and potential interest rate changes.

Analysis

The EUR/USD has experienced a strong bullish phase, but macroeconomic pressures and potential interest rate adjustments could lead to a significant correction. Key support levels will be crucial in determining future price action.

Confidence Level

Potential Risks

Unforeseen economic events or policy changes could alter the market landscape significantly.