EURUSDX Trading Predictions

1 Day Prediction

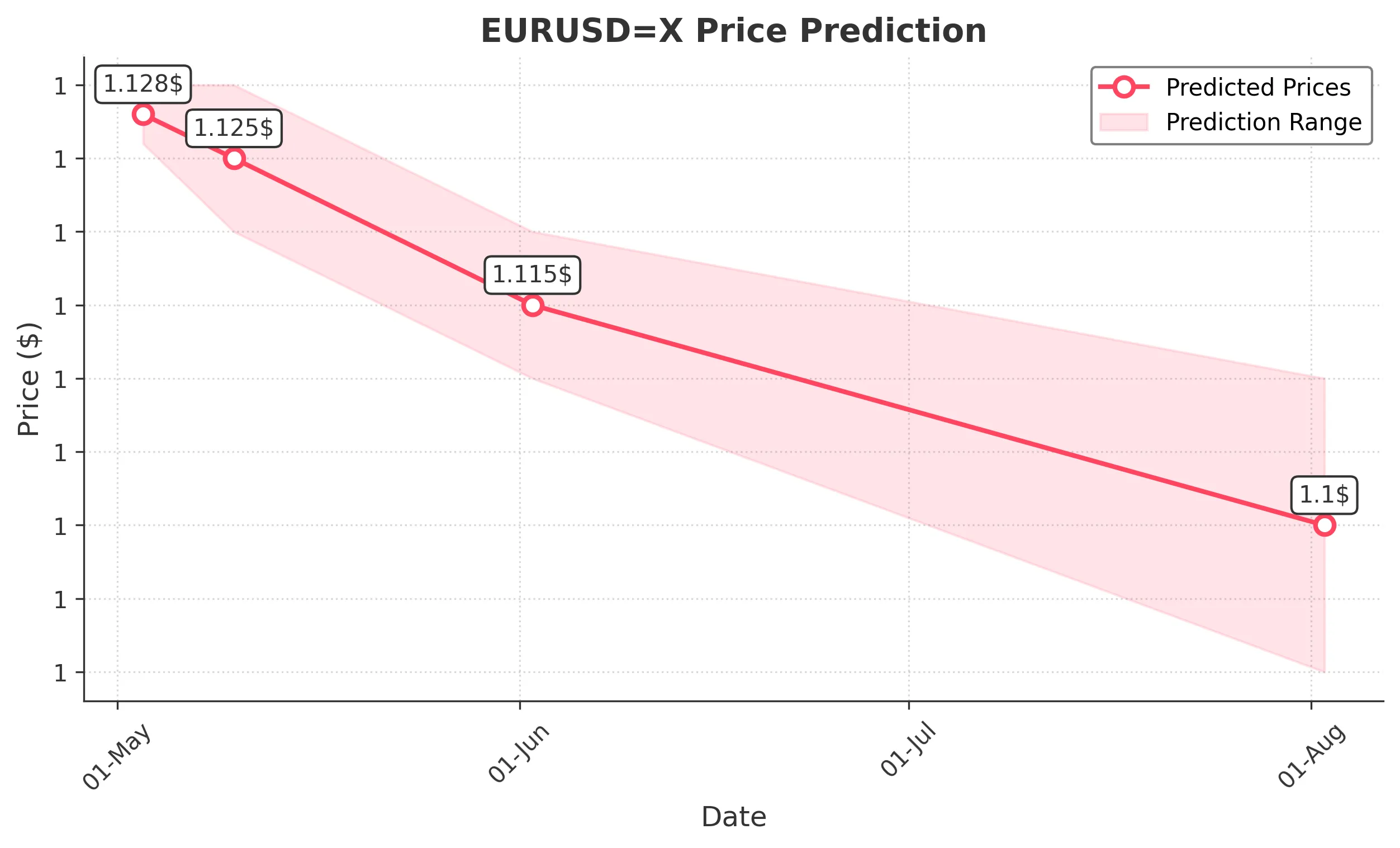

Target: May 3, 2025$1.128

$1.129

$1.13

$1.126

Description

The EUR/USD is showing a slight bearish trend with recent lower highs. The RSI indicates overbought conditions, suggesting a potential pullback. The MACD is also showing signs of divergence, indicating weakening momentum. Expect a close around 1.128.

Analysis

Over the past 3 months, EUR/USD has shown a bullish trend with significant resistance at 1.151. Recent price action indicates a potential reversal as the price approaches this level. The RSI is nearing overbought territory, and volume has been declining, suggesting weakening buying pressure.

Confidence Level

Potential Risks

Market volatility and potential geopolitical events could impact the prediction.

1 Week Prediction

Target: May 10, 2025$1.125

$1.128

$1.13

$1.12

Description

Expect a further decline as the market reacts to potential resistance at 1.130. The MACD is showing bearish divergence, and the Bollinger Bands indicate a squeeze, suggesting a breakout may occur. Anticipate a close around 1.125.

Analysis

The EUR/USD has been consolidating around 1.130, with significant support at 1.120. The recent bearish candlestick patterns suggest a potential reversal. The ATR indicates increasing volatility, and the market sentiment is mixed, with traders cautious ahead of economic reports.

Confidence Level

Potential Risks

Unforeseen economic data releases could lead to volatility and impact the prediction.

1 Month Prediction

Target: June 2, 2025$1.115

$1.125

$1.12

$1.11

Description

A bearish trend is expected as the market reacts to macroeconomic factors. The Fibonacci retracement levels suggest a potential drop towards 1.115. The RSI is likely to remain in the neutral zone, indicating indecision among traders.

Analysis

The EUR/USD has been in a corrective phase after reaching highs near 1.151. The market is currently testing key support levels, and the overall trend appears to be shifting bearish. Volume has been low, indicating a lack of conviction in the current price levels.

Confidence Level

Potential Risks

Economic indicators and central bank decisions could significantly alter market direction.

3 Months Prediction

Target: August 2, 2025$1.1

$1.105

$1.11

$1.09

Description

Long-term bearish sentiment is anticipated as economic conditions may favor the USD. The MACD is expected to cross below the signal line, indicating a potential downtrend. A close around 1.100 is likely as the market adjusts.

Analysis

The EUR/USD has shown signs of a bearish trend over the past months, with key resistance at 1.130. The market sentiment is leaning towards a stronger USD due to anticipated interest rate hikes. The overall outlook remains cautious, with potential for further declines.

Confidence Level

Potential Risks

Global economic shifts and unexpected geopolitical events could lead to significant price fluctuations.