EURUSDX Trading Predictions

1 Day Prediction

Target: May 27, 2025$1.1385

$1.137

$1.14

$1.136

Description

The price is expected to rise slightly due to bullish momentum indicated by recent higher closes and a positive MACD crossover. RSI is neutral, suggesting no overbought conditions. However, caution is advised due to potential resistance at 1.140.

Analysis

The past three months show a bullish trend with significant support around 1.130 and resistance near 1.140. The MACD indicates upward momentum, while the RSI remains stable. Volume has been low, suggesting caution in the current bullish sentiment.

Confidence Level

Potential Risks

Market volatility and external economic news could impact this prediction.

1 Week Prediction

Target: June 3, 2025$1.14

$1.1385

$1.145

$1.135

Description

A continued upward trend is anticipated as the price approaches resistance levels. The recent bullish candlestick patterns support this, but the RSI nearing overbought levels may indicate a pullback soon.

Analysis

The market has shown a bullish trend with key support at 1.130 and resistance at 1.140. The MACD is positive, and the RSI is approaching overbought territory, indicating a possible reversal. Volume remains low, suggesting caution.

Confidence Level

Potential Risks

Potential market corrections and geopolitical events could lead to unexpected price movements.

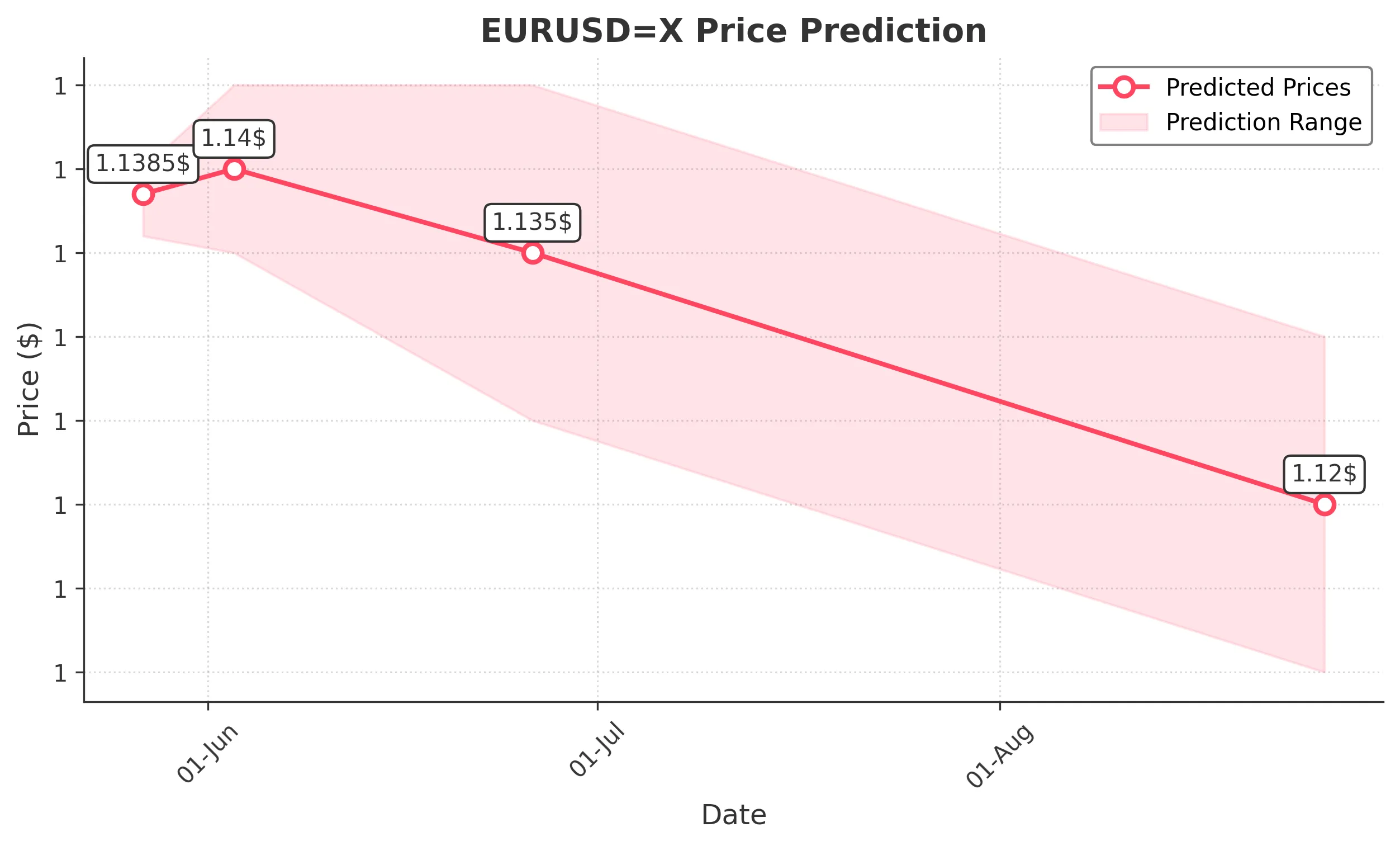

1 Month Prediction

Target: June 26, 2025$1.135

$1.14

$1.145

$1.125

Description

A slight decline is expected as the market may face resistance at 1.140. The RSI indicates potential overbought conditions, and a correction could bring prices down towards support levels.

Analysis

The market has been bullish, but signs of exhaustion are appearing. Key resistance at 1.140 and support at 1.130 are critical. The MACD is showing signs of divergence, and the RSI is high, indicating a potential pullback.

Confidence Level

Potential Risks

Economic data releases and central bank decisions could significantly impact market direction.

3 Months Prediction

Target: August 26, 2025$1.12

$1.125

$1.13

$1.11

Description

A bearish trend is anticipated as the market may correct from recent highs. Economic uncertainties and potential interest rate changes could lead to downward pressure on the EUR/USD pair.

Analysis

The overall trend has been bullish, but signs of a reversal are emerging. Key support at 1.110 and resistance at 1.140 are critical. The MACD is showing bearish divergence, and the RSI indicates potential overbought conditions, suggesting a correction.

Confidence Level

Potential Risks

Unforeseen macroeconomic events and geopolitical tensions could alter market dynamics significantly.