EURUSDX Trading Predictions

1 Day Prediction

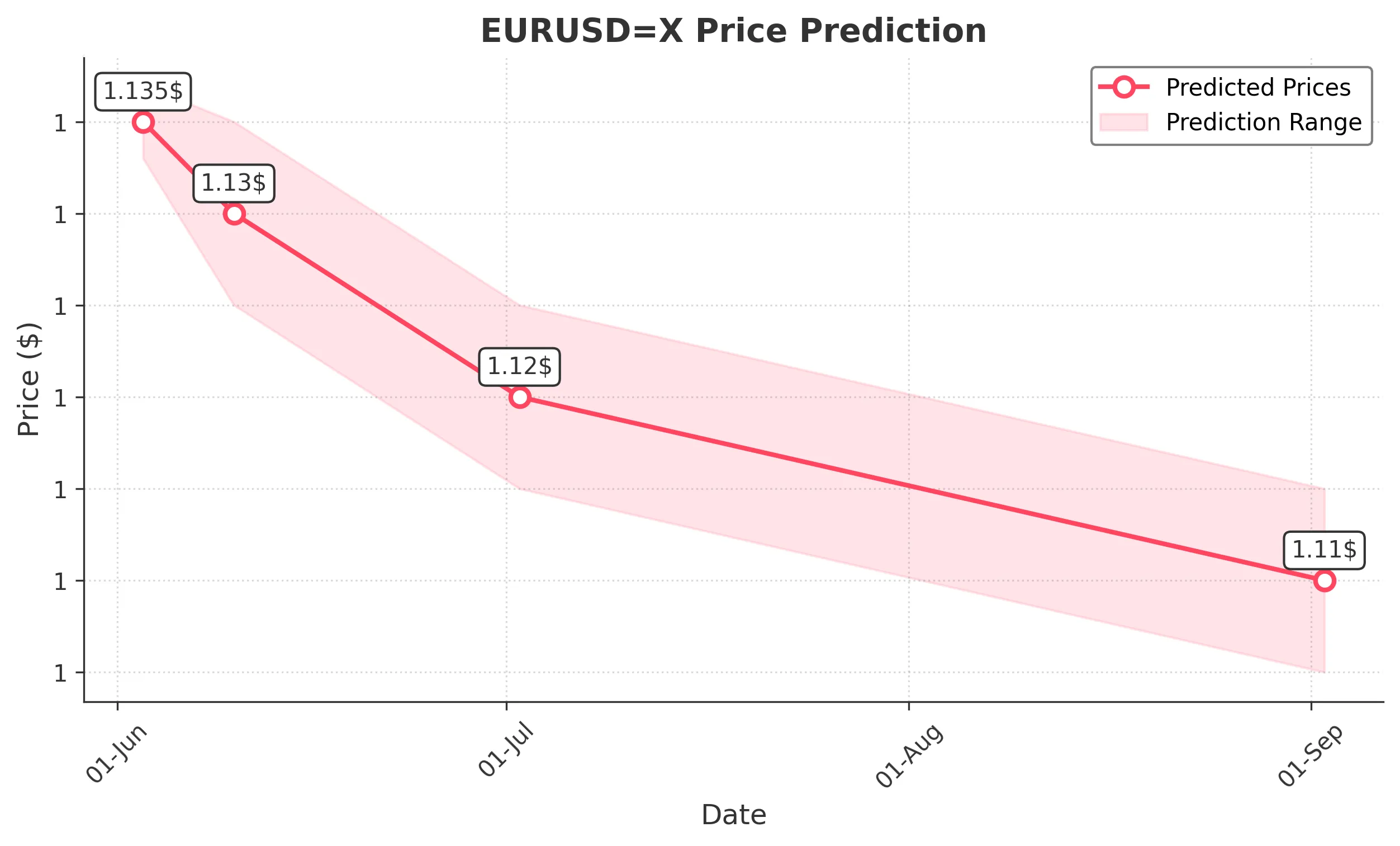

Target: June 3, 2025$1.135

$1.135

$1.137

$1.133

Description

The price is expected to stabilize around 1.135, supported by recent bullish momentum and a slight upward trend in the RSI. However, the MACD shows potential bearish divergence, indicating caution.

Analysis

The past three months show a bullish trend with significant resistance around 1.140. The RSI is nearing overbought levels, suggesting a possible pullback. Volume has been low, indicating weak conviction in recent price movements.

Confidence Level

Potential Risks

Potential volatility due to external economic news could impact the prediction.

1 Week Prediction

Target: June 10, 2025$1.13

$1.135

$1.135

$1.125

Description

A slight decline is anticipated as the market may react to overbought conditions. The Bollinger Bands suggest a squeeze, indicating potential volatility ahead. Watch for support at 1.125.

Analysis

The market has shown a bullish trend but is now facing resistance. The MACD is flattening, and the ATR indicates low volatility. A correction may be due, especially if external factors influence trader sentiment.

Confidence Level

Potential Risks

Market sentiment could shift rapidly based on macroeconomic data releases.

1 Month Prediction

Target: July 2, 2025$1.12

$1.125

$1.125

$1.115

Description

A bearish trend is expected as the market corrects from recent highs. The Fibonacci retracement levels suggest a pullback towards 1.120, with potential support at 1.115.

Analysis

The overall trend has been bullish, but signs of exhaustion are evident. The RSI is declining, and the MACD is showing bearish signals. Volume has been low, indicating a lack of strong buying interest.

Confidence Level

Potential Risks

Unforeseen geopolitical events or economic data could alter this outlook significantly.

3 Months Prediction

Target: September 2, 2025$1.11

$1.115

$1.115

$1.105

Description

A continued bearish trend is anticipated as the market adjusts to previous highs. The support level at 1.110 is critical, and a break below could lead to further declines.

Analysis

The market has shown signs of a potential reversal. The recent price action indicates a bearish sentiment, with significant resistance at 1.140. The ATR suggests increasing volatility, and external economic factors could heavily influence future movements.

Confidence Level

Potential Risks

Market conditions are highly volatile, and economic indicators could lead to unexpected price movements.