EURUSDX Trading Predictions

1 Day Prediction

Target: June 11, 2025$1.1415

$1.14

$1.144

$1.139

Description

The EUR/USD is showing a slight bullish trend with the recent close above the 50-day moving average. RSI is neutral, indicating no overbought conditions. Expect a small upward movement as market sentiment remains stable.

Analysis

The past 3 months show a bullish trend with significant support at 1.1300 and resistance around 1.1500. The MACD is positive, and volume has been steady, indicating healthy trading activity. Recent candlestick patterns suggest a continuation of the upward trend.

Confidence Level

Potential Risks

Potential volatility due to macroeconomic news could impact the prediction.

1 Week Prediction

Target: June 18, 2025$1.143

$1.1415

$1.1465

$1.138

Description

The bullish momentum is expected to continue, supported by a recent breakout above resistance levels. The MACD remains bullish, and the RSI is approaching overbought territory, suggesting a potential pullback soon.

Analysis

The EUR/USD has been trending upward, with key support at 1.1300 and resistance at 1.1500. The Bollinger Bands indicate a tightening range, suggesting a potential breakout. Volume patterns are consistent, but caution is advised as the RSI nears overbought levels.

Confidence Level

Potential Risks

Market sentiment could shift due to geopolitical events or economic data releases, which may affect the trend.

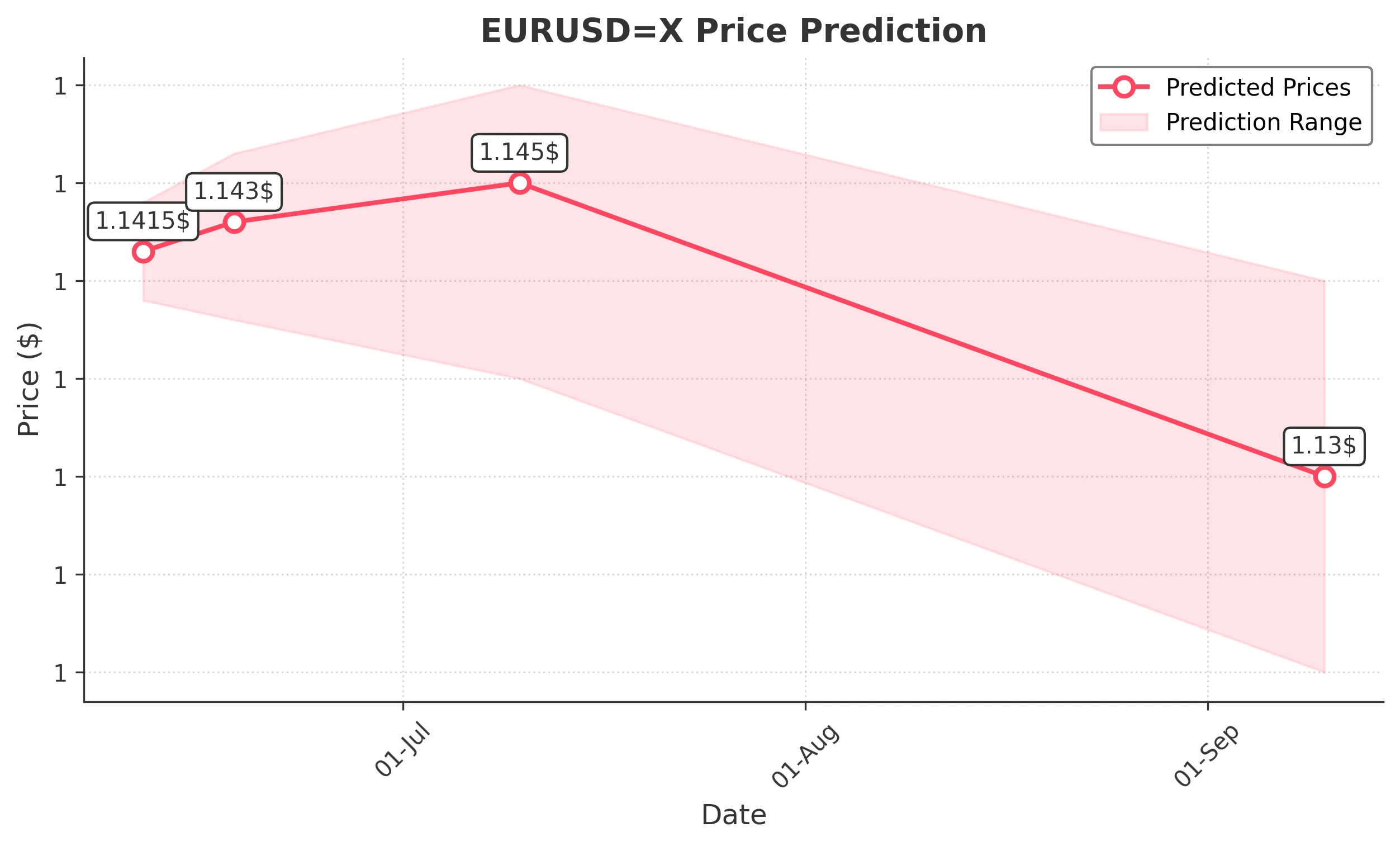

1 Month Prediction

Target: July 10, 2025$1.145

$1.143

$1.15

$1.135

Description

The trend remains bullish, with the price expected to test the upper resistance level. However, the RSI indicates potential overbought conditions, which could lead to a correction. Watch for volume spikes as confirmation.

Analysis

The last three months show a strong bullish trend, with the price consistently above the 50-day moving average. Key resistance at 1.1500 may pose challenges. The MACD is bullish, but the RSI suggests caution as it approaches overbought territory.

Confidence Level

Potential Risks

Economic indicators and central bank policies could introduce volatility, impacting the forecast.

3 Months Prediction

Target: September 10, 2025$1.13

$1.135

$1.14

$1.12

Description

A potential bearish reversal is anticipated as the market may correct after reaching recent highs. The RSI indicates overbought conditions, and a pullback towards support levels is likely.

Analysis

The overall trend has been bullish, but signs of exhaustion are emerging. Key support at 1.1200 is critical. The MACD is showing signs of divergence, and the RSI is in overbought territory, indicating a possible correction ahead.

Confidence Level

Potential Risks

Unforeseen economic events or shifts in market sentiment could lead to significant deviations from this prediction.