EURUSDX Trading Predictions

1 Day Prediction

Target: June 12, 2025$1.1445

$1.143

$1.1465

$1.142

Description

The price is expected to rise slightly due to bullish momentum indicated by the recent candlestick patterns and a positive MACD crossover. RSI is approaching overbought territory, suggesting caution.

Analysis

The past three months show a bullish trend with significant support at 1.1300 and resistance around 1.1500. The MACD is positive, and the RSI is nearing overbought levels, indicating strong upward momentum.

Confidence Level

Potential Risks

Potential reversal if RSI exceeds 70, indicating overbought conditions.

1 Week Prediction

Target: June 19, 2025$1.146

$1.1445

$1.148

$1.143

Description

Continued bullish sentiment is expected, supported by a strong upward trend and positive market sentiment. However, the RSI indicates potential overbought conditions, which could lead to a pullback.

Analysis

The market has shown consistent upward movement, with key resistance at 1.1500. The MACD remains bullish, but caution is warranted as the RSI approaches overbought levels, indicating a possible correction.

Confidence Level

Potential Risks

Market volatility and external economic factors could impact the trend.

1 Month Prediction

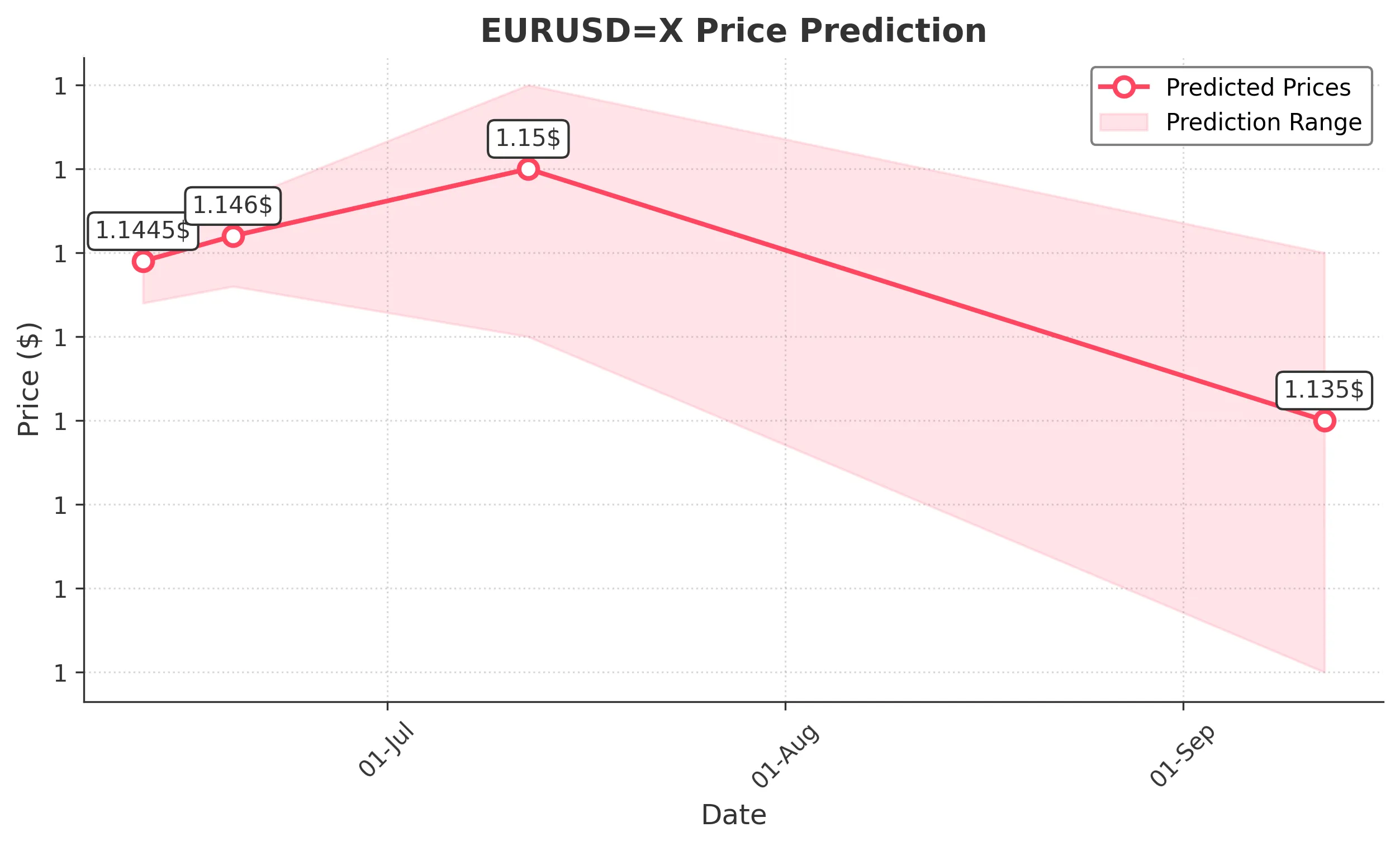

Target: July 12, 2025$1.15

$1.146

$1.155

$1.14

Description

The price is projected to reach 1.1500 as bullish momentum continues. However, the market may face resistance at this level, and a correction could occur if the RSI remains high.

Analysis

The overall trend remains bullish, with strong support at 1.1400. The MACD is positive, but the RSI indicates potential overbought conditions, suggesting a possible pullback if resistance is met.

Confidence Level

Potential Risks

Economic data releases and geopolitical events could lead to unexpected volatility.

3 Months Prediction

Target: September 12, 2025$1.135

$1.145

$1.145

$1.12

Description

A potential bearish reversal is anticipated as the market may correct from overbought levels. Economic factors and market sentiment could lead to a decline towards 1.1350.

Analysis

The market has shown volatility with a recent bullish trend, but signs of exhaustion are evident. Key support at 1.1200 may be tested if the bearish trend develops, influenced by external economic factors.

Confidence Level

Potential Risks

Unforeseen economic events or changes in market sentiment could alter this outlook.