EURUSDX Trading Predictions

1 Day Prediction

Target: June 23, 2025$1.1495

$1.148

$1.152

$1.147

Description

The recent bullish trend, supported by a rising MACD and RSI above 50, suggests a potential upward movement. However, the close proximity to resistance at 1.1500 may limit gains.

Analysis

The EUR/USD has shown a bullish trend over the past three months, with significant support at 1.1400 and resistance around 1.1500. The RSI indicates bullish momentum, while volume has been stable.

Confidence Level

Potential Risks

Potential volatility due to macroeconomic news could impact the prediction.

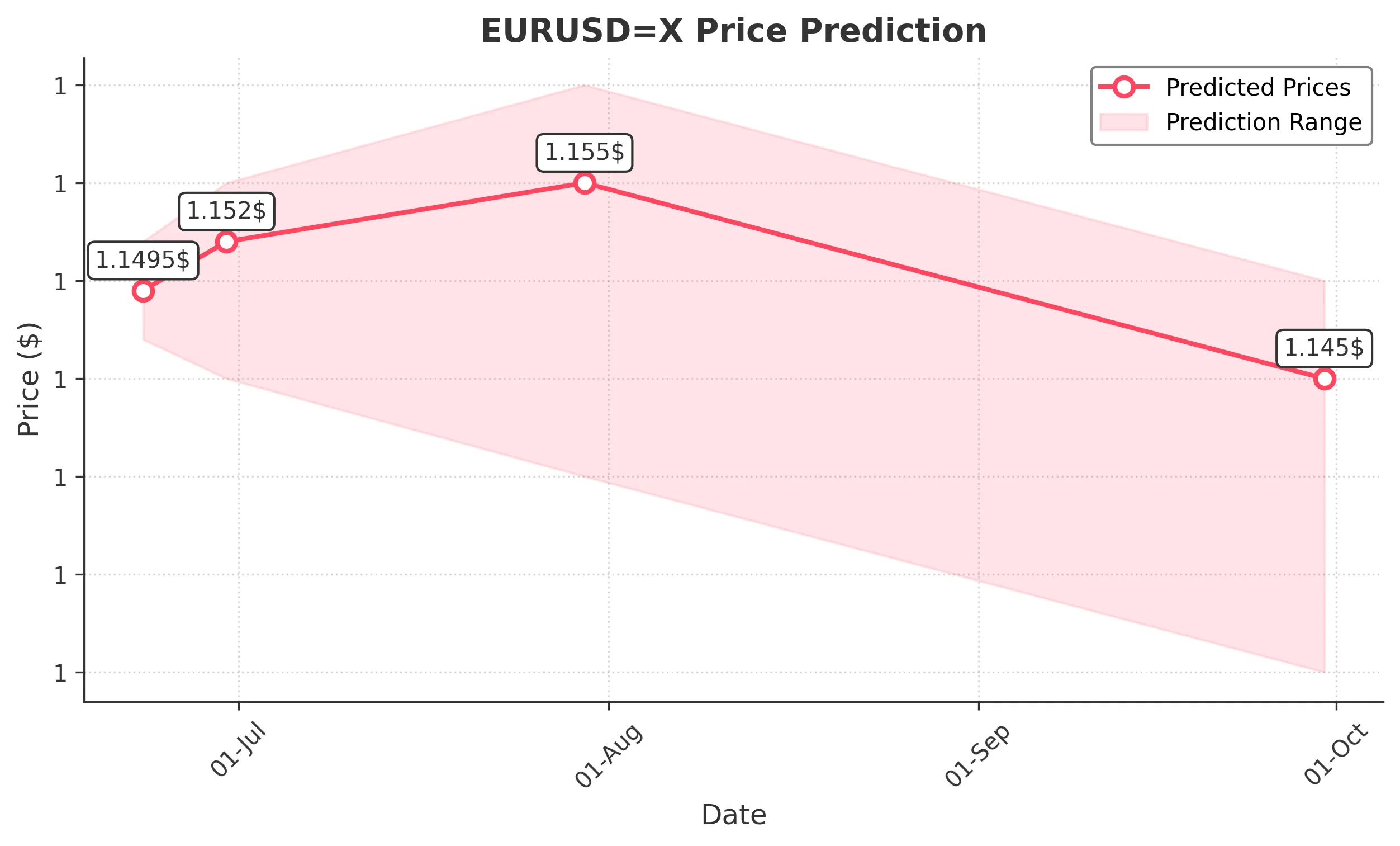

1 Week Prediction

Target: June 30, 2025$1.152

$1.149

$1.155

$1.145

Description

The bullish momentum is expected to continue, with the MACD indicating upward movement. However, the proximity to resistance levels may lead to a pullback.

Analysis

The trend remains bullish, with the price consistently testing resistance levels. The ATR indicates moderate volatility, and the market sentiment is cautiously optimistic.

Confidence Level

Potential Risks

Market sentiment could shift due to geopolitical events or economic data releases.

1 Month Prediction

Target: July 30, 2025$1.155

$1.15

$1.16

$1.14

Description

Continued bullish sentiment supported by strong economic indicators may push prices higher. However, resistance at 1.1600 could pose challenges.

Analysis

The EUR/USD has been in a bullish phase, with key support at 1.1400. The RSI is approaching overbought territory, indicating potential for a correction.

Confidence Level

Potential Risks

Economic data releases and central bank decisions could lead to unexpected volatility.

3 Months Prediction

Target: September 30, 2025$1.145

$1.14

$1.15

$1.13

Description

A potential correction may occur as the market adjusts to previous highs. The RSI indicates overbought conditions, suggesting a pullback could be imminent.

Analysis

The market has shown bullish trends, but the potential for a correction is present. Key support at 1.1300 and resistance at 1.1500 will be critical in the coming months.

Confidence Level

Potential Risks

Unforeseen economic events or shifts in market sentiment could lead to significant price changes.