EURUSDX Trading Predictions

1 Day Prediction

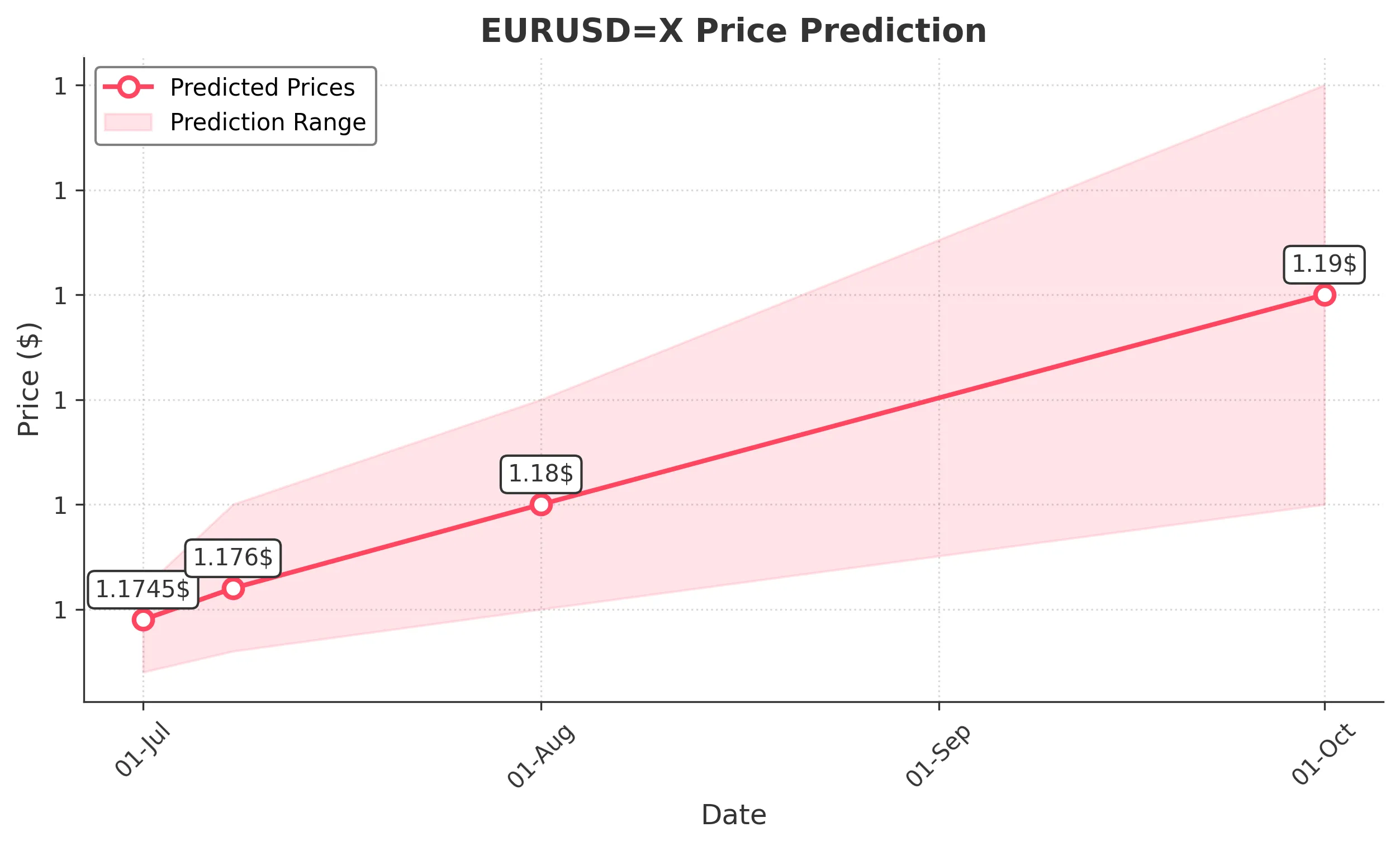

Target: July 1, 2025$1.1745

$1.1735

$1.176

$1.172

Description

The recent bullish trend, supported by a strong MACD crossover and RSI indicating upward momentum, suggests a slight increase in price. The close near resistance levels indicates potential for a breakout.

Analysis

The EUR/USD has shown a bullish trend over the past three months, with significant support at 1.1500 and resistance around 1.1750. The MACD is bullish, and RSI is approaching overbought territory, indicating potential for a pullback.

Confidence Level

Potential Risks

Market volatility and external economic news could impact the prediction.

1 Week Prediction

Target: July 8, 2025$1.176

$1.1745

$1.18

$1.173

Description

Continued bullish momentum is expected, with the price likely to test the upper resistance level. The recent candlestick patterns indicate strong buying interest, but caution is advised as RSI nears overbought levels.

Analysis

The market has been trending upward, with key support at 1.1500 and resistance at 1.1750. Volume has been stable, and the ATR indicates moderate volatility. The bullish sentiment is supported by positive macroeconomic indicators.

Confidence Level

Potential Risks

Potential for a reversal if economic data releases are unfavorable.

1 Month Prediction

Target: August 1, 2025$1.18

$1.176

$1.185

$1.175

Description

The bullish trend is expected to continue, with the price likely to break through resistance levels. The MACD remains positive, and the market sentiment is strong, although caution is warranted as the RSI approaches overbought territory.

Analysis

The EUR/USD has maintained a bullish trend, with significant support at 1.1500. The MACD and RSI indicate upward momentum, but the market is approaching overbought conditions. Volume patterns suggest sustained interest from buyers.

Confidence Level

Potential Risks

Economic data releases and geopolitical events could lead to increased volatility.

3 Months Prediction

Target: October 1, 2025$1.19

$1.18

$1.2

$1.18

Description

Long-term bullish sentiment is expected to drive prices higher, with potential for a breakout above 1.2000. However, market corrections may occur, and external economic factors could influence the trend.

Analysis

The overall trend remains bullish, with key support at 1.1500 and resistance at 1.2000. The market has shown strong buying interest, but the potential for corrections exists as the RSI indicates overbought conditions. Economic indicators will play a crucial role.

Confidence Level

Potential Risks

Unforeseen economic events or shifts in market sentiment could lead to volatility and price corrections.