EURUSDX Trading Predictions

1 Day Prediction

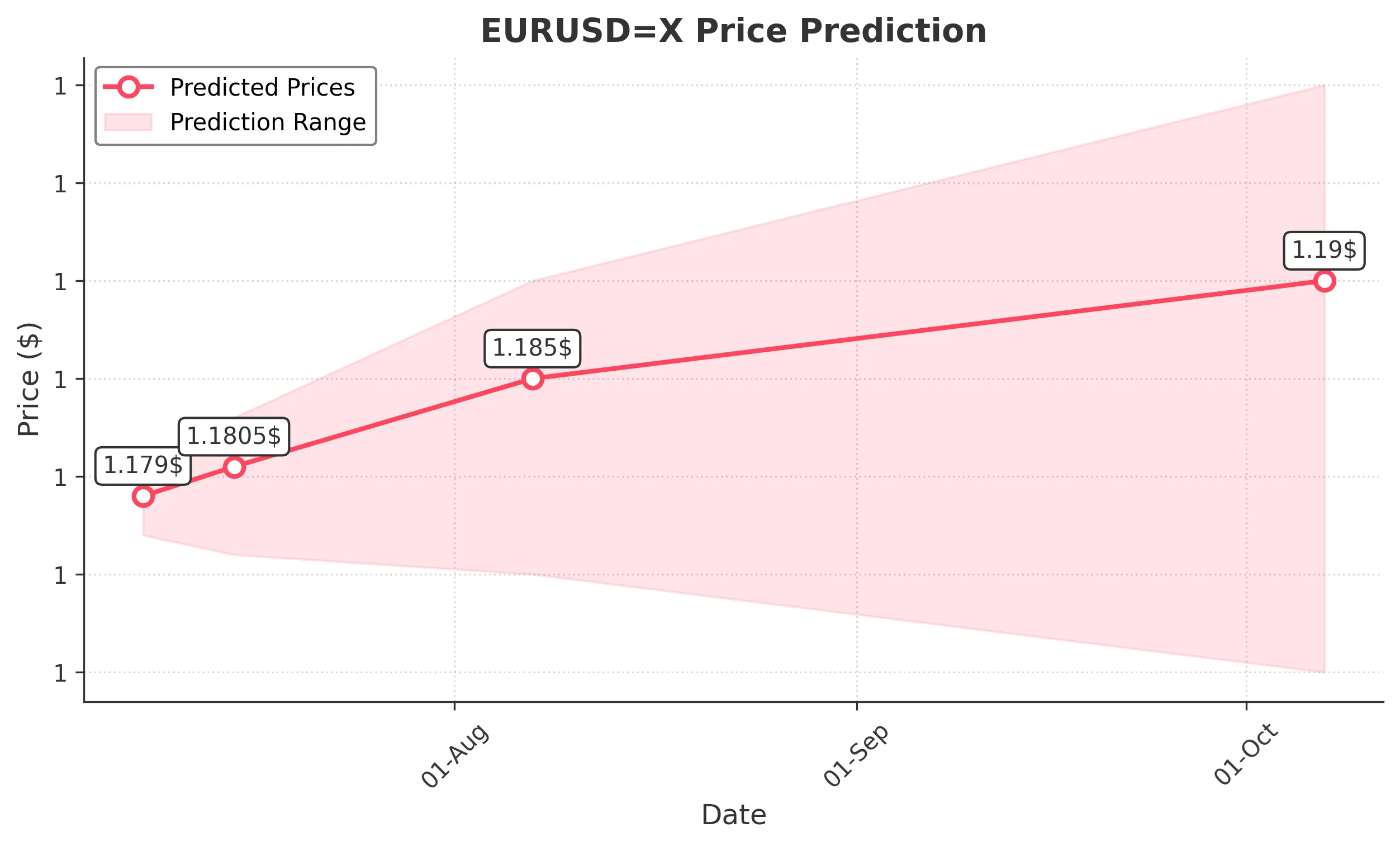

Target: July 8, 2025$1.179

$1.1785

$1.1805

$1.177

Description

The EUR/USD is showing a slight bullish trend with recent higher lows. The RSI is near 60, indicating upward momentum. However, MACD is flattening, suggesting potential consolidation. Expect a close around 1.179000.

Analysis

The past 3 months show a bullish trend with significant support at 1.1750. Recent price action indicates a consolidation phase. Volume has been low, suggesting caution among traders. External factors like economic data releases could influence volatility.

Confidence Level

Potential Risks

Potential for a reversal if market sentiment shifts or if macroeconomic news impacts trading.

1 Week Prediction

Target: July 15, 2025$1.1805

$1.179

$1.183

$1.176

Description

The bullish trend is expected to continue, supported by recent price action and a stable RSI. However, MACD divergence suggests caution. Anticipate a close around 1.180500 as traders react to upcoming economic data.

Analysis

The EUR/USD has maintained a bullish trend with resistance at 1.1830. The recent price action shows a series of higher highs and higher lows. Volume remains low, indicating a lack of strong conviction. External economic factors could lead to fluctuations.

Confidence Level

Potential Risks

Market volatility could increase due to geopolitical events or economic reports, potentially impacting the forecast.

1 Month Prediction

Target: August 7, 2025$1.185

$1.1805

$1.19

$1.175

Description

Expect continued bullish momentum as the market reacts positively to economic indicators. The RSI is approaching overbought levels, indicating potential for a pullback. Close around 1.185000 is anticipated.

Analysis

The trend remains bullish with key support at 1.1750. The MACD indicates upward momentum, but the RSI suggests caution as it nears overbought territory. Volume patterns indicate a lack of strong buying interest, which could lead to volatility.

Confidence Level

Potential Risks

Risk of a pullback if economic data disappoints or if geopolitical tensions escalate.

3 Months Prediction

Target: October 7, 2025$1.19

$1.185

$1.2

$1.17

Description

Long-term bullish outlook as economic recovery continues. However, potential resistance at 1.2000 may limit upside. Expect fluctuations as traders react to macroeconomic developments.

Analysis

The overall trend is bullish, with significant resistance at 1.2000. The market has shown resilience, but external factors such as interest rate changes and geopolitical events could impact price movements. Volume analysis indicates a cautious market.

Confidence Level

Potential Risks

Uncertainties surrounding economic policies and global events could lead to unexpected volatility.