EURUSDX Trading Predictions

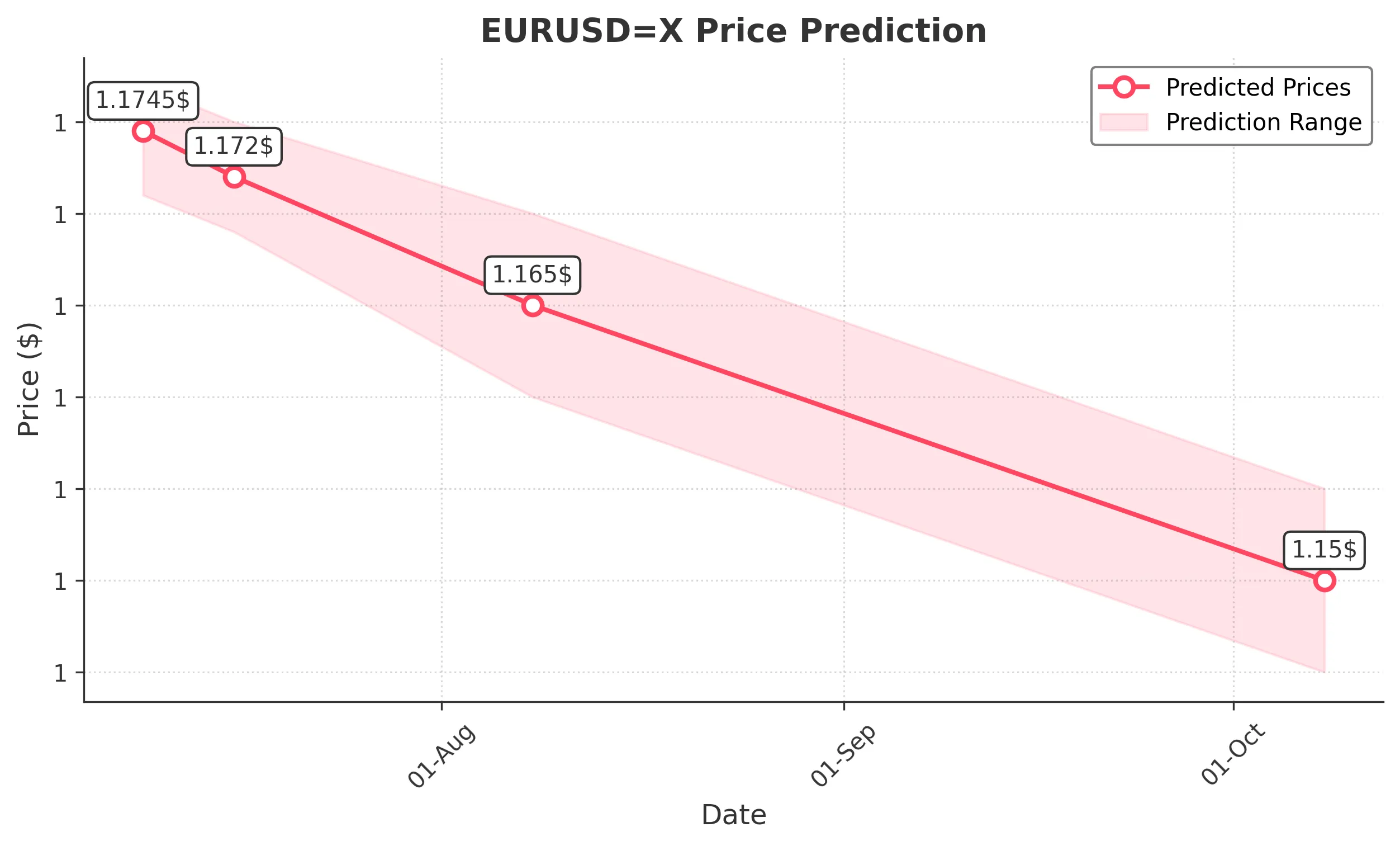

1 Day Prediction

Target: July 9, 2025$1.1745

$1.1735

$1.177

$1.171

Description

The recent price action shows a slight bearish trend with a Doji pattern indicating indecision. The RSI is approaching overbought levels, suggesting a potential pullback. Expect a close around 1.1745 with low volatility.

Analysis

The EUR/USD has shown a bullish trend over the past three months, with significant resistance at 1.1800. Recent candlestick patterns indicate potential exhaustion. The RSI is nearing overbought territory, and volume has been low, suggesting caution.

Confidence Level

Potential Risks

Market sentiment could shift rapidly due to geopolitical events or economic data releases, impacting the prediction.

1 Week Prediction

Target: July 16, 2025$1.172

$1.174

$1.175

$1.169

Description

Expect a slight decline as the market consolidates. The MACD shows a bearish crossover, and the Bollinger Bands are tightening, indicating reduced volatility. A close around 1.1720 is likely.

Analysis

The market has been in a bullish phase, but recent price action suggests a potential reversal. Key support at 1.1700 may hold, but bearish signals from technical indicators warrant caution.

Confidence Level

Potential Risks

Unforeseen economic data or central bank announcements could lead to volatility, affecting the accuracy of this prediction.

1 Month Prediction

Target: August 8, 2025$1.165

$1.168

$1.17

$1.16

Description

A bearish trend is anticipated as the market reacts to potential economic slowdowns. Fibonacci retracement levels suggest support around 1.1650, with a likely close at this level.

Analysis

The EUR/USD has shown signs of weakening momentum. The RSI is declining, and the MACD indicates potential bearish divergence. Key support levels are being tested, and market sentiment is cautious.

Confidence Level

Potential Risks

Economic indicators and geopolitical tensions could lead to unexpected price movements, impacting the forecast.

3 Months Prediction

Target: October 8, 2025$1.15

$1.153

$1.155

$1.145

Description

A continued bearish trend is expected as economic conditions may worsen. The market is likely to test lower support levels, with a close around 1.1500.

Analysis

The overall trend appears bearish, with significant resistance at 1.1800. The market is reacting to macroeconomic factors, and the potential for further declines exists as technical indicators suggest weakening momentum.

Confidence Level

Potential Risks

Long-term predictions are highly uncertain due to potential shifts in monetary policy and global economic conditions.