EURUSDX Trading Predictions

1 Day Prediction

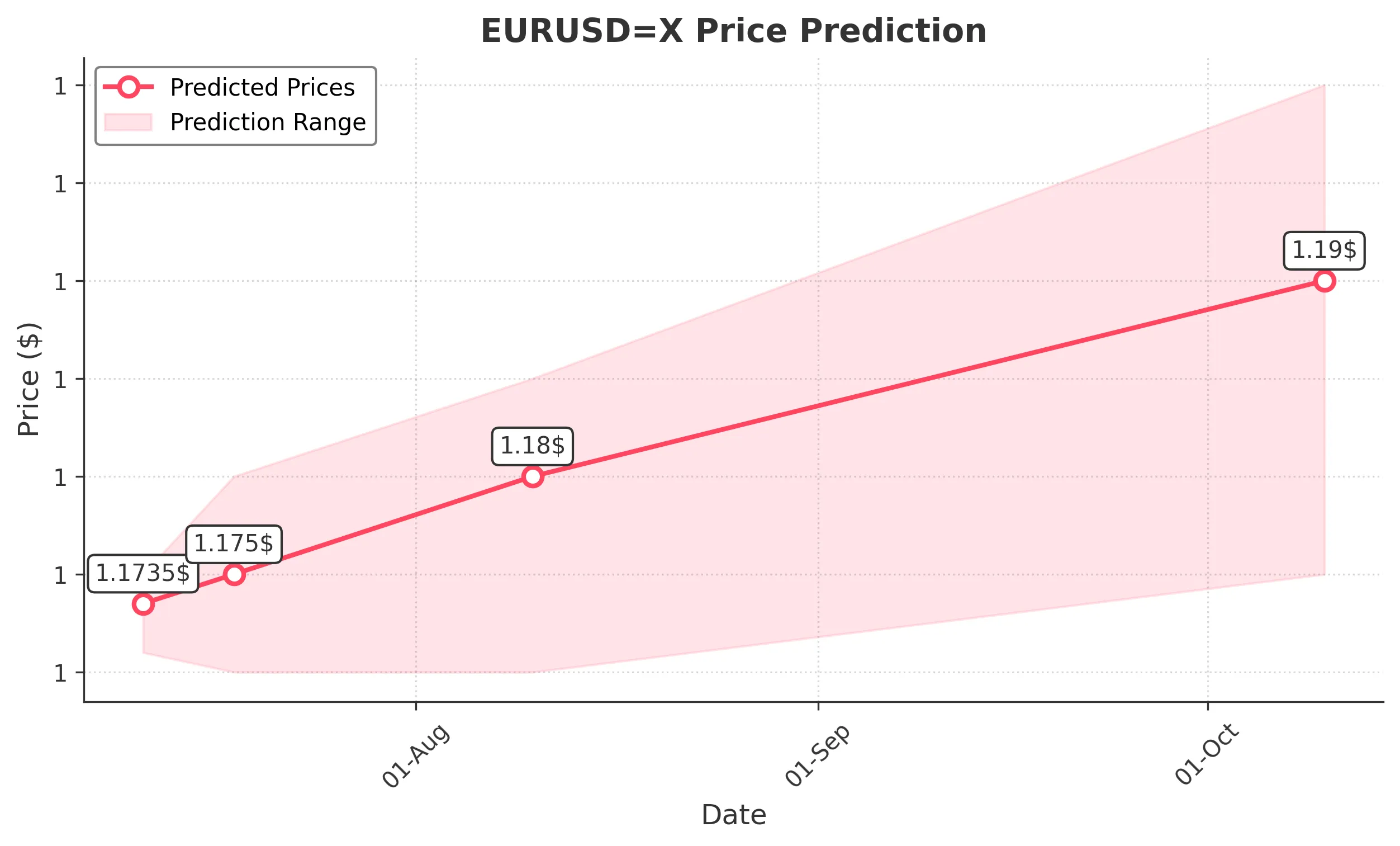

Target: July 11, 2025$1.1735

$1.172745

$1.175

$1.171

Description

The EUR/USD shows a slight bullish trend with a recent Doji candlestick indicating indecision. The RSI is near neutral, suggesting potential for upward movement. However, resistance at 1.175 may limit gains.

Analysis

Over the past 3 months, EUR/USD has shown a bullish trend with key resistance at 1.175. The MACD indicates upward momentum, while the ATR suggests moderate volatility. Volume has been low, indicating cautious trading.

Confidence Level

Potential Risks

Market volatility and external economic news could impact the prediction.

1 Week Prediction

Target: July 18, 2025$1.175

$1.1735

$1.18

$1.17

Description

The bullish momentum may continue into next week, supported by a recent upward trend. However, the proximity to resistance at 1.175 could lead to a pullback if market sentiment shifts.

Analysis

The EUR/USD has been fluctuating around 1.175, with recent bullish patterns. The RSI is approaching overbought territory, indicating a possible correction. Volume remains low, suggesting limited conviction in the current trend.

Confidence Level

Potential Risks

Potential geopolitical events or economic data releases could alter market sentiment.

1 Month Prediction

Target: August 10, 2025$1.18

$1.175

$1.185

$1.17

Description

If the bullish trend persists, the price may reach 1.180, supported by Fibonacci retracement levels. However, resistance at 1.185 could pose challenges, especially if economic indicators turn negative.

Analysis

The EUR/USD has shown a bullish trend, but recent price action suggests potential resistance at 1.185. The MACD is bullish, but the RSI indicates overbought conditions. Volume patterns are weak, indicating uncertainty.

Confidence Level

Potential Risks

Economic data releases and central bank decisions could significantly impact the trend.

3 Months Prediction

Target: October 10, 2025$1.19

$1.18

$1.2

$1.175

Description

Long-term bullish sentiment may drive prices to 1.190, but significant resistance at 1.200 could limit gains. Market sentiment and macroeconomic factors will be crucial in determining the trajectory.

Analysis

The EUR/USD has been on a bullish trajectory, but potential resistance at 1.200 looms. The ATR indicates increasing volatility, and the RSI suggests overbought conditions. Volume trends are low, indicating caution among traders.

Confidence Level

Potential Risks

Unforeseen economic events or shifts in market sentiment could lead to volatility and price corrections.