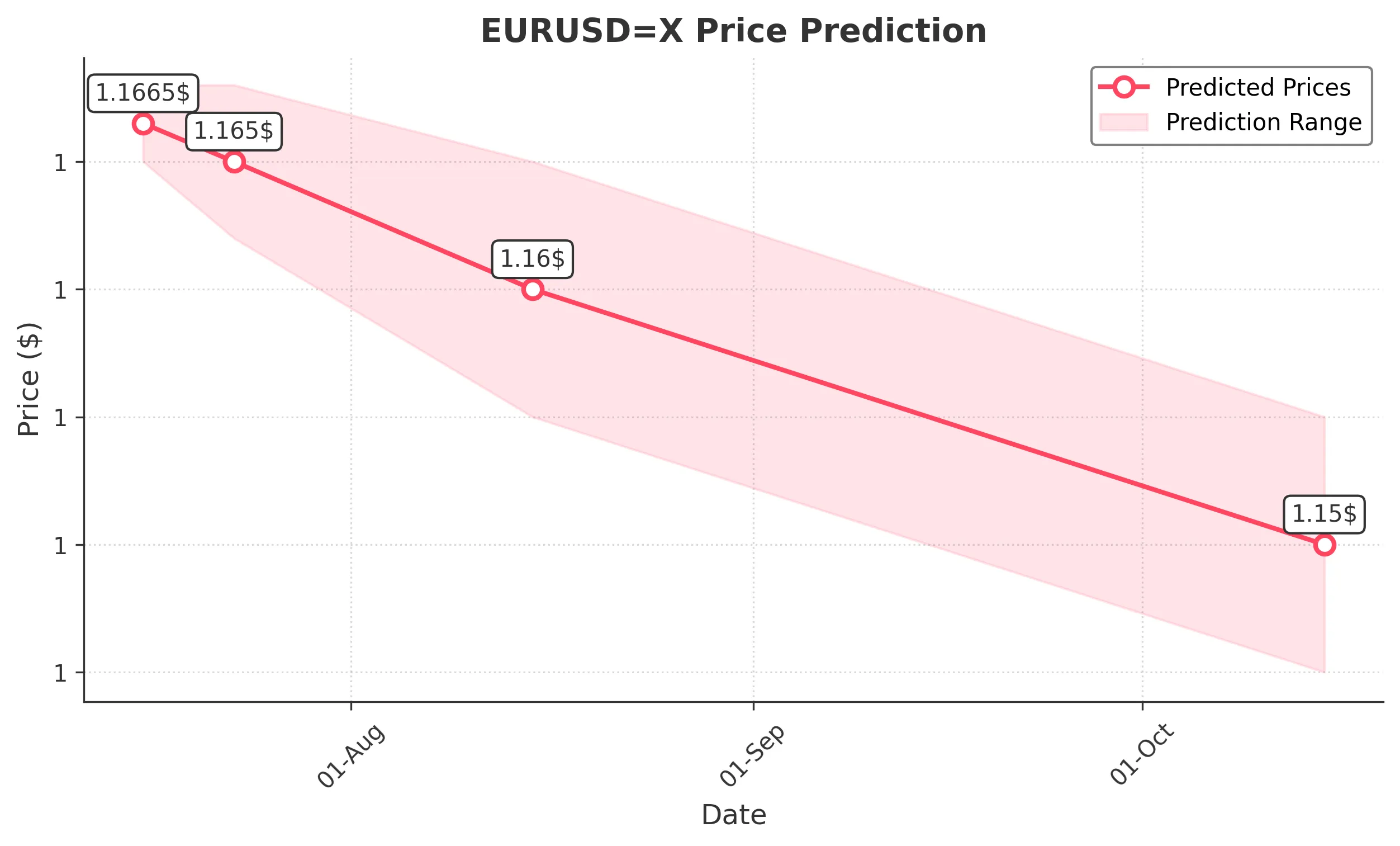

EURUSDX Trading Predictions

1 Day Prediction

Target: July 16, 2025$1.1665

$1.1665

$1.168

$1.165

Description

The market shows a slight bearish trend with recent lower highs. RSI indicates overbought conditions, suggesting a potential pullback. MACD is flattening, indicating weakening momentum. Expect a close around 1.1665.

Analysis

The past three months show a bullish trend with significant resistance around 1.1800. Recent price action indicates a potential reversal with lower highs and bearish candlestick patterns. Volume has been low, indicating lack of conviction.

Confidence Level

Potential Risks

Market volatility and external news could impact the prediction. A sudden bullish sentiment could push prices higher.

1 Week Prediction

Target: July 23, 2025$1.165

$1.166

$1.168

$1.162

Description

The bearish trend may continue as the market consolidates. Support at 1.1650 is critical. If broken, further declines are likely. Watch for volume spikes that could indicate a reversal.

Analysis

The market has shown signs of weakening momentum with lower highs. Key support at 1.1650 is being tested. Technical indicators suggest a potential bearish continuation, but external factors could influence price direction.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or geopolitical tensions could lead to unexpected volatility.

1 Month Prediction

Target: August 15, 2025$1.16

$1.165

$1.165

$1.155

Description

Expect continued bearish pressure as the market tests lower support levels. RSI indicates oversold conditions, but a recovery may be limited. Watch for potential reversal patterns.

Analysis

The overall trend is bearish with significant resistance at 1.1800. Recent price action shows a series of lower highs and lows. Volume has been declining, indicating a lack of strong buying interest.

Confidence Level

Potential Risks

Market sentiment can shift rapidly, and any positive economic data could lead to a bullish reversal.

3 Months Prediction

Target: October 15, 2025$1.15

$1.155

$1.155

$1.145

Description

Long-term bearish outlook as economic indicators suggest a slowdown. Key support at 1.1500 may be tested. Watch for any changes in macroeconomic conditions that could alter this trajectory.

Analysis

The market has been in a bearish phase with significant resistance levels. Technical indicators suggest a continuation of this trend, but external factors could lead to volatility. Key support at 1.1500 is critical.

Confidence Level

Potential Risks

Potential for unexpected economic data releases or geopolitical events that could impact the Euro's strength.