EURUSDX Trading Predictions

1 Day Prediction

Target: July 30, 2025$1.1605

$1.1595

$1.1625

$1.158

Description

The market shows signs of bearish momentum with a recent close below the 1.1600 level. RSI indicates oversold conditions, but MACD suggests potential for a slight rebound. Expect volatility around this level.

Analysis

The past three months have shown a bearish trend with significant resistance around 1.1750. Recent price action indicates a struggle to maintain above 1.1600, with volume decreasing, suggesting a lack of conviction in upward moves.

Confidence Level

Potential Risks

Market sentiment may shift due to external economic news, which could impact the prediction.

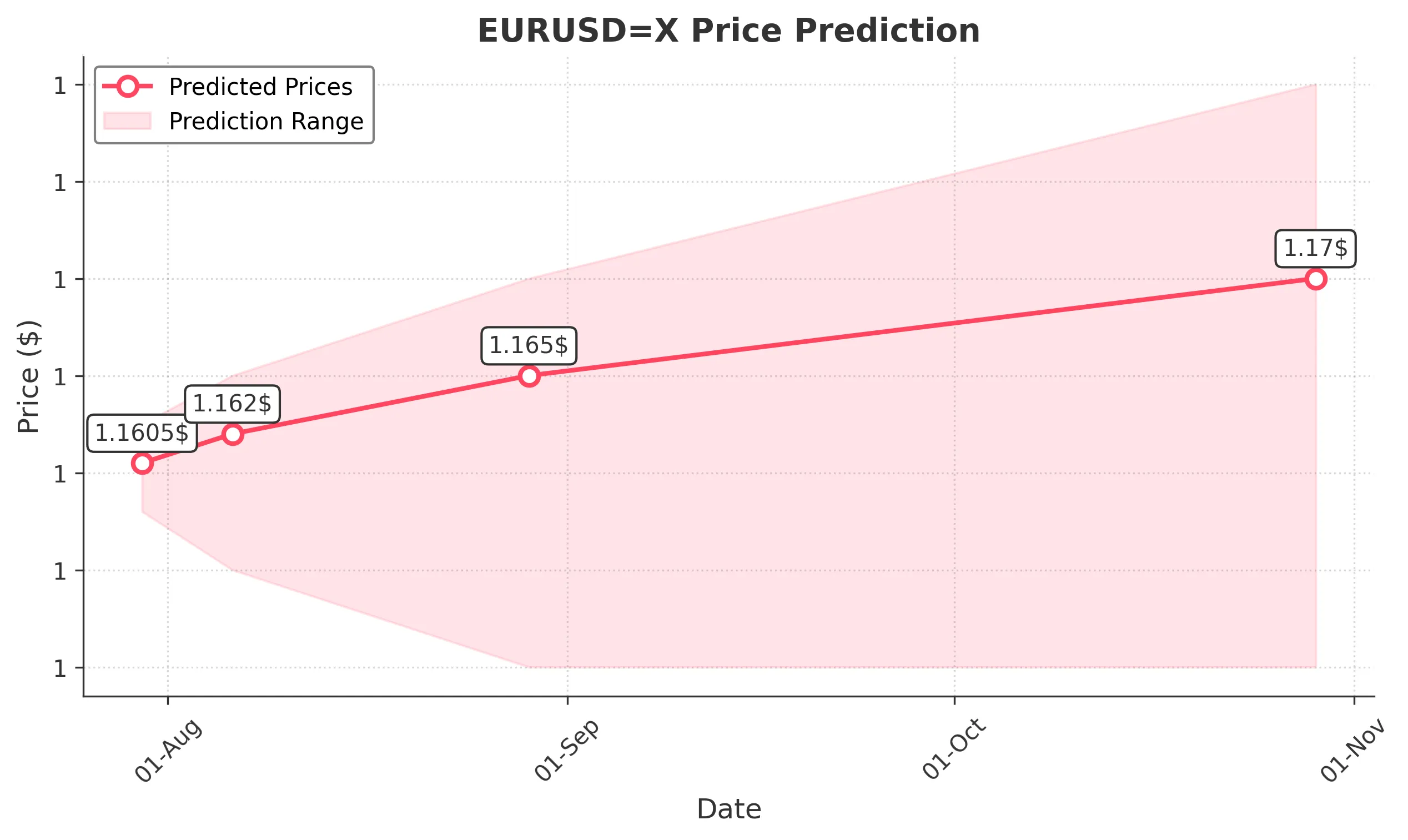

1 Week Prediction

Target: August 6, 2025$1.162

$1.16

$1.165

$1.155

Description

A potential recovery is indicated as the price approaches key support at 1.1600. If it holds, we may see a bounce back towards 1.1650. However, bearish sentiment remains a risk.

Analysis

The market has been in a bearish phase, with support at 1.1600. Technical indicators show mixed signals, with RSI nearing neutral. Volume patterns suggest a lack of strong buying interest, which could hinder recovery.

Confidence Level

Potential Risks

Unforeseen macroeconomic events could lead to volatility, impacting the price direction.

1 Month Prediction

Target: August 29, 2025$1.165

$1.162

$1.17

$1.15

Description

If the support at 1.1600 holds, a gradual recovery towards 1.1650 is possible. However, bearish pressures from macroeconomic factors could limit upside potential.

Analysis

The overall trend remains bearish, with resistance at 1.1750. The market is currently testing support levels, and any negative news could lead to further declines. Volume analysis shows a lack of strong buying interest.

Confidence Level

Potential Risks

Economic data releases and geopolitical events could significantly alter market sentiment.

3 Months Prediction

Target: October 29, 2025$1.17

$1.165

$1.18

$1.15

Description

Assuming a recovery from current levels, the price could stabilize around 1.1700. However, ongoing economic uncertainties may lead to fluctuations.

Analysis

The market has been bearish, with significant resistance at 1.1750. The potential for recovery exists, but external factors could lead to further declines. Volume trends indicate a lack of strong bullish sentiment.

Confidence Level

Potential Risks

Long-term predictions are highly uncertain due to potential economic shifts and market volatility.