EURUSDX Trading Predictions

1 Day Prediction

Target: July 31, 2025$1.154

$1.155

$1.156

$1.152

Description

The recent bearish trend, indicated by lower highs and lower lows, suggests a continuation. RSI is nearing oversold levels, but MACD shows a bearish crossover. Expect a slight decline as market sentiment remains cautious.

Analysis

The past three months show a bearish trend with significant resistance around 1.175. Technical indicators like MACD and RSI indicate weakening momentum. Volume has been low, suggesting lack of conviction in price movements. External factors, including economic data releases, could impact future performance.

Confidence Level

Potential Risks

Potential for a reversal exists if bullish news emerges or if the RSI rebounds sharply.

1 Week Prediction

Target: August 7, 2025$1.15

$1.154

$1.152

$1.148

Description

Continued bearish pressure is expected as the market reacts to recent economic data. The Bollinger Bands indicate a squeeze, suggesting potential volatility. A break below support at 1.150 could lead to further declines.

Analysis

The bearish trend persists, with key support at 1.150. Technical indicators show weakening momentum, and volume remains low. The market is sensitive to macroeconomic events, which could influence price direction. A cautious outlook is warranted.

Confidence Level

Potential Risks

Market sentiment could shift with unexpected economic news, leading to volatility.

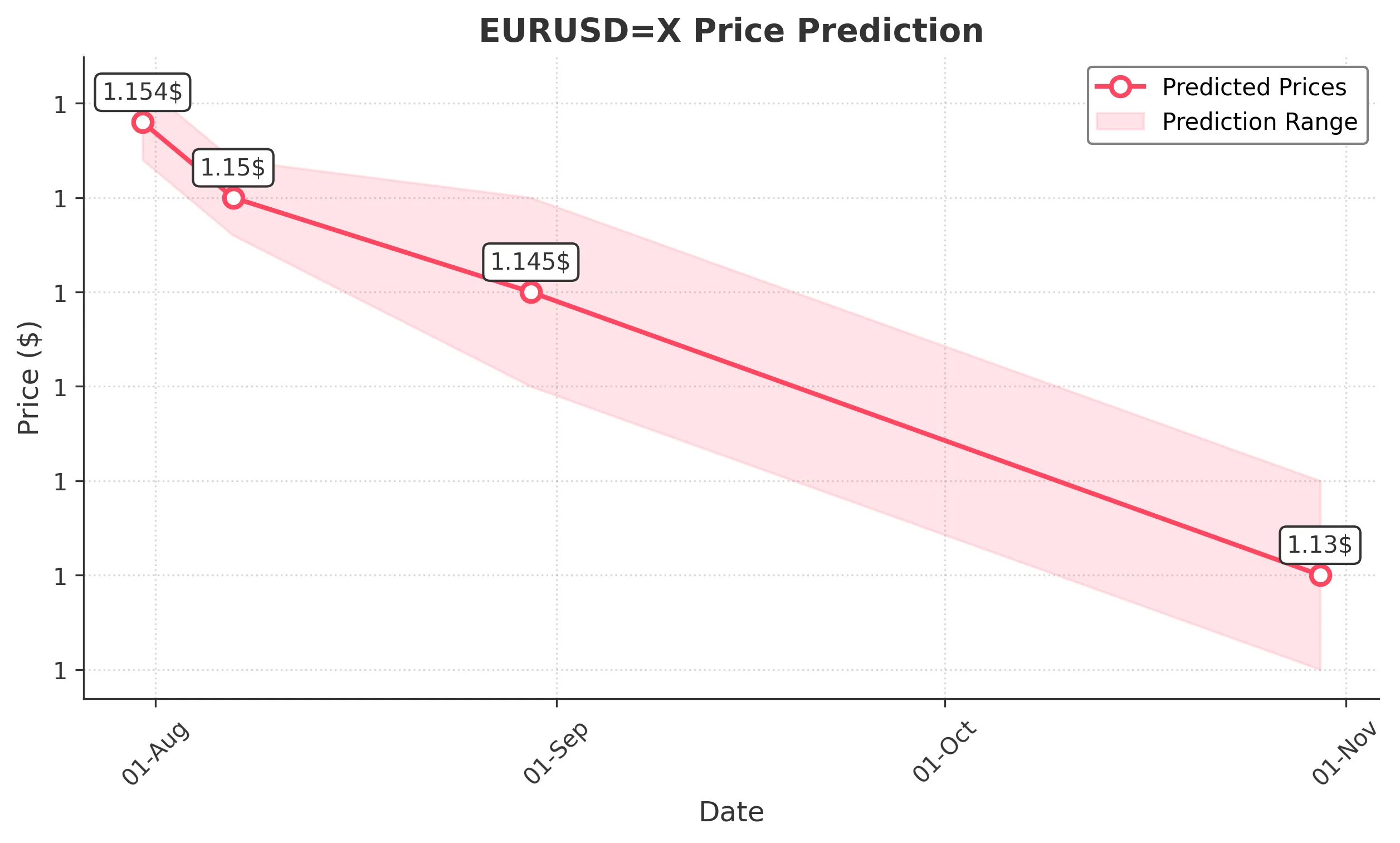

1 Month Prediction

Target: August 30, 2025$1.145

$1.15

$1.15

$1.14

Description

The bearish trend is likely to continue, with potential for a rebound if support holds. Fibonacci retracement levels suggest 1.145 as a target. However, external economic factors could lead to volatility.

Analysis

The market has shown a consistent bearish trend, with significant resistance at 1.175. Technical indicators suggest a potential for further declines, but support at 1.145 may provide a floor. Volume patterns indicate a lack of strong buying interest, and macroeconomic factors remain a concern.

Confidence Level

Potential Risks

Unforeseen economic developments could alter the trajectory significantly.

3 Months Prediction

Target: October 30, 2025$1.13

$1.135

$1.135

$1.125

Description

If the bearish trend continues, we may see a decline towards 1.130. The market is influenced by macroeconomic conditions, and any negative news could exacerbate the downward pressure.

Analysis

The overall trend remains bearish, with significant resistance levels. Technical indicators suggest a lack of momentum for recovery. Volume analysis shows low participation, indicating uncertainty. Macroeconomic events will play a crucial role in determining future price movements.

Confidence Level

Potential Risks

Market volatility and potential bullish reversals due to economic data could impact this prediction.