EURUSDX Trading Predictions

1 Day Prediction

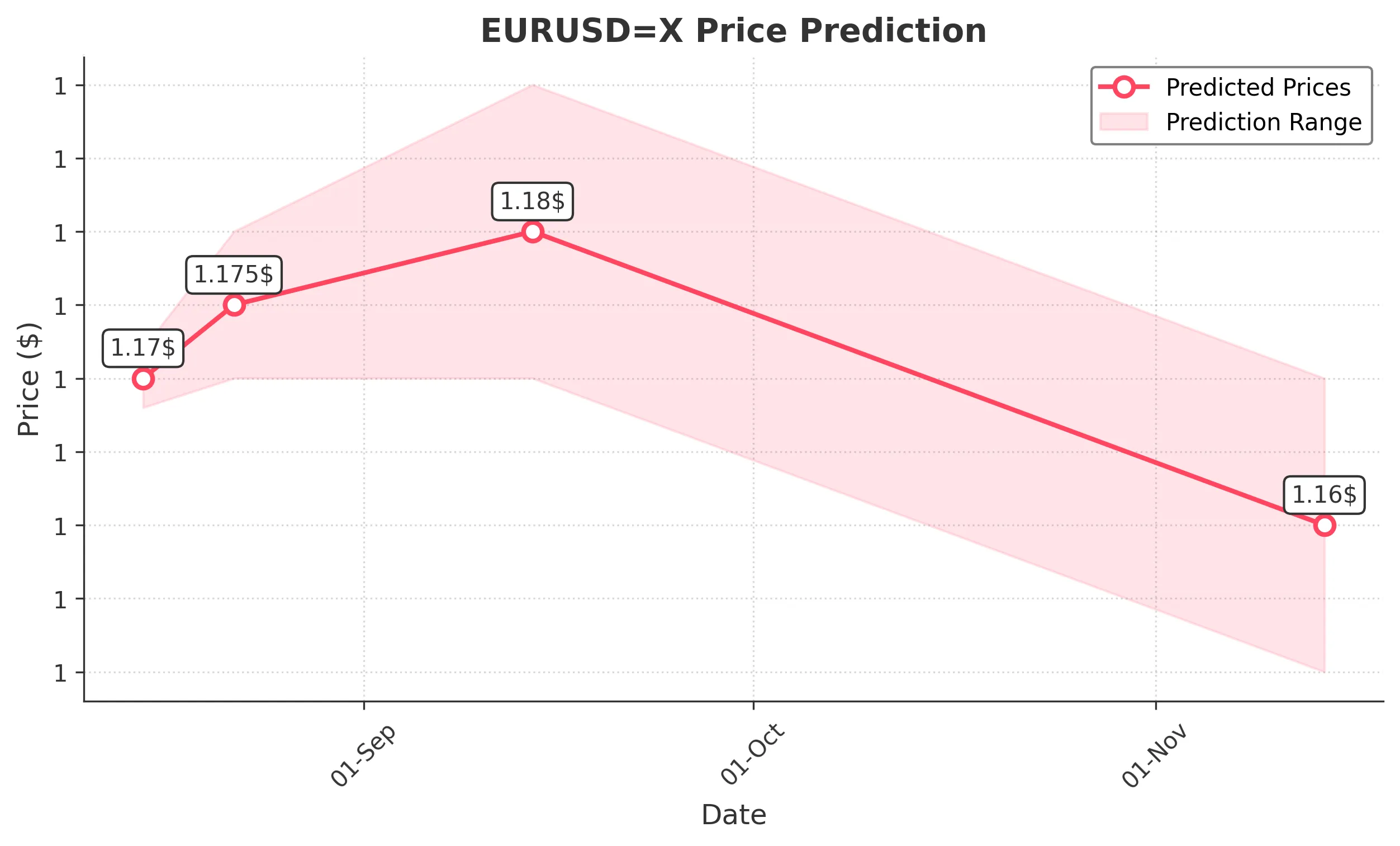

Target: August 15, 2025$1.17

$1.17

$1.172

$1.168

Description

The price is expected to stabilize around 1.1700, supported by recent bullish momentum and a Doji pattern indicating indecision. RSI is neutral, suggesting no overbought conditions.

Analysis

The past three months show a bullish trend with significant support at 1.1600. The RSI indicates a neutral stance, while MACD shows a bullish crossover. Volume has been low, indicating a lack of strong conviction.

Confidence Level

Potential Risks

Potential volatility due to external news or economic data releases could impact the prediction.

1 Week Prediction

Target: August 22, 2025$1.175

$1.172

$1.18

$1.17

Description

Expect a slight upward movement as the market reacts to positive sentiment and potential economic data. The MACD remains bullish, and the price is above the 50-day moving average.

Analysis

The market has shown a bullish trend with resistance at 1.1800. Recent candlestick patterns indicate bullish sentiment, but low volume suggests caution. The ATR indicates moderate volatility.

Confidence Level

Potential Risks

Market sentiment can shift quickly, and geopolitical events may introduce unexpected volatility.

1 Month Prediction

Target: September 14, 2025$1.18

$1.175

$1.19

$1.17

Description

A continued bullish trend is anticipated, supported by strong economic indicators and a favorable market sentiment. The price is expected to test the 1.1900 resistance level.

Analysis

The overall trend remains bullish with key support at 1.1700. The RSI is approaching overbought territory, indicating potential for a pullback. Volume patterns suggest cautious optimism.

Confidence Level

Potential Risks

Economic data releases and central bank decisions could lead to volatility, impacting the forecast.

3 Months Prediction

Target: November 14, 2025$1.16

$1.165

$1.17

$1.15

Description

A bearish correction is expected as the market reacts to potential economic slowdowns and profit-taking. The price may retrace towards the 1.1500 support level.

Analysis

The market shows signs of a potential reversal with resistance at 1.1800. Recent bearish candlestick patterns and declining volume indicate weakening momentum. The ATR suggests increasing volatility.

Confidence Level

Potential Risks

Unforeseen economic events or shifts in market sentiment could lead to significant deviations from this prediction.