GBPUSDX Trading Predictions

1 Day Prediction

Target: April 9, 2025$1.275

$1.274

$1.28

$1.27

Description

The recent bearish trend suggests a slight decline. The RSI indicates overbought conditions, while MACD shows a potential crossover. A Doji pattern indicates indecision, leading to a predicted close around 1.275.

Analysis

The past three months show a bullish trend with significant resistance around 1.304. Recent price action indicates a potential reversal, with RSI nearing overbought levels. Volume has been low, suggesting lack of conviction in the current trend.

Confidence Level

Potential Risks

Market volatility and external news could impact this prediction significantly.

1 Week Prediction

Target: April 16, 2025$1.27

$1.272

$1.275

$1.26

Description

Expecting a continued bearish trend as the market reacts to recent highs. The MACD shows a bearish divergence, and the Bollinger Bands indicate potential for a pullback. Predicted close around 1.270.

Analysis

The stock has shown a bullish trend but is now facing resistance. Key support is at 1.260. The ATR indicates increasing volatility, and recent candlestick patterns suggest a potential reversal. Market sentiment is cautious.

Confidence Level

Potential Risks

Unforeseen macroeconomic events could lead to volatility, impacting the accuracy of this prediction.

1 Month Prediction

Target: May 8, 2025$1.26

$1.265

$1.27

$1.25

Description

A bearish outlook is anticipated as the market adjusts to recent highs. Fibonacci retracement levels suggest a pullback to 1.260. The RSI indicates potential for further declines.

Analysis

The stock has been in a bullish phase but is now showing signs of weakness. Key support at 1.250 is critical. The MACD indicates bearish momentum, and volume patterns suggest a lack of buying interest.

Confidence Level

Potential Risks

Economic data releases and geopolitical events could significantly alter market dynamics.

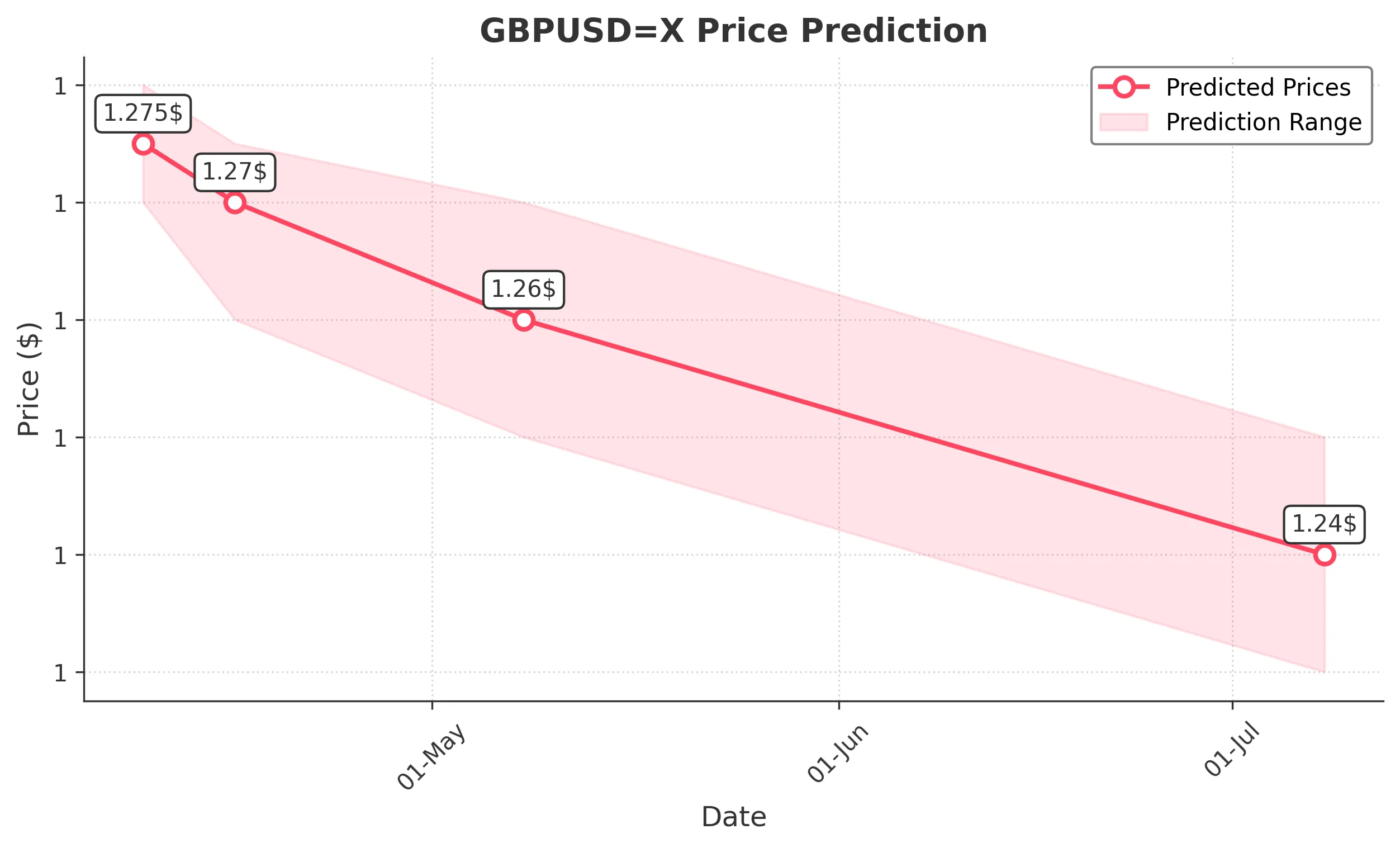

3 Months Prediction

Target: July 8, 2025$1.24

$1.245

$1.25

$1.23

Description

Long-term bearish sentiment is expected as the market reacts to macroeconomic pressures. The overall trend suggests a decline towards 1.240, with potential support at 1.230.

Analysis

The stock has shown a strong bullish trend but is now facing significant resistance. Key support levels are critical, and the overall market sentiment is shifting towards caution. The ATR indicates increasing volatility, which could lead to further price fluctuations.

Confidence Level

Potential Risks

Long-term predictions are highly uncertain due to potential economic shifts and market sentiment changes.